Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

PricingSaaS

1k members • Free

14 contributions to PricingSaaS

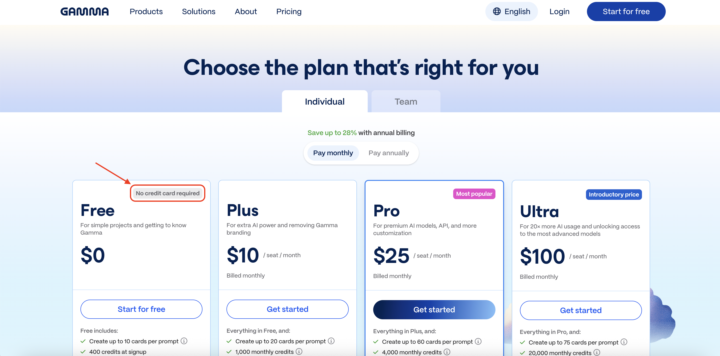

"No credit card required" above the plan names?

Gamma is the only company I have seen do this ⬇️ With their pricing plans, they put “no credit card required” above the actual plan name (the Free plan in this case). It’s the first thing my eye notices, and I immediately register that when I go on to look at the rest of the plan. Now using “popular” or similar is common in SaaS (although I always felt it was a bit contrived). But I like the broader concept of using these headers to signal something meaningful. You could imagine an enterprise plan could lead with SOC-2 compliant or SSO. We know from extensive DoWhatWork A/B testing data that many brands test into reassurance text below CTAs (see websites like Kit, Zapier, Twilio, Monday, etc.). While Gamma’s implementation on a pricing page is unique, it makes sense to me that this would be effective as a quick contextualization or important orienting detail. What do you think?

Pricing Updates this Week (and a question)

Happy Friday y'all! Recorded a quick video breaking down 5 pricing and packaging updates from the last week. Random question, but I'd love to have a rotating cast of guests to analyze changes with. Any takers?

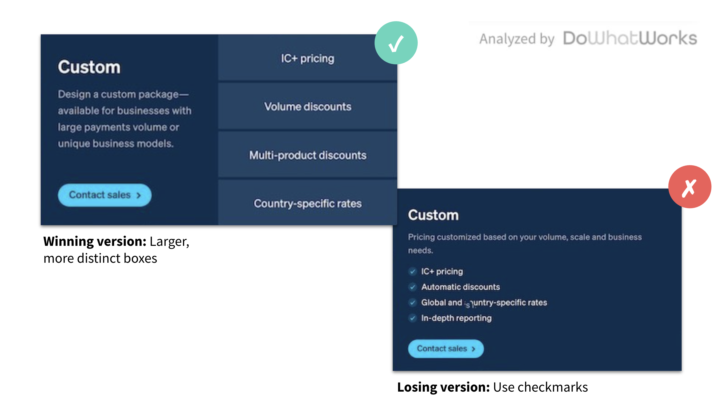

Stripe A/B pricing test around how to display information

Sometimes it's not what you say on your pricing page, it’s how you display that information. I looked at hundreds of A/B tests that have the exact same info, but try…. A grid vs. bullets More white space vs. less white space Bigger text vs. smaller text Image + Stats vs. just stats Although best practices vary depending on industry, location, company stage, and a slew of other factors (we help you navigate that at DoWhatWorks!). Here are two principles that apply to the vast majority of the winning results… → It is easier to read the key thing you want the prospect to see. That is often bigger font, more white space around stats/text, visuals to highlight the key stats etc.. When a page is visually cluttered (images or text), those versions almost always lose. Stripe has been fascinating as a case study here because recently I was going through their tests (I include one around their pricing in the visual deck on this post) and over 90% of their tests can be boiled down to “simplification” and “clarity”. The versions that are simpler and clearer win. → Expectation to reality matching. When I click this button, or tile, what happens next? Simple, clear CTA text wins. Also, helpful subtext below buttons or header/subheader framing can help contribute to clarity here. → Don't make your prospect do math. We find time and time again that the versions of pricing pages with the least required computation win (so the 2-months free, and then 70% off for the first year... yeah, don't do that) When I look at recent website updates from Stripe, Ramp, Cartra, and dozens of others, I find a lot of the same information, but displayed in ways that are far more digestible.

3

0

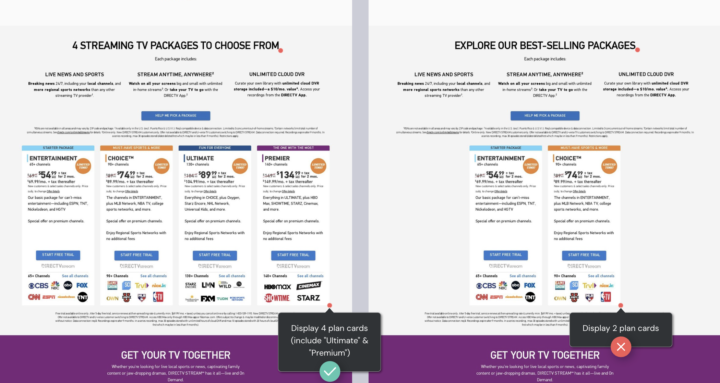

Is there a perfect amount of pricing plan tiers?

I have spent a lot of time digging into our DoWhatWorks database of A/B tests from the top brands in the world to answer this question. It's a complicated one, with variance by industry and many other variables. That being said, in general, here are a few takeaways from the data... - 4 pricing plans seem to be a sweet spot that performs well for most brands and wins against 1, 2 or 3 plans - 2 pricing plans, seems to have a slight edge over 1 or 3 pricing plans. - 5 pricing plans often wins over 1, 2 or 3 pricing plans. Below you see a test from DirectTV where they tested into 4 pricing plans over 2. Again, there is a lot of nuance here, but some interesting directional guidance.

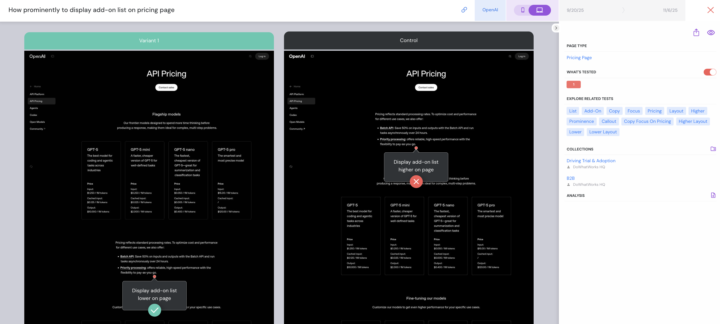

OpenAI tests their add-on strategy

Recently I have noticed OpenAI ratcheting up its A/B testing on its site. This recent test is not particularly novel: having add-ons above your normal pricing plans loses to having them below. However, I am intrigued to see how OpenAI approaches its pricing strategy in 2026. SaaStr summarized their State of AI report and noted "Enterprises aren’t just chatting with AI. They’re running complex, multi-step reasoning tasks in production. 320x increase in reasoning token consumption per org YoY means this went from experiment to infrastructure." It feels like it might be the B2B side, and not the consumer side, which is the major revenue lever that OpenAI leans into.

1-10 of 14

@casey-hill-4993

CMO at DoWhatWorks. We can see A/B tests from any major brand in the world and what is winning

Active 1h ago

Joined Oct 27, 2025

Powered by