Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Kerry

Most people don’t need another productivity hack. They need a braver relationship with themselves. ❤️ Join Boldly Human.

The worst ventriloquism in the world.🌎 Where awful hand puppets become slightly better. Craft your unique voice in The Puppet Lab. 😄

Memberships

The Unstoppable Academy

37 members • Free

Personal Growth Skool

79 members • Free

Rapid Transformation Mentoring

30 members • $29/month

Aligned Entrepreneur Network🌐

384 members • Free

Stress-Free Sobriety

457 members • Free

Strong Confident Living

1.2k members • Free

The AI Hub

239 members • Free

Better Communities

27 members • Free

Unshakeable Entrepreneurs

169 members • Free

9 contributions to Rapid Transformation Mentoring

Journal Prompts

As we all continue to map our Frame → Floor → Focus, below are some prompts to work with. 𝐃𝐨 𝐭𝐡𝐞 𝐰𝐨𝐫𝐤 𝐨𝐫 𝐭𝐡𝐞 𝐰𝐨𝐫𝐥𝐝 𝐰𝐢𝐥𝐥 𝐩𝐫𝐨𝐯𝐢𝐝𝐞 𝐲𝐨𝐮 𝐰𝐢𝐭𝐡 𝐲𝐨𝐮𝐫 𝐢𝐝𝐞𝐧𝐭𝐢𝐭𝐲. 𝐖𝐡𝐞𝐭𝐡𝐞𝐫 𝐲𝐨𝐮 𝐥𝐢𝐤𝐞 𝐢𝐭 𝐨𝐫 𝐧𝐨𝐭. 𝐈𝐭 𝐰𝐢𝐥𝐥 𝐛𝐞 𝐲𝐨𝐮𝐫𝐬 𝐭𝐨 𝐨𝐰𝐧. 1. Based on my last 7 days, my current identity (behavior-based) is: ______ 2. The identity I’m choosing (future-led) is: ______ 3. My Daily Floor (ONE yes/no item only) is: ______ 4. The thing I must remove this week to protect it is: ______ 5. If I violate it, my consequence is: ______ 6. This week’s Focus (one proof outcome by Friday) is: ______ 7. One “Go For No” ask I will send before Friday is: ______ I want you to read this part again and honestly answer to yourself if you are letting the world around you shape your identity. 𝐃𝐨 𝐭𝐡𝐞 𝐰𝐨𝐫𝐤 𝐨𝐫 𝐭𝐡𝐞 𝐰𝐨𝐫𝐥𝐝 𝐰𝐢𝐥𝐥 𝐩𝐫𝐨𝐯𝐢𝐝𝐞 𝐲𝐨𝐮 𝐰𝐢𝐭𝐡 𝐲𝐨𝐮𝐫 𝐢𝐝𝐞𝐧𝐭𝐢𝐭𝐲. 𝐖𝐡𝐞𝐭𝐡𝐞𝐫 𝐲𝐨𝐮 𝐥𝐢𝐤𝐞 𝐢𝐭 𝐨𝐫 𝐧𝐨𝐭. 𝐈𝐭 𝐰𝐢𝐥𝐥 𝐛𝐞 𝐲𝐨𝐮𝐫𝐬 𝐭𝐨 𝐨𝐰𝐧. Don't let your future you be by default. If you are here, it's because you paid to be here. I removed 60+ people last night from this group. Some, it was honestly hard to hit that button. Don't cheat yourself. Do the work.

🔥

4 likes • 1d

1. Based on my last 7 days, my current identity (behavior-based) is: Creative, Playful and Focused. 2. The identity I’m choosing (future-led) is: International Confidence Coach and Skool Community Leader. 3. My Daily Floor (ONE yes/no item only) is: Maintain consistency/No alcohol -32 Days Sober and counting. 4. The thing I must remove this week to protect it is: Emotional triggers via Emotional Regulation. 5. If I violate it, my consequence is: I won't violate it, my willpower is strong and my reasons for not drinking are varied. 6. This week’s Focus (one proof outcome by Friday) is: breaking past #100 on Discovery with my 2nd community on Skool. 7. One “Go For No” ask I will send before Friday is: Reaching out to prospective coaching clients.

Client Feedback

As I mentioned on the call and in a post a few days ago, I sent out a text to the clients that attended my client appreciation dinner. When I read it, I felt a bit uncomfortable because I see positive feedback about myself. I'm posting it here to force myself to recognize the value I bring to clients and to step out of my comfort zone and let this positive message affirm my value. Hi Michael, You were reading my mind! I have been planning to reach out to you... We enjoyed the evening immensely, thank you. The food, service & atmosphere were lovely. I had a delightful time visiting with your wife... I don't think we've really had a chance to do so in the past--she's very easy to talk to! In terms of the presentation... I really liked how you alternated between dinner courses and slideshow. It kept the evening flowing, gave us a chance to eat leisurely, and removed the distraction that passing dishes usually does. The presentation was a great balance of information and brevity. Very effective. If you were looking for additional content, I would suggest: - Go over the Allianz Tax Summary pages briefly: The income tax brackets, the cap gains tax brackets, the RMD table, and the Medicare table... make the point that managing taxable income AFTER retirement has a huge impact, so tax strategies matter as much as investment strategies. And yes, you can help with that. - Offer more insight to remove the mystery of ATS. I know you've been burned when you shared too much of your strategy, so go with less data and more of your relationship with your clients. 1) Time segments matter for each stage of life: Leading up to retirement / reaching retirement / medicare vs medical insurance / social security start date strategies / legacies & trusts / long-term care. Everyone has different needs at different stages. So how can you build a flexible plan? 2) Time segments ALSO matter for keeping the nest egg growing through market trends. The strategy is NOT unique enough to sell itself. However, you have an advantage over traditional financial advisors. We're all coming to your for our taxes, so point that out. YOU are the key here. YOU are a guru at blending the financial concerns with the tax implications to plan a long-term strategy. Don't underestimate your dual role. The ATS is a solid tool that you've used for many clients, but in the end, it's YOU that we are trusting. This is a strategy that you rely upon, so it's part of the package.

🔥

2 likes • 4d

This is an excellent win indeed. 🎉 I have noticed the language you use here and I hope you don't mind. Client appreciation dinner. Like attracts like. As you appreciated so you were appreciated in kind. ✅ The question is how can you grow to a place of comfort and flow in receiving appreciation, as opposed to uncomfortable and forced?

Bring your big boy and girl pants to tomorrow's call

If we are raising the floor, it's required. Be prepared to answer the tough questions. We are already near the end of January. Are you on track to hit the 2026 Goals? Have you finalized 2026 Goals? If not, why? Where are you different from January of 2025 - be specific and clear. I will announce the February theme since we only have one week remaining in January. Be bold. Some of you are exactly where you were this time last year. Ask yourself why? Success waits for no one! God wants you working in your purpose. Sorry, NOT Sorry. I'm dropping the hammer.

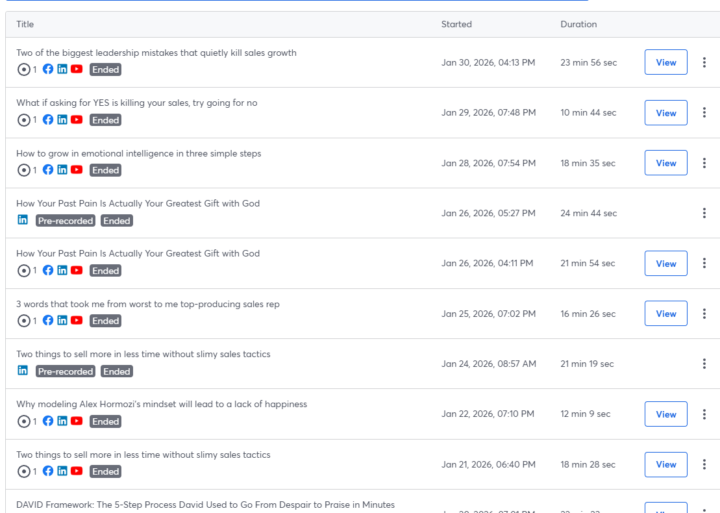

Went Live 8 times in last 10 days of the month

I used to host two live events a week back when LinkedIn had audio rooms. I’d record the video with the audio, then repurpose the content across platforms. When LinkedIn removed audio, the consistency stopped. Lives became… sporadic. Recently, I started going live again — without a scheduled event, without hype, without weeks of planning. Why? Because I’ve realized something about myself: I have more clarity inside me than I give myself credit for. I can sketch a simple outline, go live in 10 minutes, and let it flow. No stress. No perfection. Just clarity in motion. In hindsight, this wasn’t random. My subconscious was fighting for clarity. And live communication is one of the fastest ways I sharpen how I: ➔ think ➔ influence ➔ communicate ➔ clarify my messaging, copy, content, and offers It also forces me to think on my feet — a skill I’ve let dull recently. Bonus? Every live gives me a transcript I can turn into written posts, plug into my 21-page prompt, and compound into years of content in my voice that actually resonates. I’m going to run this experiment for a couple of months and see what converts. No pressure. Just progress. Question for you: What’s something you already do well that you could leverage more intentionally for your ICP? That answer might be closer than you think.

1-9 of 9

🔥

@kerry-souter

Creator. International Confidence Coach. Stand Up Comedy for 18 years 🎤 Hosted a Community Radio Show and written a book about Happiness!

Active 2h ago

Joined Jan 30, 2026

Powered by