Write something

PFE and MRK

I checked prior discussions on MRK and PFE before posting. We’ve covered both Pfizer and Merck extensively since 2023 across various threads, and a new post in those would likely get buried or lack context. MRK and PFE report earnings this week and next, respectively. Both stocks have been climbing steadily, mirroring gains in XLV (Health Care Select Sector SPDR Fund) and XBI (SPDR S&P Biotech ETF). It seems they’re finally attracting buyers. Both companies face a common challenge: patent expirations. To address this, they’re actively acquiring other firms to bolster their pipelines. I’m looking forward to their earnings reports. Thoughts on their outlook or recent moves?

Morningstar (MORN)

It looks and feels like they finally shook off all weak hands. I started buying.

Klarna (KLAR)

KLAR is the new kid on the BNPL / neobank block. Though ER was disappointing for some, numbers are still impressive. Ratio collars selling $10 puts and buying $15 calls look attractive to me. I went with Dec 2028.

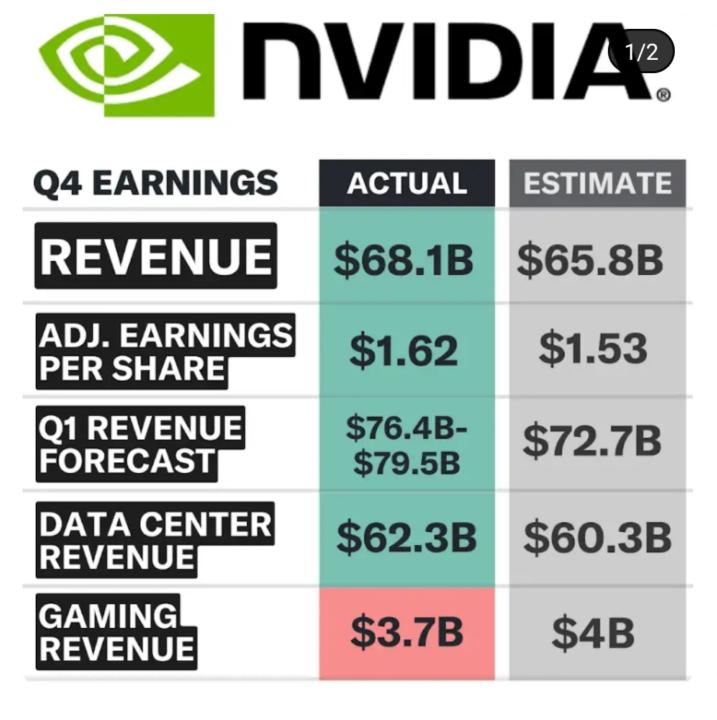

Nvda Q4 earning

Will Nvidia lifts all tides? Their guidance is raised 5bbbbillions from estimate!! 👍💪💪💪

Why I am back to bullish even with 15% tariffs?

During this weekend, I've made significant changes to my portfolio. Took a quick 3 week profits on my short position while the market is down Now, I am bullish on the overall market again. Here are two interesting ideas for you - Bitcoin - Microsoft Even though this bear market was relatively short-lived (3 weeks), I was able to hold cash and buy back at a relatively lower price using the profits from the short position The Supreme Court ruled that the Trump tariffs are illegal Trump tried to impose 10% tariffs and increase it to 15% tariffs globally. However, the market stayed strong. This is a signal that the market does not believe Trump can pull through on the global tariffs, giventhe Supreme Court's ruling So we are back to bullish for now. Remember short positions (or hedges) are only short term measures to protect yourself like insurance. Shorts / hedges are not meant to be held for a long period of time. Cheers, Eric ---- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com In March, my goal is to help 20 people with no financial background master investing. You will learn two strategies: • Long-term investing with options — learn how to find discounted blue chip stocks using technical and fundamental analysis You will also learn how to hedge during a bearish market to protect yourself • Monthly passive income — learn how to generate cash flow for retirement or replacing/boosting part of your salary using options Here's a step by step guide on how to join Investing Accelerator for free: https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free If you’re interested, you can hop on a free strategy call with me or Michael to see if you are a good fit. Schedule a call here: https://bit.ly/48mJlgR

1-30 of 407

skool.com/invest-retire-community-1699

Investment & Retirement Strategies for busy full-time professionals. Long-term investing & Monthly Passive income ideas.

Powered by