Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Isaac

💪 Helping Men Build Confidence & Accountability 📈 Business | Decision Making | Philosophy

Memberships

Free Skool Course

23.7k members • Free

AI Automation Agency Hub

280.2k members • Free

AI Automation Society

224.6k members • Free

Skoolers

182.7k members • Free

Kourse (Free)

114.8k members • Free

Synthesizer

33.5k members • Free

multifamily

382 members • Free

21 contributions to multifamily

Synthesis Questions

Hi Multifamily fam, I love the Synthesis MF deal analyzer. I do have a few questions on it if someone could help out? 1. If we want to buy out the LP's upon refinance, How do we build that in the model without deleting lines beyond the refi year in "Returns" tab? 2. If I have a unit type with 10 units and i'd be doing value add by adding 5 more units, is there a way to capture this? 3. Would be great to see the proforma P&L by Month. This will be great to build the budget. The monthly will also help monitor variances and progress against the actuals. Is this on the roadmap? Thank you!

Here we go again!

Excited to share that my team and I are officially under contract on our next multifamily property!

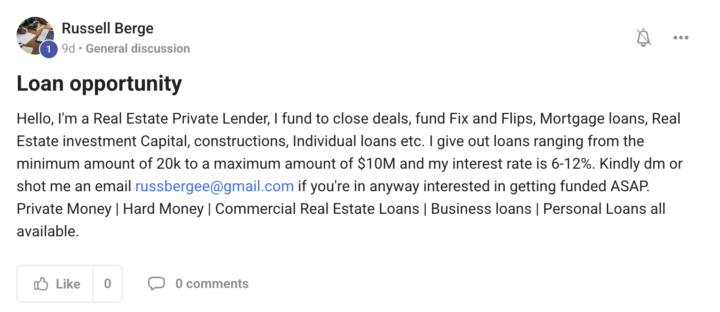

No Self Promoting

Hey team, this is a friendly reminder that this group does not allow any Self Promoting. If you want to promote yourself or your product/service, then start your own Skool community and do it there. If you self promote in this group you will be banned and your post will be deleted. This group is about posting educational content to show best practices we use in the Multifamily space to operate our portfolio of 1,600 apartments. And for others to share their own lessons and information as well. Please shoot me a DM if you have questions or aren't sure what counts as self promoting.

3

0

Hiring Guide: How to Interview Property Managers

I have interviewed dozens and dozens... and dozens of property managers in my time with Sharpline to help us find the best talent. This blog post is to help synthesize some of my best takeaways so far and help you improve your recruiting and hiring process for Property Managers going forward. Hiring the right property manager can stabilize your asset, protect your NOI, and prevent resident churn. The wrong hire slows down turns, invites resident issues, and costs you more than their salary. This guide gives you: - A short list of hiring best practices - The 10 most useful interview questions to assess ownership, systems, and performance - What red flags to look for Hiring Best Practices Define the role clearly - Unit count, property type (A/B/C), stabilized vs. value-add - What they’re directly responsible for: leasing, resident issues, vendors, reporting, maintenance coordination - Required systems knowledge (AppFolio, Yardi, ResMan, etc.) Screen for ownership early - Avoid candidates who blame their last company, team, or supervisor - Look for people who take responsibility and want to improve outcomes Prioritize real-world experience - Ask about what they did — not what they would do - Push for data and KPIs: occupancy, renewals, delinquency, NOI, turn times Assess alignment - Be clear about hours, pace, workload, team size, and pay - Ask if this role matches what they’re actually looking for - Don’t skip questions about income expectations and schedule Watch how they communicate - Do they follow up? - Are they organized and clear? - Do they understand resident-facing and ownership-facing communication styles? 10 Interview Questions That Work VERY Well Use these to assess both competence and character. Keep the tone direct and conversational. Take notes. Don’t settle for vague answers. 1. Why are you looking for a new role right now? - You’re looking for signs of ownership. Not blame. 2. What attracted you to this company and role? - If they don’t know much about your business, they didn’t prepare. 3. What does your ideal job look like — and how close is this one? - Helps you catch misalignment early. 4. What’s your biggest weakness — and how are you working on it? - Look for self-awareness. Avoid rehearsed or fake-sounding answers. 5. What KPIs did you own at your last property? What were your results? - Push for numbers. If they can’t give any, that’s a problem. 6. Tell me about a time you had to turn around a struggling property. - Listen for prioritization, clarity, and follow-through. 7. Walk me through how you manage resident complaints and maintenance follow-up. - Look for systems, not just “I follow up.” 8. How do you hold vendors and your team accountable? - You’re looking for leadership and communication under pressure. 9. What kind of hours are you looking to work — and what’s your minimum required income? - Set expectations early. Avoid surprises later. 10. What do you enjoy doing outside of work? - Adds context and helps you understand personality fit.

Property owner is the PM

Has anyone ever had a property owner ask if they could also serve as the property manager? Curious how others have handled this. Any creative ways to leverage this arrangement to improve cash flow or reduce overhead

4 likes • May '25

Hey @Sheena Harvey sorry for the delayed response, but here is my perspective on this for you. While I haven't directly had this situation with the former owner being the manager, we have had multiple instances at takeover of the current maintenance and/or manager asking if we could keep them on, which is a similar situation. The most important questions to answer in this situation are as follows: Does this individual align with the values of our company? Is this individual qualified to fill the role, irrespective of whether or not they previously had the title? (tons of people have jobs where they are under qualified, not driving progress, and not contributing to the bottom line. We have had tons of managers we deferred to hire on at takeover because they had no business managing the property and their standards were too low.) Are you hiring this person because it is convenient and easy, or because you have done your professional due diligence to find the best possible fit? Another way to phrase this.. If this person applied for the job today amongst other applicants, and you knew nothing about them, would you still pick them? It could be an amazing opportunity to build a relationship with the seller long term, but it could also lock you in to a lack luster employee-employer relationship. You know the context and details in order to answer the above questions better than anyone else. Hopefully this helps to bring you some clarity!

1-10 of 21

@isaac-holtz-6209

Founder of Stoic Training Systems. Community and Accountability for Men.

Business | Philosophy | Decision Making

Active 1d ago

Joined Aug 11, 2024

Mission, Kanasas 66202

Powered by