Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

What is this?

Less

More

Memberships

Invest & Retire Community

3.5k members • Free

Investing Accelerator

458 members • Free

13 contributions to Invest & Retire Community

When you enter into a position, take a 3-6 months view

When you are entering a long term position, it is important to not overreact The market goes up and down 50/50 of the time So if you are entering into the market right now, you are probably still a bit early. That's fine as long as you understand that Feb is usually down and Mar / Apr is when things turn around So when you enter into a long term position, you need to give the market room to breathe Expect to hold for 12 months (which is not really that long in the world for investing) But you should get positive results in 3-6 months This is different from monthly passive income options, where you enter into trades with an expiry date of 30-60 days. Cheers, Eric --- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com In March, my goal is to help 20 people with no financial background master investing. You will learn two strategies: • Long-term investing with options — learn how to find discounted blue chip stocks using technical and fundamental analysis You will also learn how to hedge during a bearish market to protect yourself • Monthly passive income — learn how to generate cash flow for retirement or replacing/boosting part of your salary using options Here's a step by step guide on how to join Investing Accelerator for free: https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free If you’re interested, you can hop on a free strategy call with me or Michael to see if you are a good fit. When you are ready, you can schedule a call here: https://bit.ly/48mJlgR Remember to go to the Classroom tab for additional investing resources. Disclaimer: This communication is provided for educational and informational purposes only and does not constitute investment advice, a recommendation, or an offer to invest in any fund or strategy. No advisory relationship is formed by receipt of this content. Any references to strategies or markets are general in nature and do not reflect the performance of any client account or investment product.

"A picture is worth a thousand words"

A picture is worth a thousand words

Profit on BIDU Call

Hi fellow Accelerators, I made a call on BIDU and watched as it stormed upward to 184% profit three days ago. Greedy me, I held out hoping for a magical 200%. Then WOOSH, I didn't pay attention for a little bit and just barely sold in time to take a 50.5% profit. Sob. Lesson learned. I guess 50% is better than a kick in the pants, but sheesh... :-| In my defence, I'm travelling in Asia and my Investment account is in Canada, hours of operation 10:30 pm - 3:30 a.m. my local time. Tough to stay awake when it matters. In any case, thank you Eric! I'm learning so much and gaining confidence every day.

Surround yourself with people you love (at work)

Mark Zuckerberg has spoken in multiple interviews about how chemistry and trust matter as much as raw competence when choosing senior leaders. There were periods where Meta delayed or reshuffled executive hires not because candidates weren’t impressive, but because he didn’t feel he could work closely with them day-to-day. This was a story I remembered today as I contemplate expanding my business. When it comes to senior leadership, competence is, of course, an important attribute. However, it is more important that we feel that we can share ideas openly and trust each other. This is true in both business and life. When you surround yourself with people you love (to work with / to be with) Things become easier. People who already know you, like you, and trust you require little to no convincing and would actively help you succeed. Cheers, Eric ----- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com In February, my goal is to help 20 people with no financial background to learn long term investing and monthly passive income strategies for retirement. To date, we have 740+ students and our model monthly passive income strategy focusing on making one trade a week using our data driven tools. The program has two parts: • Long-term investing — how to use technical analysis, fundamental analysis combined with data science help us find discounted blue chip stocks We also analyze the macro economic environment on a weekly basis in case we need to hold cash / short the market to hedge our portfolio. • Monthly income strategies (most popular) — how advance option strategies like selling and buying creates monthly income Here's a step by step guide on how to join Investing Accelerator for free: https://www.skool.com/invest-retire-community-1699/how-to-join-investing-accelerator-for-free

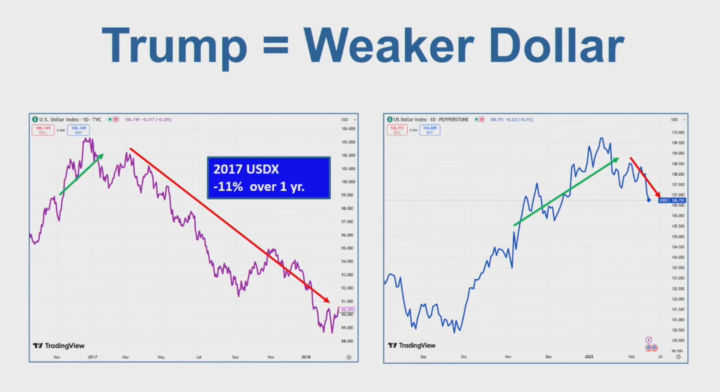

US Tariffs on Canada 100% threat & Sometimes I like to believe in fairy tales

In the recent coaching call, I mentioned that Canada is entering into the EV tariffs reduction in exchange for the canola seed tariff reduction would trigger USA. The main concern is that North America together imposed 100% tariffs on China EV because the industry is heavily subsidized by the Chinese government to achieve a large market share in the world. North America is the last stronghold against China's cheap EVs. Within weeks,Trump announced 100% tariffs on Canada if Canada goes through the trade deal with the US. This is not surprising to me, given we talked about this during the coaching call in Investing Accelerator Now, Canada is stuck in a pickle. Canada can go through with China, which may uphold their agreements better andhurt the automotive industry in Ontario (which is dying anyway because of previous US tariffs) and help Canadian canola farmers. Canada can appease the US for now, but Trump can always threaten with more tariffs anytime he wants. However, there's no guarantee US wouldn't impose tariffs as a threat later down the line (which seems to be the recurring weapon). At some point, the story becomes the boy who cries wolf. A man's words can no longer be trusted. Living in North America, it is easyto believe that US has the largest economy and hence couldn't be alienated. However, this is only partially true US GDP: $30T (largest in the world) EU GDP: $20T China GDP: $20T I look at all the European countries together as EU instead of individual countries. EU and China are not that far off from US in terms of GDP. If US alienates itself more in the future, EU and China will have an easier time catching up. This would lead to a significant change in world order. Cheers, Eric ----- Eric Seto Chartered Professional Accountant (CPA) Chartered Investment Manager (CIM) Founder of 5MinInvesting.com In February, my goal is to help 20 people with no financial background to learn long term investing and monthly passive income strategies for retirement.

0 likes • Jan 29

I get the sense that this discussion ignores what is the clearly documented game plan by the US.: to annex Canada and take over Greenland, and eventually topple or subjugate Mexico and Cuba etc. etc. I would appreciate guidance from Eric on how to navigate this. Moreover, recent moves by Europe, UK, Canada, BRICS, etc , coupled with extrajudicial killings of US citizens by the current administration and wide scale collapse of popular support for that administration seems to lend credence to the Sell America movement. Where (especially in Canada) should we move our money? I am already experiencing losses in my portfolio specifically because of the declining value of the us dollar. If as many are predicting the US economy is on the brink of collapse, what are our options?

1-10 of 13

@william-hipwell-3449

retired geography professor, globetrotter.

Active 1d ago

Joined May 23, 2025

Powered by