Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Superior Students

18.4k members • Free

The Off Grid Collective

293 members • Free

Plan Your Tech

111 members • Free

The Electricity Lab

162 members • Free

DIY Solar Alliance

49 members • Free

The Solar Network

32 members • Free

Energy Passive Income Academy

29 members • Free

Oil and Gas Australia

25 members • Free

Best Job Ever Career Club

69 members • Free

25 contributions to Energy Economics & Finance

Round2 Interview Question

In the interview , for a company (energy investments / commodities) a panel of 3 interviewers asked me the following during a discussion . Panel: Let's talk about some important Python details. It's ok if you don't remember things. Just an approximate answer will be fine for us. So, in Python, what is the difference between a List comprehension and a Generator expression. In a few words... Correct answer: A generator expression is like a list comprehension, except that it doesn't store the list in memory. Panel: Give some example . Write here in the tablet. Answer: list comprehension: simulated_returns = [price * volatility for price in historical_data] portfolio_value = sum(simulated_returns) generator: simulated_returns = (price * volatility for price in historical_data) portfolio_value = sum(simulated_returns)

1 like • 56m

@Babette Pascal Same worked for me. By just typing the code that you see on screen, really makes my mind to absorb it. It is weird but really works. Trust the process! It works with all of us. Just type the code, and as you type always try to focus on what the code means e.g. dont just think about other things, but think about the code. Just 1-2 hours a day , you will see.

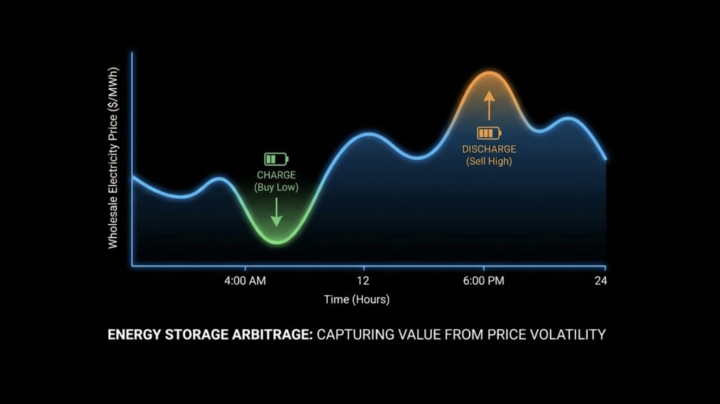

Energy Storage Arbitrage: 2 common Interview Questions

A new online course is being prepared about Energy Storage Trading using optimisation, machine learning (including reinforcement learning) , beginner-friendly ( no prerequisites ). This course will explain what energy storage trading is, what energy storage arbitrage is, etc - also all developed in Python. This is a topic that all energy companies are interested in, so there is very high probability that a relevant interview question will be asked . Even if you're not looking for jobs at the moment, you may look soon, so it is definitely useful to know this terminology. Here are two common interview questions: Interview Question1: What do we mean by Energy Storage Arbitrage? Interview Question2: What is the difference between Financial Arbitrage and Energy Storage Arbitrage? ================== Answer to Question1: It is when an Energy Storage unit buys electricity when the electricity price is low, and sells it when the electricity price is high. This operation generates economic profit by exploiting this price volatility over the course of a day, as shown in the attached slide. Answer to Question 2: The main difference is between space and time. Financial arbitrage exploits price differences between two different locations (e.g. New York and London) at the same moment (i.e. we buy a financial asset in New York and immediately we sell the same asset in London at a slightly higher price e.g. $100 versus $100.1 ). While Energy Storage arbitrage exploits price differences at different times within the same location (electricity market) e.g. the same storage unit (same location) buys electricity when its price is low, and sells it when the price is high. VIDEOS: Also, in the Classroom/6.3 I have uploaded 2 videos, each for these two questions (they provide some extra analysis). These two videos will also be part of the new course (in a few days).

New Report on Small Nuclear Reactors

A new report on energy trends has been published and can be found by clicking on 'Classroom' and navigating to Section 6.2 (See the attached screenshot). You can use this report and the visualisations it includes, in your own projects, work, or studies, without limits. This report is about Small Nuclear Reactors and current trends by February 2026. Big technology companies like Amazon and Google are racing to find reliable electricity to meet the massive energy demands of new AI data centers. Their primary long-term solution is investing in Small Modular Reactors (SMRs) which are smaller nuclear plants that provide steady "zero-emission" electricity. However, because SMRs take about 8 years to build, these companies are also restarting and upgrading existing nuclear plants to bridge the gap. The report includes lots of diagrams and flowcharts that provide context, and also a list of relevant sources that were used to complete this report. These sources are from the Financial Times, Wall Street Journal, the Economist and Investors Chronicle (all sources are available inside the report). Your subscription in this Skool community gives you access to paywalled energy-economics articles from these publications (Financial Times etc) indirectly through these reports. I have also included some explanations and additional text that explains some details. The text is written in beginner-friendly, easy-to-understand language. Reading these reports is helpful for interviews, panel discussions , presentations, networking, and public speaking. Strongly recommended.

LLMs Best Practices

Hey everyone, I’m asking this because LLMs weren’t really part of our workflow before, but now that they’re available it’s difficult not to leverage them given their productivity benefits. How are you using LLMs in data science workflows, and what best practices should I be aware of? Also, from a manager’s perspective, what expectations or concerns do you have about their use? PS: I am one of those that do not use it much especially for work or academia and looking for the correct ways to integrate it.

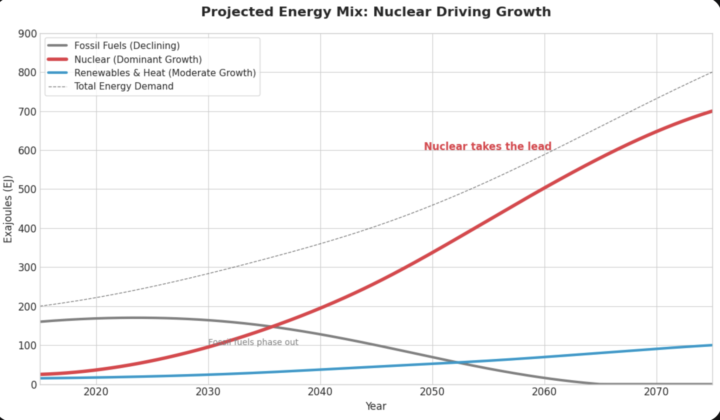

Energy Transition : Adding instead of Replacing

Below is part of some consultancy work I completed recently and sharing a few key ideas: Renewable energy is growing but fossil fuels are still growing too, so the system is adding rather than replacing. Oil and gas will remain important for a long time, so new investment in fossil‑fuel supply and infrastructure (pipelines, power plants, refineries, and other big long‑lasting equipment) will still be needed. If clean energy supply grows faster than total demand for long enough, clean energy first covers new demand and then starts replacing fossil fuels. If clean energy supply keeps outgrowing demand by a few percentage points for decades, fossil fuels will eventually be squeezed out. Real replacement of fossil fuels, not just adding clean energy, is not guaranteed. Most likely we will see 'addition' and co-existence of fuels. This is because the demand is keep rising more and more eg due to AI etc. See the plot .

1-10 of 25

@ronan-murphy-8621

Technical Consultancy in Energy, with focus on Power/LNG/Hydrogen

Active 41m ago

Joined Nov 15, 2025

ISTP

Dublin/IR