Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Invest & Retire Community

3.5k members • Free

Investing Accelerator

458 members • Free

1365 contributions to Invest & Retire Community

Using EPS estimates to help me identify stocks that could grow (even) more in the coming year

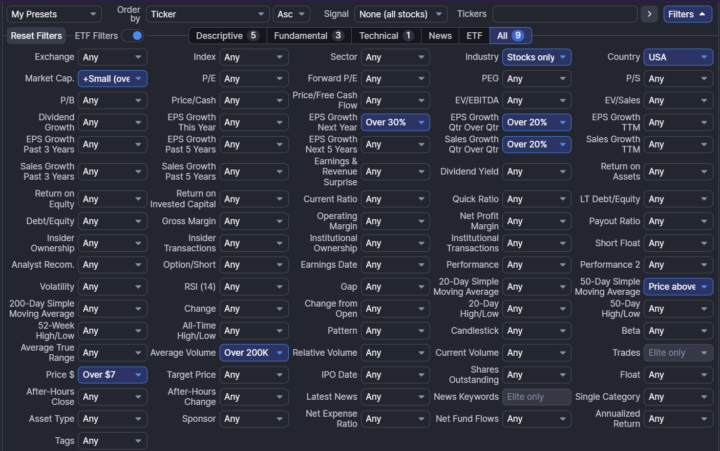

Previously, I didn’t really have a clear process for finding stocks — I mostly stuck to names I was already familiar with. The problem is, that approach doesn’t always line up with the best opportunities, especially from a technical standpoint. Recently I’ve started using screeners to expand my search and identify better setups. One thing I’ve learned is to look at EPS estimates. Obviously, they’re not always perfect, but institutions tend to put their money where earnings growth is happening. So knowing where positive EPS estimates are showing up feels like an important piece of the puzzle. Just sharing a few of the tickers I’ve come across recently that I’ll be digging into more closely to start planning — they range from small caps upward. I’ll keep sharing what I find — would love to know what’s on your radar too. For those who are interested, i took a screenshot of the filters I used in FINVIZ --- and you'll notice i chose EPS Growth Next Year = Over 30% A few tickers that I have selected to study more closely so far. Some are already setting up technically so I have my work cut out for me - although I will be leveraging chatgpt to help me with my deep dive into the fundamentals (esp growth rates). AFRM ALHC AMPX CALX CECO FTAI GKOS HROW LIF LITE MC MEG NTST NVDA OUST PLTR SSRM TPC

Good job data but pull out of USMCA in the works?

The US added over 100,000 jobs but... 1. Some critics say the data is incorrect 2. The US is considering pulling out of the trade deal USMCA This led to a jump for Wednesday's open and quickly reversed within an hour If we end this week with the same bearishness, then we will likely continue to be bearish for another week. From a technical analysis perspective, we observe that there are large orders selling the market while the bullish orders are smaller and much more incremental. If you want to be part of Investing Accelerator, here's the 33% discounted link to join directly and skip the onboarding call (LINK) Cheers, Eric ---- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com In February, my goal is to help 20 people with no financial background master investing. You will learn two strategies: • Long-term investing with options — learn how to find discounted blue chip stocks using technical and fundamental analysis You will also learn how to hedge during a bearish market to protect yourself • Monthly passive income — learn how to generate cash flow for retirement or replacing/boosting part of your salary using options Here's a step by step guide on how to join Investing Accelerator for free: https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free If you’re interested, you can hop on a free strategy call with me or Michael to see if you are a good fit. Schedule a call here: https://bit.ly/48mJlgR To date, we have 740+ students in Investing Accelerator. Remember to go to the Classroom tab for additional investing resources. Disclaimer: This communication is provided for educational and informational purposes only and does not constitute investment advice, a recommendation, or an offer to invest in any fund or strategy. No advisory relationship is formed by receipt of this content. Any references to strategies or markets are general in nature and do not reflect the performance of any client account or investment product.

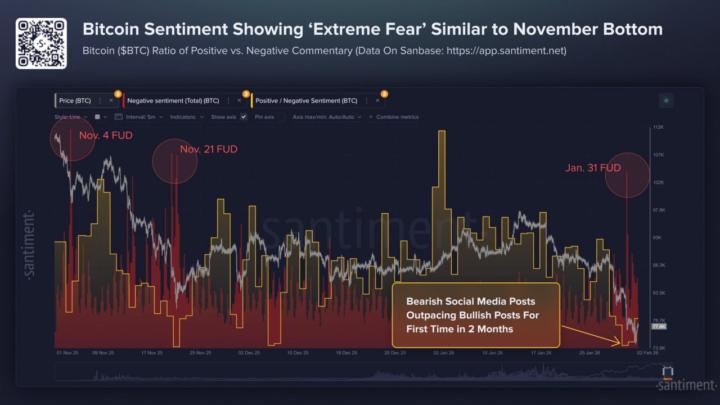

#BTC #Crypto #Sentiment

😱BTC is currently experiencing extreme fear and FUD — Santiment data

Plains All American Pipeline, L.P. (PAA).

It's a midstream infrastructure play. 8%+ divi. Not overpriced. Still have room for appreciation.

Profit on BIDU Call

Hi fellow Accelerators, I made a call on BIDU and watched as it stormed upward to 184% profit three days ago. Greedy me, I held out hoping for a magical 200%. Then WOOSH, I didn't pay attention for a little bit and just barely sold in time to take a 50.5% profit. Sob. Lesson learned. I guess 50% is better than a kick in the pants, but sheesh... :-| In my defence, I'm travelling in Asia and my Investment account is in Canada, hours of operation 10:30 pm - 3:30 a.m. my local time. Tough to stay awake when it matters. In any case, thank you Eric! I'm learning so much and gaining confidence every day.

1-10 of 1,365

@sandra-van-den-ham-2626

Artist, realtor and business owner. Soon to be just Artist and hoping for a flow of retirement income.

Active 3d ago

Joined Jan 1, 2023

Powered by