Credit based pricing.

Had an interesting conversation this week on credit based pricing and I know this group has the experience, curiosity, and expertise. I’d love your thoughts on this little AI Ramblings blast I put out once in a while. https://www.linkedin.com/posts/akshaypatel07_productmanagement-venturecapital-privateequity-activity-7425524767883169792-SdgG?utm_source=share&utm_medium=member_ios&rcm=ACoAAABJjBEBGcaO8S8AHEITnczM9B_WTSKa6dc

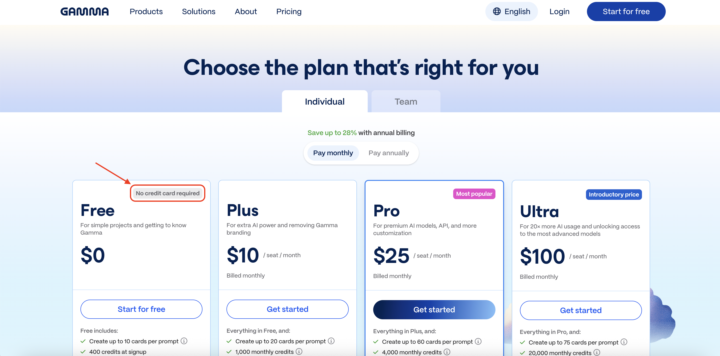

"No credit card required" above the plan names?

Gamma is the only company I have seen do this ⬇️ With their pricing plans, they put “no credit card required” above the actual plan name (the Free plan in this case). It’s the first thing my eye notices, and I immediately register that when I go on to look at the rest of the plan. Now using “popular” or similar is common in SaaS (although I always felt it was a bit contrived). But I like the broader concept of using these headers to signal something meaningful. You could imagine an enterprise plan could lead with SOC-2 compliant or SSO. We know from extensive DoWhatWork A/B testing data that many brands test into reassurance text below CTAs (see websites like Kit, Zapier, Twilio, Monday, etc.). While Gamma’s implementation on a pricing page is unique, it makes sense to me that this would be effective as a quick contextualization or important orienting detail. What do you think?

PricingSaaS Trend Report, Q1 2026

Howdy pricing people! Our latest Trend Report just dropped and I wanted to share it here first. We tracked pricing, packaging, and product changes across 500 companies from 2024-2025. The big story: monetization is finally catching up to AI product development. A few things that stood out: → Credit models went mainstream. Up 126% YoY. Figma, Salesforce, HubSpot - everyone's experimenting with credits now. → Packaging moved faster than pricing. 2 1% increase in packaging events vs. 15% for pricing. Plan additions were the most common change. → AI is increasingly dominating the product roadmap. Early AI releases were gated; now we're seeing migration to core plans and even free tiers. Plus we’re seeing the addition of Agentic AI features that warrant different monetization models. The report includes 50+ examples with before/after screenshots. Grab it here → Drop your feedback and predictions for 2026 in the thread 😃

Looking for guidance: Enterprise WTP research

Hi everyone, and happy holidays! I am kicking off Q1 with a revamp of my current company's enterprise offering structure, from packages to pricing structure. Like many others, we are looking to move away from user-based pricing. I am planning to run WTP research through qualitative interviews to help us better understand the value within our product for large enterprises and to validate the options we have for new metrics to bring into a value-aligned pricing structure. My ask: Does anyone have resources they have found particularly insightful in informing how to set up successful qualitative enterprise WTP studies? Any lessons learned that could help me here? Any input is appreciated! Additional context: We're a Series A SaaS/"on-prem" hybrid product with deep open-source roots (https://www.localstack.cloud/).

Pricing for Membership (B2B on-line training)

Hi all. I have a question about "pricing" that is not related to SaaS, but rather to transforming Professional Services into ARR. Two years ago we started an initial experiment: delivering live online training to IT professionals working in SMEs, using a membership-based approach. Our value proposition: - 8 courses scheduled throughout the year - Two yearly membership options for the customer: - 1) Membership for 1 participant: X€ - 2) Membership for up to 3 participants: 1.6 × X€ (It worked. And we were so happy that we (I) made the BIG mistake: not considering at all - for the second year - the physiological Churn Rate..) For next year, we want to apply the same business model to end-user training (Office M365 Apps). OUR PRODUCT: 8 courses scheduled in advance for all of 2026 OUR TARGET: small/micro companies (2 to 10 potential users) OUR COST STRUCTURE: main costs are fixed (trainer, organization), so the number of people per company in each class is not an issue. PRICING IDEA: offer customers a flat yearly price, divided into tiers that help maintain profitability. We are considering pricing per Company, based on the total number of attendees per course. For example: - 1–2 attendees - 2–5 attendees - 5–10 attendees - I would appreciate any suggestion on how to keep the pricing simple and fair for both sides I have already interviewed about 5 customers who are interested in the concept, but I have not shared any pricing with them yet. Do you thing that pricing per tier is the best options or do you think we have to think in a different way? Thanks in advance to all. Claudio

1-30 of 76

skool.com/pricingsaas

The first stop for SaaS pricing and packaging.

Powered by