Pinned

🚀 The Future of DeFi Automation: Brahma ConsoleKit + Euler Finance on Base

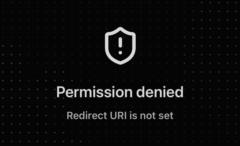

Hey DeFi fam! 👋 Just finished diving deep into something that's about to change how we think about automation in DeFi. Let me break down this game-changing integration between Brahma ConsoleKit and Euler Finance on Base. 🎯 What's the Big Deal? We're moving away from the old-school EOA (your basic wallet) interactions toward policy-driven, autonomous execution. Think of it like hiring a super-smart assistant that can manage your DeFi positions 24/7, but with ironclad rules that prevent them from ever running away with your funds. 🔐 🏗️ The Double Sub-Account Architecture Here's where it gets spicy. This integration uses TWO layers of sub-accounts working together: Layer 1: Brahma Sub-Accounts (The Custody Layer) 🛡️ - This is your smart contract wallet that's governed by CODE, not just a private key - YOU keep ownership and withdrawal rights - But you delegate execution rights to an automated agent (the "Executor") - The beautiful part? The Executor literally CANNOT move your funds unless the on-chain policy says it's cool Layer 2: Euler Sub-Accounts (The Risk Layer) ⚖️ - Each address can control up to 256 separate sub-accounts - Each one is treated as completely isolated for collateral and liquidation purposes - Want to run a degen leverage play AND a safe blue-chip position? Now they won't contaminate each other The Magic Combo: Your Brahma Sub-Account owns the Euler position. The agent can rebalance your portfolio, but the Brahma policy layer acts as a bouncer—no sketchy moves allowed. 💪 🔧 The Technical Reality (For the Builders) If you're looking to build with this stack, here's what you need to know: The Challenge: The Brahma SDK doesn't have pre-built Euler functions yet. No simple consoleKit.euler.deposit() calls. You've gotta roll your own using the Executable schema. The Executable Schema is your universal translator for any EVM transaction: - callType: Always use 0 (CALL) for external protocols - to: Your target contract (Euler modules or eToken addresses) - value: Usually 0 for ERC-20 stuff - data: The encoded function call (deposit, borrow, etc.)

2

0

Pinned

Euler + Pendle PT Borrowing Strategy Doing 30% APY

Just completed a thorough test of Pendle and Euler on the Plasma network and I'm genuinely impressed with what I'm seeing. Speed & Cost Comparison vs Base - Transaction Speed: Plasma is noticeably faster than Base - Gas Costs: Actually cheaper than Base - we're talking pennies per transaction - Multiple approvals and swaps executed with minimal gas spend The network handled USDT approvals and PT swaps smoothly, with negligible slippage throughout the process. Euler + Pendle Borrowing Strategy Walkthrough The Setup Swapped into PT (Principal Tokens) on Plasma to use as collateral on Euler, with the goal of borrowing stablecoins against the position. Key Challenge: LTV Limitations Initial Plan: Borrow at 84% LTV Reality: Platform limited me to 70% LTV This adjustment changed the math significantly: - At 70% LTV on a $25k position → ~$17,435 borrowing capacity - Required position size increased to $7,500 to maintain strategy viability Critical Discovery: Wrong Market Link Found that Pendle's link was directing to the USDE market instead of the correct sUSDAI market. Always verify you're on the right market before executing - this could have been costly. Risk Assessment: The De-Peg Scenario Before committing to the 70% LTV, I analyzed the sUSDAI token's historical performance: Token Analysis (via CoinMarketCap) - Identified past de-peg event from October - Measured maximum drawdown: 4% de-peg - Recovery timeline: ~30 days (regained peg in November) Position Sizing for Safety With a 70% LTV, ran the numbers through my DeFi flight simulator: - Position size: $7,500 - Health score after opening: 1.07 - Verdict: Can comfortably weather a 4% de-peg event Technical Notes & Considerations Oracle Issues Encountered adapter staleness warnings during setup: - "Adapters maximum staleness, 87,000 seconds, is insufficient for the feed's heartbeat" - Using Chainlink oracles - always check oracle parameters before borrowing Approval Management

2

0

Pinned

Welcome to DeFi U!

Hello everyone and welcome. As we begin building out DeFi University together, please know that any ideas you may have for a new tool, a new live call, a new course, anything that you'd like to build or incorporate in to add more value for us, the community members, that is 100% a yes here. This community is AI first, which simply means that we learn together how to use AI tools to build what will generate more value for us, the community members. We hope to foster an environment of learning and growth in many different areas of life within our DeFi University community, and now with these new AI tools any suggestion that any member has which will add value can quickly be built out and incorporated in. It's a very exciting and transformative time that we live in. To foster a sense of community spirit, please introduce yourself in the general chat as you join, and share a bit about yourself so that we can all get to know one another better. Live calls in the community take place every day Monday through Friday and they are open to all members. See you on the next live call and in the DeFi U chats! -David

Hacked!

Hey everyone, I just wanted to give you a heads up to be extra careful. I just lost 4.6 ETH. I used Aperture finance to open and LP, 1 week later I withdrew my position on Revert finance and the funds hit my wallet and instantaneously were sent to an unauthorized contract address. Turns out there was a hack on Aperture Finance, that I am just now realizing I was affected by - https://phemex.com/news/article/17-million-stolen-in-attacks-on-aperture-finance-and-0xswapnet-56041 I use a Tangem hardware wallet, VPN, and am very cautious, yet this still happened to me. It's enough to make me vomit and want to run from the crypto space. 🤮 Just sharing so hopefully you can avoid something like this.

1-30 of 419

skool.com/defiuniversity

Master DeFi from beginner to advanced. Security-first curriculum, live mentorship, gamified learning. Join us and build DeFi expertise safely.

Powered by