Write something

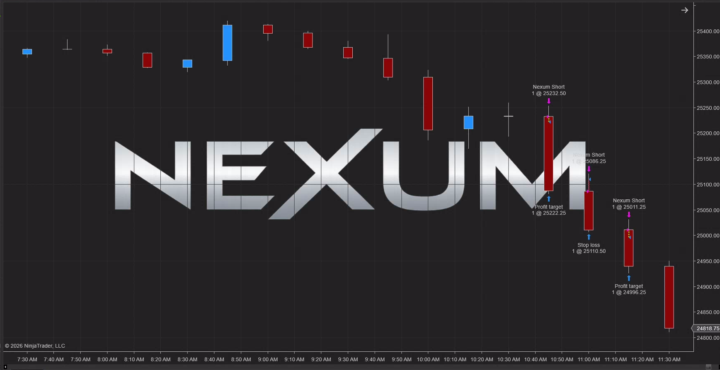

Post-Game 2-12-26

Nexum ended flat after 3 morning trades. Volturon hit its target in 5 trades. Stopped trading after 6 trades. How did you all make out? We'd love to hear what you have to say!

2

0

Pre-market 2-11-26

**The E-mini Nasdaq-100 futures (NQ) for the March 2026 contract are trading modestly higher this morning as of around 8:20 AM EST on February 12, 2026.** The current price stands at approximately 25,335–25,345, reflecting a gain of about 45–55 points or +0.18% to +0.22% from the previous close of 25,288.50–25,299. Today's open was near 25,289, with a session high around 25,384 and a low of 25,206. Volume is moderate at roughly 50,000–60,000 contracts in early trading. From a technical perspective, NQ shows a **Neutral to Sell** overall summary. Moving averages are mixed (roughly balanced or leaning Sell), while technical indicators lean Sell in shorter time frames (e.g., Strong Sell on some oscillators). Key indicators include RSI(14) near neutral-to-mild buy territory, MACD with recent sell signals, ADX indicating moderate trend strength, and overbought readings on Stochastic/Williams %R that could cap upside. Pivot points for intraday trading feature a classic pivot near 25,300–25,320, with resistance at approximately 25,355–25,370 (R1/R2) and support at 25,280–25,250 (S1/S2). The setup suggests potential consolidation or limited upside unless key resistances break, amid recent volatility from AI/tech concerns. Market sentiment is cautiously positive in premarket, with Nasdaq futures up ~0.2–0.3% alongside broader gains (S&P 500 and Dow futures +0.25–0.35%). This follows yesterday's stronger-than-expected January jobs report (payrolls beat, unemployment dipped), which eased recession fears but kept Fed rate-cut expectations tempered. Tech remains under pressure from AI spending worries and earnings digestion (e.g., Cisco weakness on margins), though rotation and resilient data provide some support. Earnings continue today (e.g., Brookfield, Howmet, others), with focus shifting to tomorrow's CPI for inflation clarity. Broader indices closed mixed yesterday, but futures point to a firmer open. **Incorporating Fed speakers' announcements:** Today includes discussions with Governor Stephen I. Miran (conversation at the Dallas Fed event) and Vice Chair for Supervision Michelle W. Bowman (supervision and regulation topic around 10:15 AM ET). These could offer mild insights on policy or oversight but are unlikely to be major market movers unless comments shift rate expectations.

3

0

Post-game 2-11-26

Both Nexum and Volturon ended with a small profit today. Profit is always a good thing, even when it isn't big! Some have argued that the settings on both strategies are a little too conservative, but I don't think so. Even so, the loss-prevention settings are largely configurable, so by all means, experiment while sim trading. One of you shared that turning off the VWAP filter (settings 4a in your properties) and lowering ADX minimum threshold to 18 from 20 (settings 4b in your properties) yielded 2 extra winning trades in Volturon today. So yes, tweaking property settings over time may work for the adventurists among us. Just remember, "a dollar saved is a dollar earned". And what worked today may not work next week, so be careful. But continue to share your ideas because we are all interested in learning new methodologies!

Prop Firms

Which trading strategy would you say is best for funding accounts from prop firm? Should there be an adjustment of settings?

Pre-market 2-11-26

The E-mini Nasdaq-100 futures (NQ) for the March 2026 contract are trading modestly higher this morning as of around 8:10 AM EST on February 11, 2026. The current price stands at approximately 25,243.25, reflecting a gain of 25.00 points or +0.10% from the previous close (not explicitly listed but implied around 25,218.25). Today's open was at 25,259.00, with a session high of 25,345.50 and a low of 25,146.75. Volume is moderate at around 64,500-100,000 contracts, showing steady but not aggressive pre-open participation. Other feeds confirm a slight upside bias, with minor variations due to timing. From a technical perspective, NQ shows a Neutral overall summary. Moving averages are Buy (7 Buy vs. 5 Sell), while technical indicators are Neutral (3 Buy, 3 Neutral, 3 Sell). Key indicators include an RSI(14) at 48.277 (Neutral), MACD(12,26) at -15.21 (Sell), ADX(14) at 27.223 (Buy), STOCH(9,6) at 99.298 (Overbought), Williams %R at -0.516 (Overbought), Ultimate Oscillator at 47.566 (Sell), ROC at 0.029 (Buy), and Bull/Bear Power(13) at -41.088 (Sell). Pivot points for intraday trading include a classic pivot at 25,222.83, with resistance levels at 25,239.91 (R1), 25,267.08 (R2), and 25,284.16 (R3), and support at 25,195.66 (S1), 25,178.58 (S2), and 25,151.41 (S3). The mixed signals reflect potential consolidation, with overbought conditions hinting at short-term pullback risks amid recent breaks from upward trends. Market sentiment is cautious to mildly positive in premarket, with Nasdaq futures up around 0.1-0.3% amid anticipation of key labor data, following a mixed close yesterday (Nasdaq Composite down 0.6%, but Dow at records). Broader indices are similarly subdued: S&P 500 futures up 0.09-0.2%, Dow up 0.08-0.2%. Ongoing AI fatigue and sector rotation weigh on tech, but resilient economic signals (e.g., gold up 1.7%, oil +2%) provide some cushion. Global markets are steady, with limited tariff or macro noise impacting today. X discussions emphasize NFP volatility and setups, urging risk management.

3

0

1-30 of 63

powered by

skool.com/futures-trading-group-7221

Welcome to the Futures Trading Group, an exclusive community dedicated to the mastery and advancement of AI-driven automated futures trading.

Suggested communities

Powered by