Narrative Capital Raising

Post i stole from linked in: GPs are still raising capital like it's 2015: • Generic track record deck • Quarterly letters no one reads • Placement agent intermediaries • Zero direct narrative control LPs, customers, and talent make decisions based on narrative. The market has shifted. LPs aren't just underwriting returns anymore. They're underwriting platforms, people, and theses they believe in. If two GPs have identical IRRs, the ones who can articulate their: • Market conviction • Operator relationships • Differentiated approach • Compelling point-of-view They’ll win the allocation. All because of storytelling. “But I don’t know what or how to say it.” Not true. You have better stories than most Fortune 500 companies: • Why you see opportunities others don't • Your thesis on where markets are heading • How you built relationships that create deal flow • The infrastructure you've built to compound over cycles Write them down. Share them consistently. Build an audience. Are you building a narrative strategy or just updating slides? @The MHP Pros

Off market deal

So I have an off market deal pending, here are a few issues I'm having. 1. The deal works with owner financing as a POH 2. I'm raising the capital for this which I'm good with 3. The guy I'm going to partner with wants the maximum cashflow from the POH and doesn't want to make an offer based on turning them to TOH, but keeps saying we can switch them to TOH down the road Which somewhat creates the issues. If we keep them as POH, it will be life changing capital coming in, however we will likely be unable to refinance the asset to pay off the owner and my investors. Both ways I've structured will get the owner to about 1.97M I need to have both ways ready to send to my potential partner on Monday. The other issue is the owner of this park is my potential partners family which may cause certain problems I also belive my potential partner thinks that this will not be a lot of work for both of us. Can someone give any input, I'm open to having a call with anyone to discuss. [email protected] or cell 845-542-2302

How GP-LP Match Actually Works, in 20 Seconds

Another post from Aleksey on LinkedIn People keep asking how the GP-LP Match platform works. Most GPs and LPs have no idea how simple the process is. Here is the short version. 1. LPs register for free. They set their criteria. Property type, market, leverage, GP coinvest, fees, and more. The platform has about 2,300 active LPs who range from UHNW to large allocators. 2. GPs register and submit a deal. Takes about 1 minute to create an account and 3 minutes to upload a deal. 3. The platform matches in real time. If your deal fits an LP’s filters, it hits their inbox with a short summary, plus your GP profile, contact info, and investment deck. 4. LPs reach out directly. No middleman. No success fees. No friction. So far the platform has sent more than 300 deals. LPs have already wired millions after finding opportunities through it. If you raise capital or want more deal flow, this is worth a look. Happy Friday to all 😎

The 506(c) Rule Change That Most GPs Missed

Another great post by Aleksey on LinkedIn A major change happened within 506(b) vs 506(c) real estate raises earlier this year, and I meet GPs daily who are not aware of it. Wanted to walk everyone through this at a high level today. First, the disclaimer: I am not an attorney and these are just my thoughts. If you need a referral to someone who handles legal or compliance work all day (at the best prices I’ve seen fwiw), just send me your email and I am happy to introduce you. THE BASICS 506(b): • You cannot market publicly and you must already know the investor • You can accept non accredited investors 506(c): • You can market publicly and reach anyone, this is required on GP-LP Match submissions, since we send deals to LPs who the GP does not have a pre-existing relationship with • All investors must be accredited Prior to March 2025, 506(c) was a headache because investors had to go through a verification process. Imagine sending a $100mm net worth LP who is investing $1mm a questionnaire to prove they are accredited. This is exactly why most firms stuck with 506(b) in the past. WHAT CHANGED IN MARCH 2025: • If an individual LP is investing $200,000 or more, they no longer need to go through that verification process. This is a big deal that is not getting talked about enough. If most of your LPs are (1) accredited and (2) already investing larger checks, then 506(c) has become nearly a no brainer. As always, I hope this is helpful and look forward to your feedback!

7

0

GP/LP Splits and Coinvests

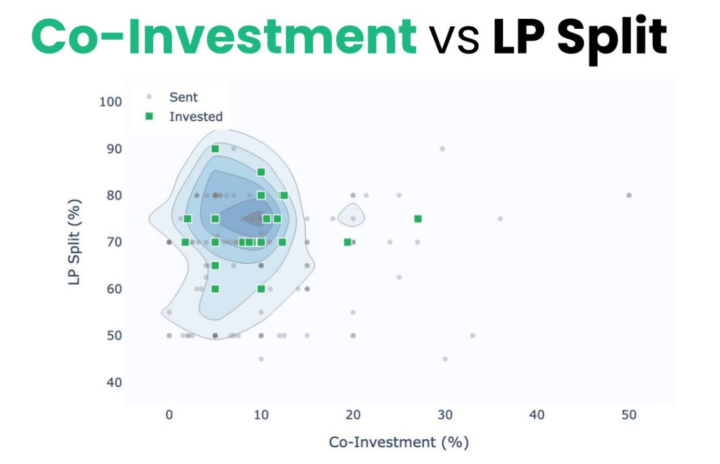

Alex Chernobelskiy on LinkedIn: GP/LP Waterfalls and GP Co-invests “What type of GP/LP waterfalls and GP coinvests get LP attention nowadays? This is a fairly intricate topic, but I'd like to share some data and discuss today. The short answer on one foot: - 70%+ split beyond a 7-8% pref - 5-10% coinvest Of course, the true answer is a lot more intricate. Here's the longer answer: In the graph below you'll see which deals received wires (green squares) from all the deals we've sent (gray dots). As a reminder, I do not tell GPs what splits or terms to go out at, and sending a deal and getting a wire on GP-LP Match is totally free - so this is a really interesting exercise in supply & demand. A few things stand out: - Sub 5% coinvest is unlikely to get funded, and you'd likely want to be in the 5-10% range (rolling in an acq fee is standard here). The opposite is true once you're above 10% ... you're more likely to get funded there with far less deals with that size of coinvest. - On the waterfall, it's clear that most deals are getting funded at a 70/30 final split or higher ... this is the final split, and some begin at 80/20 or higher. This is a massive shift against a few years ago, where deals were getting done with multiple hurdles, or even a single 50/50 split. - I posted some stats on this a week or so ago, but splits vary greatly by property type ... the below represents all property types but (as an example) LPs are currently open to more aggressive splits on some property types (RV Parks, IOS as an example) vs other property types (multifamily) ... these property level changes in expectation are purely driven by supply/demand from what I can tell - The vast majority of deal flow has prefs in the 7-8% range now, with some GPs starting to go to 9-10% to stand out

5

0

1-19 of 19

Powered by