Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Steven J.

Memberships

Skoolers

189.9k members • Free

5-Minute Futures

7.4k members • Free

62 contributions to Futures Trading Group

Reminder

I wanted to share something that's happened over the past three trading days—because it perfectly illustrates the guidance I provided about adjusting your settings during simulation. For three consecutive days, the strategy's very first trade was a loss for some of you. And for three consecutive days, the strategy went on to hit its full daily profit target of $1,000 (or $100 on micro contracts). If you're running the default daily max loss setting of $1,000 ($100 micro), that first losing trade may have stopped your strategy for the entire session. You would have recorded a losing day—while the strategy, given the room to continue, actually delivered a winning day. This is exactly the scenario I want to help you avoid during your trial. Please double your daily max loss to $2,000 ($200 for micro contracts) while you're in simulation mode. Remember: you're not risking real capital right now. What you are doing is giving the AI the opportunity to learn from a full range of market activity, and giving yourself the chance to see how the strategy recovers and performs across an entire session. A single trade—win or loss—is never the full picture. Let the strategy show you what it can do. Once your trial concludes and you're ready to trade live, you can tighten those limits back to whatever level fits your personal risk tolerance. But for now, give it room to breathe. As always, reach out if you have any questions.

1

0

Today so far....

New Nexum version in action today....1 losing trade this morning. Let's see what the new afternoon 2pm window brings!

Nexum Update

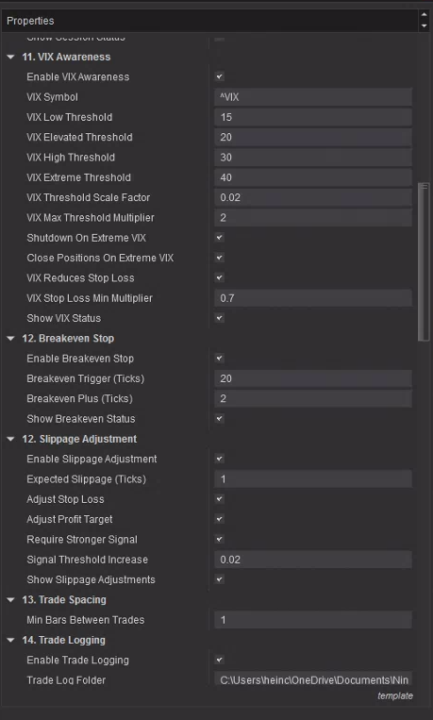

We encourage you to download the Nexum update, as it consists of bug fixes and additional logic that provides configurable slippage and breakeven settings that you might find helpful as you continue to sim trade. It also contains changes in the hidden logic that increases profit factor and win rate. The trading window has been adjusted and includes a small window in the post-lunch session. There is no need for you to make those adjustments in your settings; they are already programmed into the updated file. The new trade windows are 10:30-11:30 and 2:00-2:45. The one configurable change we encourage you to make is in the the maximum number of daily trades. Enter 4 in that setting. We've attached 3 screenshots for those who want to ensure all their settings are correct. Our goal is to continue to increase successful trades while reducing their number. Increased success rate + reduced number of trades = ever-increasing return on investment. Take the new update home. Let us know what you think Download Nexum Update

0 likes • 3d

@Bob Shapiro I hear you Bob. But if you need help, just reach out. We're here. Remember, we're in an ever-evolving industry (ai-automated trading) that follows another ever-evolving industry (the futures market...or any financial market, for that matter). Given that ever-evolving multiple, the changes are destined to come quickly! Hence, the update. Even so, we're able to corner on a dime, so please don't worry.

Pre-market 2-6-26

The E-mini Nasdaq-100 futures (NQ) for the March 2026 contract are trading higher this morning as of around 8:00 AM EST on February 6, 2026. The current price stands at approximately 24,782.50, reflecting a gain of 131.50 points or +0.53% from the previous close of 24,651.00. Today's open was at 24,416.00, with a session high of 24,873.25 and a low of 24,239.75. Volume is building at around 151,000 contracts, indicating solid participation amid event anticipation. CME and other feeds show minor variations due to timing, but the rebound from early lows is consistent. From a technical perspective, NQ shows a Sell overall summary, reflecting recent downside pressure but with potential for short-term relief. Moving averages lean Sell (e.g., breakdowns below key levels), while technical indicators also favor Sell amid overbought conditions on select oscillators. Key indicators suggest neutral-to-bearish momentum, with potential consolidation if supports hold. Pivot points for intraday include a classic pivot at 24,784.33, with resistance at 24,875.66 (R1), 24,978.33 (R2), and 25,069.66 (R3), and support at 24,681.66 (S1), 24,590.33 (S2), and 24,487.66 (S3). Current pricing above the pivot supports mild upside, but failure to hold could retest lows. Market sentiment is cautiously positive in premarket, with Nasdaq futures leading a rebound after a three-day tech rout (Nasdaq Composite down ~4.5% since Tuesday) driven by AI spending concerns, high capex from Amazon/Alphabet, and risk-off flows into value stocks. Bitcoin has stabilized above $65,000 (+3%), aiding sentiment, while Amazon shares drop ~8-9% premarket on capex guidance. Broader indices mixed: S&P 500 futures up 0.4-0.5%, Dow up 0.4-0.5%. Global cues include stable European/Asian markets, but U.S. tariff risks and AI fatigue linger. Incorporating Fed speakers' announcements: Today, Federal Reserve Vice Chair Philip N. Jefferson speaks at 12:00 PM ET on "Economic Outlook and Supply-Side Inflation Dynamics" at the Brookings Institution event "Supply-Side Factors and Inflation: What Have We Learned?" This could provide insights on rate paths amid resilient data and inflation watch, potentially sparking volatility if hawkish.

Pre-Market 2-5-26

The E-mini Nasdaq-100 futures (NQ) for the March 2026 contract are trading modestly higher this morning as of around 8:20 AM EST on February 5, 2026. The current price stands at 25,038.00, reflecting a gain of 38.75 points or +0.16% from the previous close of 24,999.25. Today's open was at 25,061.75, with a session high of 25,169.00 and a low of 24,915.75. Volume is building at approximately 95,000-97,000 contracts, indicating moderate pre-open liquidity. CME and other feeds show slight variations due to timing, but the mild upside bias holds amid mixed broader futures cues. From a technical perspective, NQ shows a Sell overall summary. Moving averages lean Sell (5 Buy vs. 7 Sell), while technical indicators also favor Sell (1 Buy, 2 Neutral, 5 Sell). Key indicators include an RSI(14) at 42.919 (sell), MACD(12,26) at -94.18 (sell), ADX(14) at 32.58 (sell, indicating moderate downward trend strength), STOCH(9,6) at 99.211 (overbought), Williams %R at -0.929 (overbought), CCI(14) at -27.5474 (neutral), Ultimate Oscillator at 40.903 (sell), ROC at 0.153 (buy), and Bull/Bear Power(13) at -48.684 (sell). Pivot points for intraday trading include a classic pivot at 25,049.08, with resistance levels at 25,075.66 (R1), 25,117.58 (R2), and 25,144.16 (R3), and support at 25,007.16 (S1), 24,980.58 (S2), and 24,938.66 (S3). The setup reflects recent breakdowns below key averages, though overbought oscillators could trigger short-term bounces. Market sentiment is subdued to bearish for Nasdaq futures, extending yesterday's tech-led declines (Nasdaq Composite down 1.51% to 22,904.58) amid AI hype fatigue, high capex signals from Alphabet (projecting up to $185B in 2026 spending), and Qualcomm's post-earnings drop on memory shortages and weak guidance. Sector rotation favors value stocks (Dow up 0.53% yesterday), while precious metals like silver tank amid broader risk-off vibes. Broader indices are mixed: S&P 500 futures up ~0.1-0.13%, Dow flat to down 0.07-0.15%. Global cues include BoE and ECB rate holds, with vague data-dependent guidance echoing the Fed. Tariff concerns under Trump and potential 2026 market crash risks add longer-term caution. Earnings focus shifts to Amazon after the close, alongside reports from LIN, COP, BMY, etc.

3

0

1-10 of 62

Active 8h ago

Joined Feb 13, 2024

New York