Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

DeFi University

188 members • Free

19 contributions to DeFi University

🎯 MASTERING UNISWAP V3 LIQUIDITY: From Passive LP to Active Volatility Trader 📊

Hey DeFi fam! 👋 Just dove deep into this incredible quantitative framework for managing Uniswap V3 positions, and I HAD to share this with you all. This isn't your typical "set it and forget it" LP strategy - this is next-level stuff. 🚀 💡 THE BIG IDEA: Short Volatility, Don't Just Provide Liquidity Most LPs are getting REKT because they treat liquidity provision like passive yield farming. But here's the truth bomb 💣: When you provide liquidity, you're essentially underwriting variance and profiting when markets overpay for risk. This framework shows you how to do it systematically. 📋 THE 4-PHASE FRAMEWORK: Phase 1️⃣: Entry Analysis (The Go/No-Go Decision) ✅ Before you even think about deploying capital, you need to pass THREE critical tests: 1. Calculate the Variance Risk Premium (VRP) - Only enter if VRP > 0, meaning the volatility implied by fees is HIGHER than actual realized volatility. The market needs to be overpaying you for risk! 📈 2. Filter for Market Regime - Use the Hurst exponent to identify market conditions. H > 0.55 = trending market (stay out!), H = 0.5 = random walk, H < 0.55 = mean-reverting (perfect for LPing) 🎲 3. Check Breakeven Volatility - Your forecast for realized volatility must be LESS than your position's breakeven volatility. Otherwise, you're just donating to arbitrageurs. 😬 Phase 2️⃣: Position Structuring & Active Management ⚙️ - High volatility environment? → Set WIDER ranges to survive longer - Low volatility environment? → Set NARROW ranges to maximize capital efficiency - Always aim for delta neutrality by opening a short futures position equal to your LP delta. This isolates the volatility premium! 🎯 Phase 3️⃣: Rebalancing (The Stopping Problem) 🔄 Here's where most people blow up their returns. Rebalancing is DANGEROUS and COSTLY because: - You crystallize permanent impermanent loss 💸 - Swap costs eat into your profits - You're essentially resetting your position The Rebalancing Breakeven Test: Only rebalance if: Expected Future Fees > (GAS + Swap Costs + Crystallized Loss)

BTC follwoing gold price moves?

Remember, when a few months ago one youtuber brought a chart that showed something about BTC potentially following gold's moves up? David thought it was a classic case of curve fitting and it possibly is. Here is another one of the guys I follow on yt, Aaron Bennett, and he claims the same thing at 2 mins. https://www.youtube.com/watch?v=ko1Ip3tzeto What do you guys think?

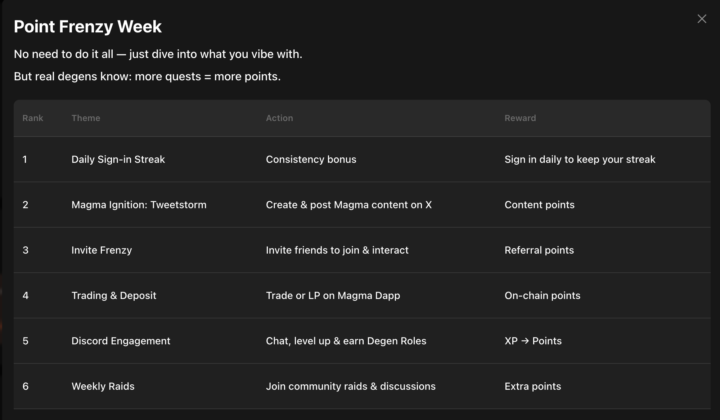

Farming points on Magma

It started providing liquidity on Magma (Sui) and they have a points program where you can earn points in many different ways.

Peter Schiff Launches Tokenized Gold Project 🪙

Gold advocate Peter Schiff is entering the blockchain space with "Tgold" - a tokenized gold platform that aims to revolutionize how we use precious metals in the digital age. What's Being Built: Mobile app for buying, holding & transferring vaulted gold Debit card for spending your gold tokens Ability to redeem tokens for physical gold Blockchain-based ownership transfers The Vision: Schiff believes tokenized gold can achieve what Bitcoin promises - serving as a real medium of exchange, unit of account, and store of value - but backed by physical assets in secure vaults. The Controversy: The project has sparked debate in the crypto community. Binance founder CZ argues that tokenized gold relies on custodial trust and third-party promises rather than true on-chain ownership - calling it a "trust me bro" token. Market Context: The tokenized gold sector is already worth $3.8B+, with Tether Gold and PAX Gold leading the market. Big Event: Schiff is set to debate CZ in Dubai (Dec 3-4) on Bitcoin vs. Tokenized Gold, with the token launch expected around the same time. Will tokenized gold bridge the gap between traditional finance and crypto, or is it just old wine in new bottles? #PeterSchiff #TokenizedGold #Crypto #Gold #Blockchain #Bitcoin #DigitalAssets

1 like • 26d

I think tokenized gold /PMs has a place in the marketplace. Some people in historically safe jurisdictions, like Switzerland for instance may trust their friendly neighborhood dealer/custodian. I used to trust a company like this, until they went under with 10 grand of my initial investment... it was the LODE project, supposedly holding my silver in the Cayman islands...https://medium.com/lode

1-10 of 19