Write something

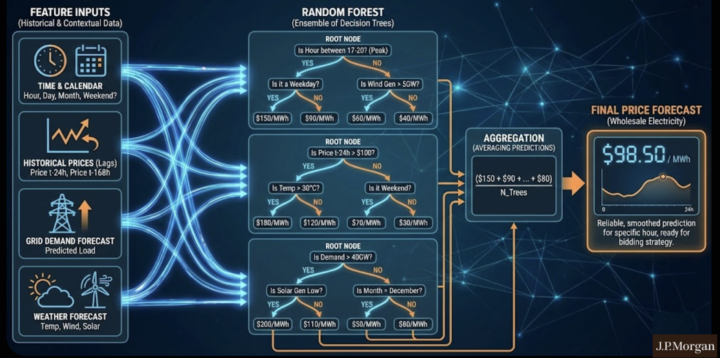

Random Forest (ML) for Energy Trading

I was in a project collaboration (Enel, EDF, JP Morgan, Universities etc) on algorithmic trading, and the use of Machine Learning for electricity price prediction. I am sharing one slide. Why are trading desks using Random Forest so much ?

Trick interview question for energy consultancy role!

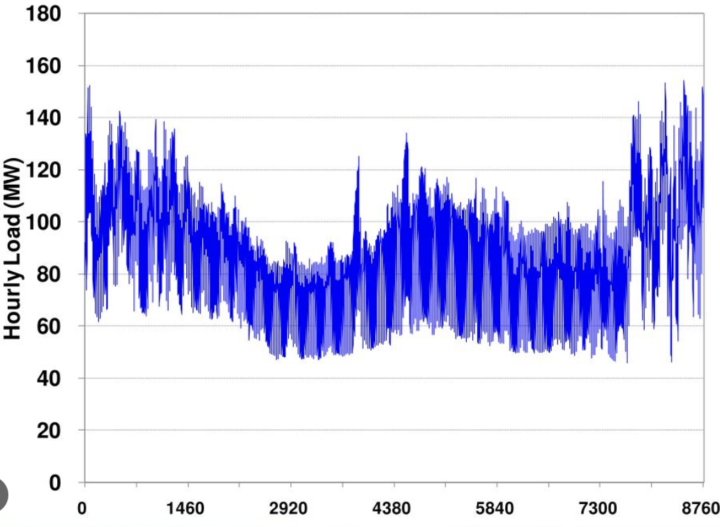

Speaking of interview rounds, I am sharing a very classic 'tricky' and frequently occurring question asked to those applying for consultancy roles in energy for entry roles . By 'entry roles' I do not mean internship. You need to have a BSc for sure, and you aim for a salary around $120k gross annual revenue - speaking of the United States , for 0-1 years of experience , i.e. fresh graduates. But this question is also asked to intermediate experience candidates e.g. 2-5 years experience (salary around. $180k / year in the USA. This is gross ie pre-tax, and annual). Below you see the plot of an electricity demand profile i.e. shows the electricity demand over a day. First, the question is to explain what we see. What do we understand in this plot. To explain the ups and downs. They may point with their finger e.g. 'why here it is low ' , 'why there it is high', speaking of this blue line. And then explain what happens to the price of electricity. Can we infer the wholesale electricity price from this plot? Because this plot doesn't show the price. It shows the demand . And this is the total demand in that region. Electricity demand. This question is asked because when you' re a consultant, your client often asks such questions. And you have to reply fast and accurately, or you may risk your reputation. If you try to evade e.g. by changing topic, then your client isn't stupid.. they will understand... and sometimes they will ask again... So such questions are asked. So this is a classic "gotcha" interview question. The interviewer is testing two things: your technical knowledge of energy markets and, more importantly, your attention to data validation.

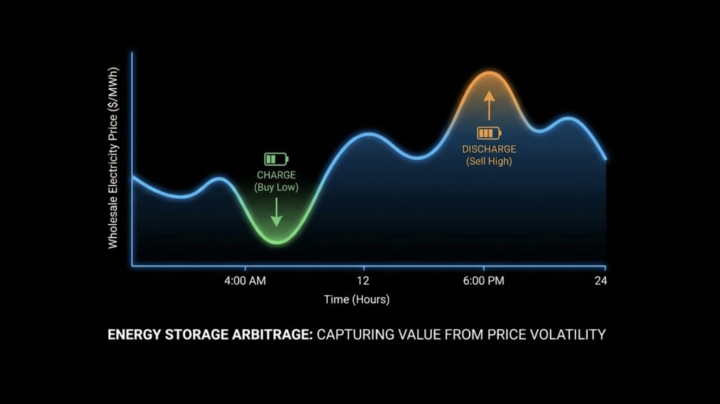

Energy Storage Arbitrage: 2 common Interview Questions

A new online course is being prepared about Energy Storage Trading using optimisation, machine learning (including reinforcement learning) , beginner-friendly ( no prerequisites ). This course will explain what energy storage trading is, what energy storage arbitrage is, etc - also all developed in Python. This is a topic that all energy companies are interested in, so there is very high probability that a relevant interview question will be asked . Even if you're not looking for jobs at the moment, you may look soon, so it is definitely useful to know this terminology. Here are two common interview questions: Interview Question1: What do we mean by Energy Storage Arbitrage? Interview Question2: What is the difference between Financial Arbitrage and Energy Storage Arbitrage? ================== Answer to Question1: It is when an Energy Storage unit buys electricity when the electricity price is low, and sells it when the electricity price is high. This operation generates economic profit by exploiting this price volatility over the course of a day, as shown in the attached slide. Answer to Question 2: The main difference is between space and time. Financial arbitrage exploits price differences between two different locations (e.g. New York and London) at the same moment (i.e. we buy a financial asset in New York and immediately we sell the same asset in London at a slightly higher price e.g. $100 versus $100.1 ). While Energy Storage arbitrage exploits price differences at different times within the same location (electricity market) e.g. the same storage unit (same location) buys electricity when its price is low, and sells it when the price is high. VIDEOS: Also, in the Classroom/6.3 I have uploaded 2 videos, each for these two questions (they provide some extra analysis). These two videos will also be part of the new course (in a few days).

Round2 Interview Question

In the interview , for a company (energy investments / commodities) a panel of 3 interviewers asked me the following during a discussion . Panel: Let's talk about some important Python details. It's ok if you don't remember things. Just an approximate answer will be fine for us. So, in Python, what is the difference between a List comprehension and a Generator expression. In a few words... Correct answer: A generator expression is like a list comprehension, except that it doesn't store the list in memory. Panel: Give some example . Write here in the tablet. Answer: list comprehension: simulated_returns = [price * volatility for price in historical_data] portfolio_value = sum(simulated_returns) generator: simulated_returns = (price * volatility for price in historical_data) portfolio_value = sum(simulated_returns)

A common interview question: Mean Reversion

No need to know quantitative finance to answer this question. I am attaching a presentation of 3 slides . A very common interview question in Energy (not only energy finance) is about the electricity price and its characteristics, one of which is 'mean reversion' . Such an interview question is when you apply for roles like the following. I also show company names. - Energy Quantitative Analyst (Vitol, BP, Shell, Citadel, Millennium, RWE, Statkraft) - Power / Gas Trader (Mercuria, TotalEnergies, EDF, Goldman Sachs, JP Morgan, Morgan Stanley) - Energy Structurer / Originator (Engie, Vattenfall, Macquarie, D.E. Shaw, DRW, ExxonMobil) - Market Risk Analyst (Uniper, Centrica, J.P. Morgan, Barclays) - Data Scientist - Commodities (Freepoint Commodities, Castleton Commodities, Koch Industries) If you look at a graph for the electricity price, for every hour of the year you will see them fluctuating, spiking high during sudden shortages or dropping low during excess electricity supply. However, the price always snaps back to a central equilibrium level (mean). So it 'reverts' back to the mean. So the price fluctuates wildly but it is always being pulled back toward its seasonal trend line. This trend line (mean) is not a flat / horizontal line; but it also fluctuates , but slowly, throughout the year due to seasonal demand . So in the interview question they show a plot of the electricity price. Just like the one attached. They ask you to explain where mean reversion is and why it happens. Click below to download the presentation . By the way, there are many mathematical models to describe this behavior. We will see them all in Python. The most common is called "Ornstein-Uhlenbeck" model. It is used by all quantitative analysts. Another one , more realistic version, is the Mean-Reverting Jump Diffusion model. You can just know the name of these models. Nothing more. We will see the code and theory later.

1-30 of 41

powered by

skool.com/software-school-for-energy-7177

A beginner-friendly training program for a career in the energy sector. Regardless of your location, age, sex, education or experience level.

Suggested communities

Powered by