Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Engineers Can Talk

103 members • Free

Engineer Your Mission

226 members • Free

Software Engineering

621 members • Free

Engineering Entrepreneurs

99 members • Free

DIY Solar Alliance

49 members • Free

AI Builders Lab

1.8k members • $1

ConstruPRO

350 members • Free

Data Analysis with R

428 members • Free

Modern Data Community

1.5k members • Free

45 contributions to Energy Economics & Finance

LLMs Best Practices

Hey everyone, I’m asking this because LLMs weren’t really part of our workflow before, but now that they’re available it’s difficult not to leverage them given their productivity benefits. How are you using LLMs in data science workflows, and what best practices should I be aware of? Also, from a manager’s perspective, what expectations or concerns do you have about their use? PS: I am one of those that do not use it much especially for work or academia and looking for the correct ways to integrate it.

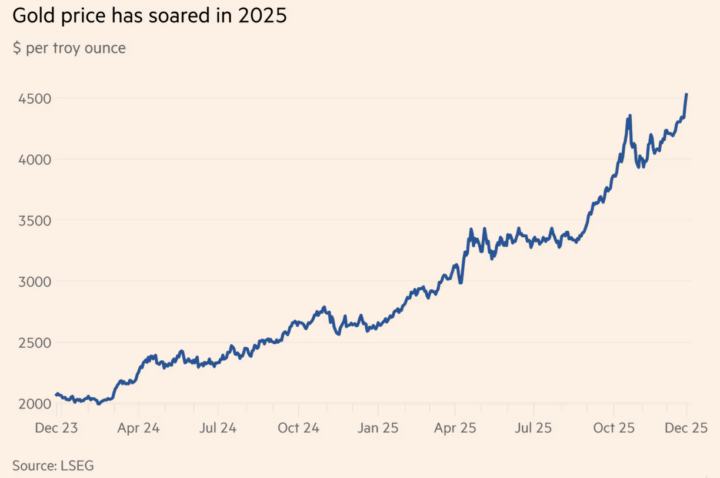

Why the Price of Gold increased in 2025

In 2025 the prices of gold and silver rose fast and reached new records. Because of this, many banks and trading firms hired more staff, and expanded their trading so they can earn more money from gold/silver related trading and services. These price increases occurred due to macroeconomic and geopolitical reasons. See the attached image (source : LSEG). A new analysis on this topic has been uploaded in Classroom --> 6.2. By the way, the analysis has been compiled using the sources below , along with some extra comments I have added. These sources below, such as the Financial Times, Bloomberg, Wall Street Journal, the Economist etc, all request you to subscribe to read their articles. I am subscribed to all of them, and so there is no need for you to subscribe also because I am bringing you the most interesting articles on energy-economics and energy - finance, including my own comments and all re-written in simple beginner-friendly accessible language. Also, they all come with my support which means if you have any questions regarding the content of these reports, you can message me! Sources: [1]: Financial Times: https://www.ft.com/content/ae214919-1617-48fa-8f0d-7734f5c98e72 [2]: Bloomberg: https://www.bloomberg.com/news/articles/2025-10-26/gold-trader-hiring-spree-drives-up-pay-as-bullion-market-booms? [3]: Wall Street Journal: https://www.wsj.com/finance/commodities-futures/a-new-wall-street-trade-is-powering-gold-and-hitting-currencies-62a61fdb?gaa_at=eafs&gaa_n=AWEtsqfhN3SK_q3Urvm-i_8Nsla_Bl-lOBBSs2p5R1c6uzTNsebYGJ6F2n3l&gaa_sig=epeZAbrguUmRTBAsQ6PG28zNhMYLR3-vgNVT9IHepcRc-paBb2Ak99AzgGzLTcSnpEzcy-fKftw4N_pIZOfDuA%3D%3D&gaa_ts=69515e33&

Analysis of a Research Topic: Investments in Photovoltaics

- Here we analyse, using simple beginner-friendly language, a research paper which focuses on the topic of Energy investments. No need for you to memorize anything. It is enough to read it once and get the main idea. It is considered very valuable at workplace to be informed about research topics - this is why it is strongly recommended to have a quick read. - You can find more than 250 such analyses in the Classroom --> section 6.1 and section 6.4. - Downloadable resource is attached down below (scroll down to download the full paper). No need to read the full paper because below you can find the key points written in beginner-friendly language. - Title of the research paper: Optimal investment decision for photovoltaic projects in China: a real options method - Citation: Zhu, X., & Liao, B. (2023). Optimal investment decision for photovoltaic projects in China: a real options method. Journal of Combinatorial Optimization, 46, 30. https://doi.org/10.1007/s10878-023-01096-5 Introduction to Solar Investment Challenges Renewable energy is essential for fixing climate change and reducing pollution. Solar photovoltaic projects, often called PV projects, are a popular way to generate clean electricity. However, building these solar projects is expensive and it takes a long time to make the money back. Because the cost of technology is dropping and government rules on electricity prices keep changing, investors find it hard to know exactly when to spend their money. This paper looks at how uncertainty makes it difficult for investors to choose the best time to build solar projects in China. The Problem with Traditional Financial Models Investors usually use a method called Net Present Value to decide if a project is worth money. This method works well when everything is certain, but it fails when the future is unpredictable. Solar projects have many unknowns, and once the money is spent, it cannot be recovered. To fix this, the authors use a method called Real Options. This approach treats a physical investment like a financial option, giving the investor the right, but not the obligation, to invest now or wait until later when conditions might be better.

Science fiction scenarios about energy

Predicting the future of energy (literature) In France, the Defense Red Team for the Ministry of the Armed Forces publishes science fiction stories that are accessible to all, offering a new way of looking at energy and geopolitical issues. Are there any current science fiction stories, scenarios, about energy in other countries? Stories written by science fiction authors who are members of a state-affiliated circle?

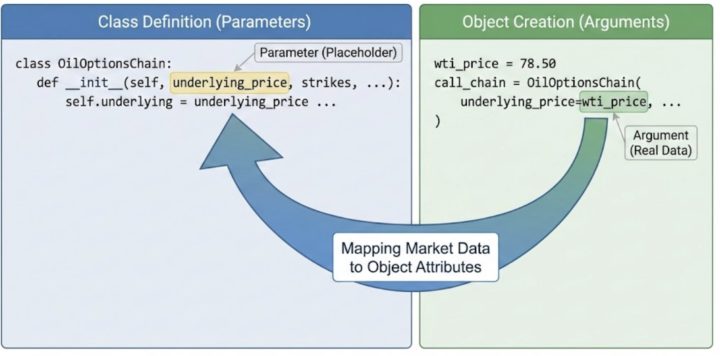

Oil Option Contracts in Python : New Video

I have uploaded a new video to the Classroom in Course 5.20. This video focuses on Python but also has useful theory on Options. Course 5.20 , as a reminder, is on Option Contracts for Crude oil. We examine how to evaluate Call and Put options on Oil. This is the 5th video for this course. We examine the OilOptionsChain class . We again look at some fundamental concepts of Object Oriented Programming . So it is a good revision for Object Oriented Programming. We speak about what the Options Chain is. Specifically, we create an object called call_chain from the OilOptionsChain class. All contracts of this class are for the same underlying asset (WTI Crude Oil) and expire on the same day. The only difference between them is the Strike Price. By creating this OilOptionsChain object in Python, we are essentially generating this financial "menu" based on the market conditions we defined (volatility , etc). See the attached images about what we are doing in this video.

1-10 of 45

@henrik-larsson-9047

Masters Student KTH, in Energy Systems

Active 11d ago

Joined Sep 18, 2025

ISTP

Sweden