Write something

Pinned

Free Trial - No Credit Card or Any Obligation - Just have fun...!!

For those who are just joining us: We are looking for traders to try our strategy with absolutely no obligation. Do you already use NinjaTrader? Download our NT8 approved algo, and give it a try. No credit card. No registration. Use it for 14 days and see if it works for you. There is zero downside to this offer. If you have questions, simply respond to this post or email [email protected]. In any event, download either algo without obligation here: Volturon Trend Strategy: https://drive.google.com/file/d/1tymVrx5GSnZz-DGgPPfmkZD_JKPrCldt/view?usp=sharing Nexum_ai: https://drive.google.com/file/d/1ZfhigGm-SJHJH2h1LL8K3RPzG68LY5eU/view?usp=sharing

Pre-Market 2-5-26

The E-mini Nasdaq-100 futures (NQ) for the March 2026 contract are trading modestly higher this morning as of around 8:20 AM EST on February 5, 2026. The current price stands at 25,038.00, reflecting a gain of 38.75 points or +0.16% from the previous close of 24,999.25. Today's open was at 25,061.75, with a session high of 25,169.00 and a low of 24,915.75. Volume is building at approximately 95,000-97,000 contracts, indicating moderate pre-open liquidity. CME and other feeds show slight variations due to timing, but the mild upside bias holds amid mixed broader futures cues. From a technical perspective, NQ shows a Sell overall summary. Moving averages lean Sell (5 Buy vs. 7 Sell), while technical indicators also favor Sell (1 Buy, 2 Neutral, 5 Sell). Key indicators include an RSI(14) at 42.919 (sell), MACD(12,26) at -94.18 (sell), ADX(14) at 32.58 (sell, indicating moderate downward trend strength), STOCH(9,6) at 99.211 (overbought), Williams %R at -0.929 (overbought), CCI(14) at -27.5474 (neutral), Ultimate Oscillator at 40.903 (sell), ROC at 0.153 (buy), and Bull/Bear Power(13) at -48.684 (sell). Pivot points for intraday trading include a classic pivot at 25,049.08, with resistance levels at 25,075.66 (R1), 25,117.58 (R2), and 25,144.16 (R3), and support at 25,007.16 (S1), 24,980.58 (S2), and 24,938.66 (S3). The setup reflects recent breakdowns below key averages, though overbought oscillators could trigger short-term bounces. Market sentiment is subdued to bearish for Nasdaq futures, extending yesterday's tech-led declines (Nasdaq Composite down 1.51% to 22,904.58) amid AI hype fatigue, high capex signals from Alphabet (projecting up to $185B in 2026 spending), and Qualcomm's post-earnings drop on memory shortages and weak guidance. Sector rotation favors value stocks (Dow up 0.53% yesterday), while precious metals like silver tank amid broader risk-off vibes. Broader indices are mixed: S&P 500 futures up ~0.1-0.13%, Dow flat to down 0.07-0.15%. Global cues include BoE and ECB rate holds, with vague data-dependent guidance echoing the Fed. Tariff concerns under Trump and potential 2026 market crash risks add longer-term caution. Earnings focus shifts to Amazon after the close, alongside reports from LIN, COP, BMY, etc.

2

0

Post-Game 2-4-26

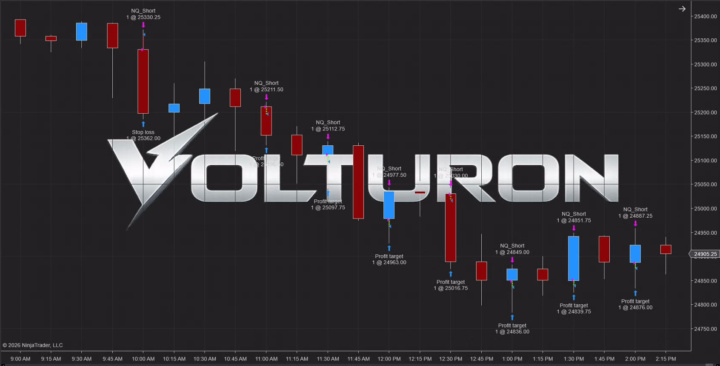

Nexum won in 3 trades. Some of you saw it lose the first trade, but it recovered quickly and hit its target. Volturon lost its first trade here, but quickly recovered and hit its target. If any of you have questions about the strategies, please feel free to post them here, or send us an email at [email protected]

3

0

Important: Recommended Settings for Your Trial Period

I want to share some guidance on getting the most out of your simulation experience. The default profit/loss limits and trading window settings are intentionally conservative—they reflect parameters that have historically produced the best results in live trading. However, these tight restrictions can work against you during simulation. Here's why: if the strategy's first trade of the day happens to be a loss, the daily loss limit may be reached immediately, stopping all further activity for that session. While this protection is valuable when trading real capital, it prevents two important things during your trial: 1. AI Learning — The strategy's AI models improve through exposure to diverse market conditions and trade outcomes. More trades mean better learning. With overly restrictive settings, the AI simply doesn't get enough data to develop effectively. 2. Your Own Discovery — The trial period is your opportunity to observe how the strategy behaves across different market environments and to identify your personal comfort level with risk. You can't do that if trading stops after one trade. My recommendation: During simulation, consider opening up the daily profit/loss limits and expanding the trading window. Let the strategy trade more freely so you can see its full range of behavior. Take notes on what you observe. Then, when you're ready to go live, you can dial the parameters back to levels that match your own risk tolerance—informed by what you've actually seen. You're not risking real money during the trial. Use that freedom to learn. If you have any questions about specific settings, don't hesitate to reach out.

3

0

Premarket 2-4-26 | Caution

The E-mini Nasdaq-100 futures (NQ) for the March 2026 contract are trading lower this morning as of around 8:19 AM EST on February 4, 2026. The current price stands at 25,391.75, reflecting a decline of 60.25 points or -0.24% from the previous close of 25,452.00. Today's open was at 25,387.50, with a session high of 25,514.25 and a low of 25,354.50. Volume is building at 84,264 contracts, showing moderate early participation. Other feeds confirm the softness, with prices hovering around 25,385-25,391 amid broader caution. From a technical perspective, NQ exhibits a Strong Sell overall summary. Moving averages signal Strong Sell (0 Buy vs. 12 Sell), while technical indicators lean Sell (1 Buy, 3 Neutral, 5 Sell). Key indicators include an RSI(14) at 40.737 (sell), MACD(12,26) at -65.01 (sell), ADX(14) at 25.456 (neutral), STOCH(9,6) at 99.553 (overbought), Williams %R at -0.662 (overbought), CCI(14) at -7.6769 (neutral), Ultimate Oscillator at 47.694 (sell), ROC at -0.041 (sell), and Bull/Bear Power(13) at -31.284 (sell). Pivot points for intraday include a classic pivot at 25,464.33, with resistance at 25,491.91 (R1), 25,510.33 (R2), and 25,537.91 (R3), and support at 25,445.91 (S1), 25,418.33 (S2), and 25,399.91 (S3). The bearish alignment from breakdowns below key averages reinforces downside risks, though overbought conditions on select oscillators could prompt minor rebounds. Market sentiment remains bearish to cautious for Nasdaq futures, building on yesterday's pullback (Nasdaq Composite down 1.43% on February 3) driven by sector rotation away from tech toward cyclicals, ongoing Fed policy uncertainty with Trump's hawkish nominee for Chair, and a volatile precious metals environment weighing on risk assets. Earnings from key players like AMD, Amazon, and Alphabet are due today, which could swing sentiment if results miss amid AI hype fatigue or exceed on growth metrics. Broader indices are mixed, with S&P 500 futures slightly lower and Dow resilient, while global cues show European PMIs indicating sluggish services growth and Asian markets focused on NZ/China data. VIX around mid-teens suggests moderate fear, with the jobs report later this week (Friday's NFP) adding to anticipation.

3

0

1-30 of 60

powered by

skool.com/futures-trading-group-7221

Welcome to the Futures Trading Group, an exclusive community dedicated to the mastery and advancement of AI-driven automated futures trading.

Suggested communities

Powered by