Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

DeFi University

237 members • Free

100 contributions to DeFi University

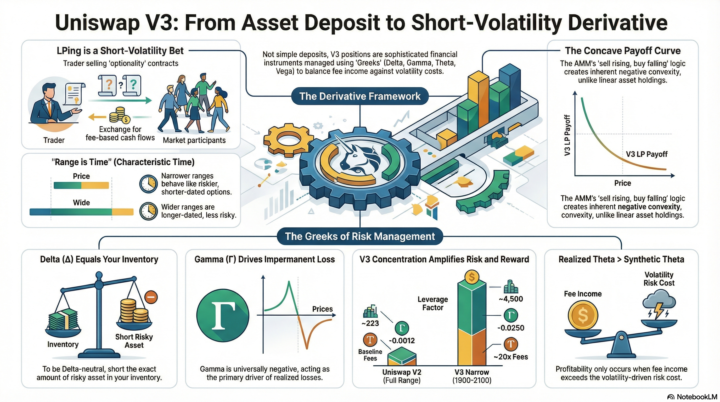

The Core Concept

Providing concentrated liquidity is mathematically equivalent to selling options. You are earning fees (Theta) in exchange for taking on negative convexity (Gamma risk). If price moves too much, your Impermanent Loss (IL) accelerates.

0

0

Rotating

2 days ago I took profits from my GLDG stocks (Goldminer) +125% and rotated those profits in BTC. Will the rest of the world follow?

Welcome to DeFi U!

Hello everyone and welcome. As we begin building out DeFi University together, please know that any ideas you may have for a new tool, a new live call, a new course, anything that you'd like to build or incorporate in to add more value for us, the community members, that is 100% a yes here. This community is AI first, which simply means that we learn together how to use AI tools to build what will generate more value for us, the community members. We hope to foster an environment of learning and growth in many different areas of life within our DeFi University community, and now with these new AI tools any suggestion that any member has which will add value can quickly be built out and incorporated in. It's a very exciting and transformative time that we live in. To foster a sense of community spirit, please introduce yourself in the general chat as you join, and share a bit about yourself so that we can all get to know one another better. Live calls in the community take place every day Monday through Friday and they are open to all members. See you on the next live call and in the DeFi U chats! -David

Non KYC on and off ramp solutions

With the help of AI I’m doing some research on decentralized (non KYC) on and off ramp solutions. According to AI Bisq and Hodl Hold are good P2P solutions and VeilCards (prepaid debit card) could be a way spend your crypto outside the traditional banking system. Does anyone have experience with these platforms?

🇯🇵 The Japanese Sovereign Crisis and the "Sanaenomics" Regime Shift

The Japanese financial system has reached a critical structural break, transitioning into a state of fiscal dominance. This regime shift is characterized by the subjugation of monetary policy to the government's solvency needs, effectively dismantling the Japanese Yen's (JPY) decades-long status as a "safe haven." 🔑 Critical Takeaways: 💥 The Yield Breakpoint: The 40-year Japanese Government Bond (JGB) yield has breached the 4.0% threshold for the first time since 2007, signaling a collapse in investor confidence regarding long-term fiscal sustainability. 💱 Currency Destabilization: The Yen is trading near 160.00 against the USD. The traditional correlation has inverted; rising domestic yields now drive Yen weakness—a dynamic typical of emerging market crises. ⚡ The Catalyst: Prime Minister Sanae Takaichi's "Sanaenomics" platform—anchored by a record ¥122.3 trillion budget and unfunded tax cuts—has unanchored inflation expectations and introduced a severe sovereign risk premium. 🏦 Systemic Vulnerability: Regional banks and institutional "whales" like Norinchukin Bank are facing acute solvency pressures due to duration-heavy bond portfolios. Norinchukin has already realized losses of ¥1.8 trillion ($12.6 billion). 🌍 Global Contagion: Japan's crisis threatens US Treasury (UST) stability. While the Ministry of Finance (MoF) utilizes the Federal Reserve's FIMA Repo Facility to avoid "fire sales," the Japanese private sector is engaged in a "silent liquidation" of US assets to repatriate capital. 🇺🇸 The "Trump Trap": Japan faces a geopolitical standoff with the second Trump administration, where currency intervention to support the Yen could trigger retaliatory tariffs on the auto sector under the "Greenland Tariff" precedent. 🎯 The Macro-Political Catalyst: "Sanaenomics" The election of Sanae Takaichi in late 2025 has fundamentally altered Japan's economic trajectory. Her doctrine, "Sanaenomics," moves beyond the original "Abenomics" by implementing aggressive reflationary tactics in an already inflationary environment.

1-10 of 100

Online now

Joined Aug 17, 2025

Powered by