Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Unchained CEO

433 members • Free

North Eden Community

274 members • Free

Little G Farms

36 members • Free

Off Duty Truckers

12 members • Free

The Off Grid Collective

286 members • Free

Off Grid Only Collective

69 members • Free

Herman Homestead

44 members • Free

Off Grid Academy

31 members • Free

ConstructionX AI Hub

139 members • Free

55 contributions to Energy Economics & Finance

New Report on Small Nuclear Reactors

A new report on energy trends has been published and can be found by clicking on 'Classroom' and navigating to Section 6.2 (See the attached screenshot). You can use this report and the visualisations it includes, in your own projects, work, or studies, without limits. This report is about Small Nuclear Reactors and current trends by February 2026. Big technology companies like Amazon and Google are racing to find reliable electricity to meet the massive energy demands of new AI data centers. Their primary long-term solution is investing in Small Modular Reactors (SMRs) which are smaller nuclear plants that provide steady "zero-emission" electricity. However, because SMRs take about 8 years to build, these companies are also restarting and upgrading existing nuclear plants to bridge the gap. The report includes lots of diagrams and flowcharts that provide context, and also a list of relevant sources that were used to complete this report. These sources are from the Financial Times, Wall Street Journal, the Economist and Investors Chronicle (all sources are available inside the report). Your subscription in this Skool community gives you access to paywalled energy-economics articles from these publications (Financial Times etc) indirectly through these reports. I have also included some explanations and additional text that explains some details. The text is written in beginner-friendly, easy-to-understand language. Reading these reports is helpful for interviews, panel discussions , presentations, networking, and public speaking. Strongly recommended.

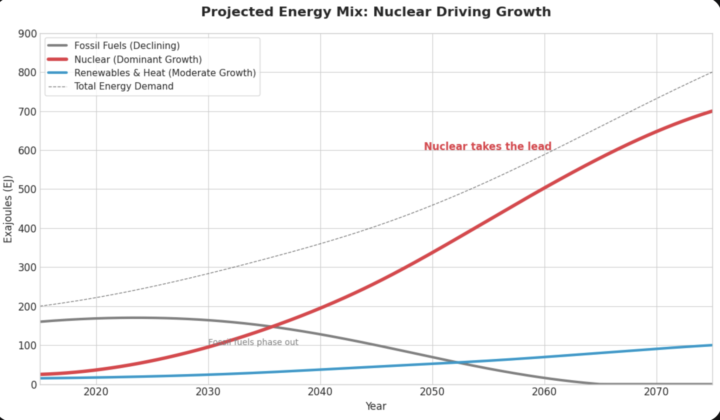

Energy Transition : Adding instead of Replacing

Below is part of some consultancy work I completed recently and sharing a few key ideas: Renewable energy is growing but fossil fuels are still growing too, so the system is adding rather than replacing. Oil and gas will remain important for a long time, so new investment in fossil‑fuel supply and infrastructure (pipelines, power plants, refineries, and other big long‑lasting equipment) will still be needed. If clean energy supply grows faster than total demand for long enough, clean energy first covers new demand and then starts replacing fossil fuels. If clean energy supply keeps outgrowing demand by a few percentage points for decades, fossil fuels will eventually be squeezed out. Real replacement of fossil fuels, not just adding clean energy, is not guaranteed. Most likely we will see 'addition' and co-existence of fuels. This is because the demand is keep rising more and more eg due to AI etc. See the plot .

The Renewable Energy sector grows in the US despite Government Policy

A new report has been published. You can access all reports by clicking on Classroom and navigating to Section 6.2. This report explains what is happening in the U.S. electricity system during the “energy transition” (the long-term shift away from coal, oil, and gas toward cleaner power like solar and wind). It shows that even if federal politics becomes less supportive of renewables, the core trend still looks similar: electricity demand keeps rising, solar and wind keep growing, and coal keeps shrinking. It also breaks down, simply, why this continues to happen. The report has been written using the following sources, along with extra details that I added. Reading industry reports like this one is very helpful because it helps us demonstrate energy market awareness (economics, finance, trends). You can expect 1-2 such reports every week, focusing on key economic trends in the energy sector (extremely valuable for interviews, networking, and demonstrating expertise). The report has been written using the following sources, along with extra details that I added. The Economist: https://www.economist.com/business/2025/09/16/despite-presidential-animus-americas-solar-industry-is-buzzing? Financial Times: https://www.ft.com/content/0f0327f1-573a-4336-bed4-b08a5e04c6b3? Bloomberg: https://www.forbes.com/sites/kensilverstein/2025/03/06/renewables-will-best-fossil-fuels-over-time-despite-trumps-efforts/? Wall Street Journal: https://www.wsj.com/articles/solar-projects-face-turmoil-under-trump-but-big-business-is-still-banking-on-them-e68e397f

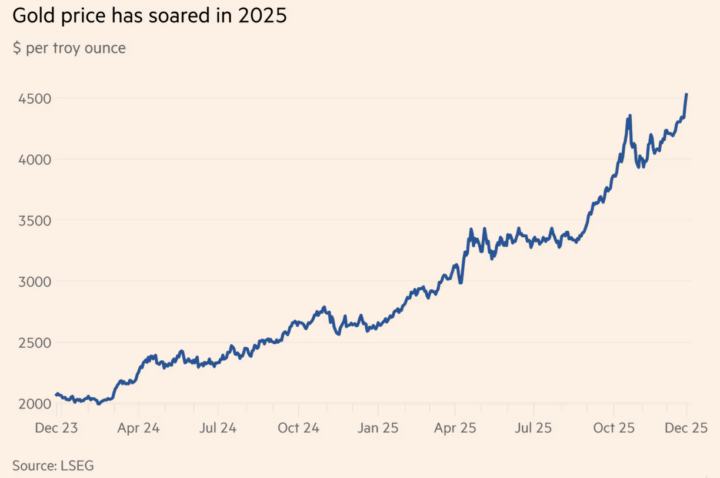

Why the Price of Gold increased in 2025

In 2025 the prices of gold and silver rose fast and reached new records. Because of this, many banks and trading firms hired more staff, and expanded their trading so they can earn more money from gold/silver related trading and services. These price increases occurred due to macroeconomic and geopolitical reasons. See the attached image (source : LSEG). A new analysis on this topic has been uploaded in Classroom --> 6.2. By the way, the analysis has been compiled using the sources below , along with some extra comments I have added. These sources below, such as the Financial Times, Bloomberg, Wall Street Journal, the Economist etc, all request you to subscribe to read their articles. I am subscribed to all of them, and so there is no need for you to subscribe also because I am bringing you the most interesting articles on energy-economics and energy - finance, including my own comments and all re-written in simple beginner-friendly accessible language. Also, they all come with my support which means if you have any questions regarding the content of these reports, you can message me! Sources: [1]: Financial Times: https://www.ft.com/content/ae214919-1617-48fa-8f0d-7734f5c98e72 [2]: Bloomberg: https://www.bloomberg.com/news/articles/2025-10-26/gold-trader-hiring-spree-drives-up-pay-as-bullion-market-booms? [3]: Wall Street Journal: https://www.wsj.com/finance/commodities-futures/a-new-wall-street-trade-is-powering-gold-and-hitting-currencies-62a61fdb?gaa_at=eafs&gaa_n=AWEtsqfhN3SK_q3Urvm-i_8Nsla_Bl-lOBBSs2p5R1c6uzTNsebYGJ6F2n3l&gaa_sig=epeZAbrguUmRTBAsQ6PG28zNhMYLR3-vgNVT9IHepcRc-paBb2Ak99AzgGzLTcSnpEzcy-fKftw4N_pIZOfDuA%3D%3D&gaa_ts=69515e33&

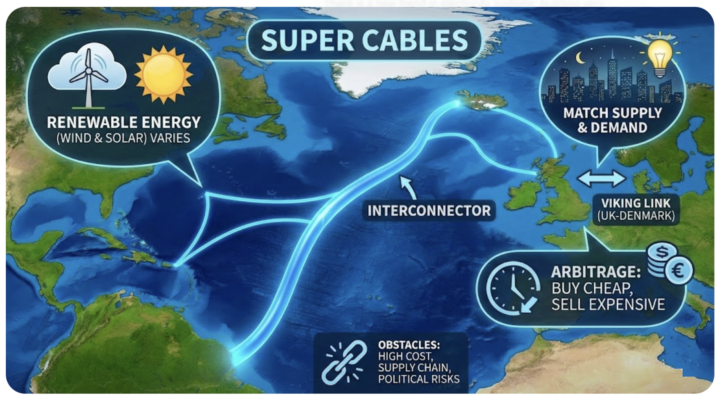

Global Electricity Arbitrage with Interconnectors

- A new report has been uploaded. You can find it in Classroom --> 6.2. - Below, it's a summary of key points, along with useful screenshots. Electricity interconnectors, often referred to as "supercables," are high-capacity transmission lines that link the power grids of different countries or regions. Their primary function is to balance the variability of renewable energy sources like wind and solar by moving electricity from where it is abundant to where it is needed. Since weather conditions differ across locations, one region may produce surplus green energy while another faces a shortage. Interconnectors allow for "arbitrage," where traders buy electricity in a region with low demand (and low prices) and sell it to a region with high demand. A key example is the Viking Link between the UK and Denmark, which allows the two nations to exchange power based on real-time wind speeds and consumption needs. Despite their benefits, building these supercables involves significant challenges. Developers are proposing ambitious projects to connect distant time zones—such as Australia to Singapore or Morocco to Europe—to take advantage of differing peak usage hours. However, these projects are incredibly expensive and technically difficult, requiring specialized ships to lay cables on the seabed during narrow weather windows. The industry also faces supply chain bottlenecks for essential equipment like transformers, as well as political and security risks regarding control and potential sabotage of critical infrastructure. Nevertheless, if these hurdles can be overcome, interconnectors could play a vital role in making renewable energy more reliable and globally accessible. Relevant Sources: [1] Financial Times: https://www.ft.com/content/db0a6697-c120-4f72-b876-e7bbc6e1e6e9 [2]: The Economist: https://www.economist.com/international/2025/01/23/why-dont-more-countries-import-their-electricity

1-10 of 55

@lukas-ml-1908

Pursuing greater understanding of Energy and Software Engineering for my under/post grad studies and beyond.

Active 3d ago

Joined Sep 14, 2025

Switzerland