Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

The Electricity Lab

164 members • Free

Electricians Wired Together

87 members • Free

Solar Operations Excellence

265 members • Free

Python & AI Builders

2.7k members • Free

Energy Economics & Finance

397 members • Free

16 contributions to Energy Economics & Finance

Interview Questions (Since October 2025)

The goal of this community is to help you secure jobs across the wider energy sector. That includes: - Major Energy Firms (Trading houses, Utilities, Oil & Gas). - Non-Energy Firms that manage their own energy assets or investments. - Academia (PhD applications and research roles). I have compiled a list of recent questions that candidates have faced in interview stages mostly between October 2025 and January 2026 ( retrieved from student databases ). You can also see below the company they were applying to. When reading these questions we need to ask ourselves: "Could I answer this question under pressure (with maybe 1 minute of thinking)"? Also, my answers to each question are in Classroom 6.3 compiled in the form of a PDF file. This PDF file has 5 more questions included as well (and answers). 1. Energy Quant (Power/Gas) - BP: “Walk me through a forward-curve model you would use for power or gas. How do you handle seasonality, mean reversion, and spikes?” - Shell Energy Trading: “Design a risk framework for an options book on power. Which metrics would you report daily, and how would you stress test extreme events?” 2. Energy Trader - TotalEnergies: “Explain the spark spread and how it links fuel prices, heat rate, and power prices. When does a plant dispatch?” - Trafigura: “You have a short physical position for next month. How would you hedge it with futures, swaps, and optionality, and what basis risks remain?” 3. Electricity Market Analyst (ISO/Utility) - National Grid ESO: “Explain Locational Marginal Pricing (LMP): what are its components, and what data does the market-clearing optimization need?” - EPRI: “How would you build a day-ahead load forecast and quantify uncertainty? Which error metrics matter most for operations?” 4. Project Finance Analyst - Macquarie: “Define DSCR and explain how it drives debt sizing. What DSCR range would you expect for a contracted wind or solar project?”

6 likes • 6d

A real source of ideas! For example, I took a question from one of my areas of interest and broke it down into another project that was basic, but achievable with the lessons! And it works! In addition to technical skills, it allows you to explore other angles of research to apply in the field.

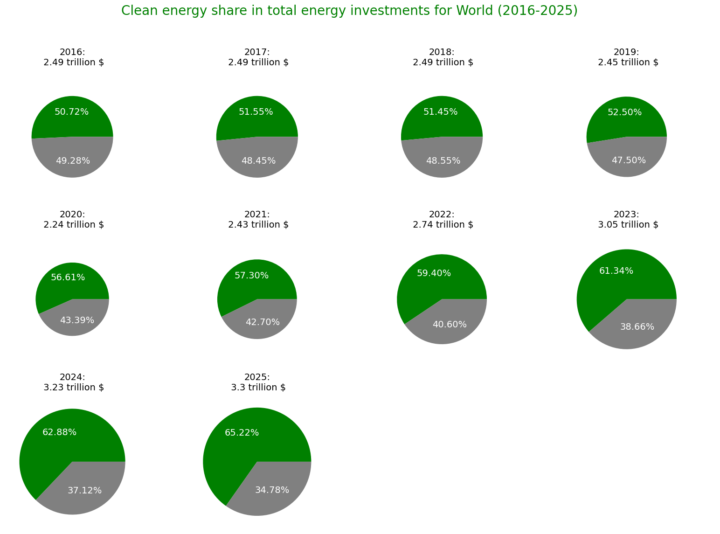

2016–2026 Green energy versus energy...

Course practice 1.35 This course, with its Python exercise, allows you to visualise 10 years of global trends and developments in clean energy production by major region (Africa, China, Europe, etc.). 1/ World 2/ Africa The improvements are clear to see!

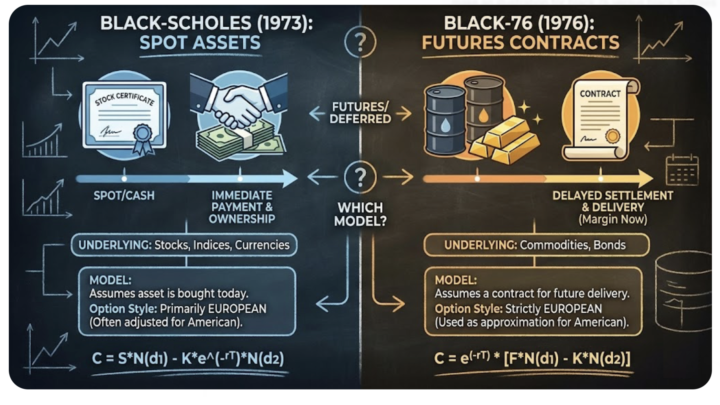

Valuation of Commodity Options - New Course

Online Course 5.20 is Now Live in the Classroom! The course includes a PowerPoint presentation, full Python implementation and many hours of video lectures. It is a beginner-friendly course on the valuation of Commodity Options (like options on crude oil), including full Python implementation. No stochastic calculus, and no fancy "martingale" mathematics. Just simple, practical language, explaining exactly how it is used in practice, in finance. Banks like JPMorgan use these exact models to help oil companies guarantee their income, even if oil prices crash. On the other side, oil refineries use this same math to lock in cheap fuel prices. What we need to remember (also great for interviews): When a company exercises a Commodity Option, it doesn't get the commodity (e.g. oil) immediately. Rather, it receives a Futures Contract. Once that contract expires, it then receives the commodity ( crude oil). So: Option --> Futures --> Commodity. The attached cheat sheet compares the two main pricing models in energy finance: 1. Black-Scholes: Used for Energy Equities (Stocks). 2. Black-76: Used for Commodities (Futures). What’s Inside Course 5.20: - Foundations: Spot Price vs. Futures Price vs. Strike Price. - The Math: Calculating "Premium" using the Black-76 Model. - The Code: Full Python implementation for pricing Call and Put options. - Valuation: Understanding Intrinsic vs. Extrinsic (Time) Value. - Mechanics: American vs. European options and Physical Settlement. - Real World: How an Option becomes a Future, and how a Future becomes Oil.

Science fiction scenarios about energy

Predicting the future of energy (literature) In France, the Defense Red Team for the Ministry of the Armed Forces publishes science fiction stories that are accessible to all, offering a new way of looking at energy and geopolitical issues. Are there any current science fiction stories, scenarios, about energy in other countries? Stories written by science fiction authors who are members of a state-affiliated circle?

5.18 Study to optimize energy consumption costs cooking, restaurant, fast food

I'm working on Course 5.18 (Retail Electricity Market in Python) and want to design a study to optimize energy consumption costs. My idea: For a small food business (e.g., burger shop), calculate the energy cost per product. This would involve: - Tracking appliance consumption (grill, fryer, refrigerator) - Linking to time-of-use electricity pricing - Determining which products/times are most cost-effective How would you structure this analysis step-by-step in Python? What data would I need, and which calculations are most important?

3 likes • Nov '25

Our daily lives and optimizing electricity use Thank you for your suggestions. Based on my analysis of the code examples shared here, I am pursuing three objectives: - Improving my Python skills - Deepening my understanding of how energy shapes our lifestyles - Conducting a study on the energy cost of a fast-food hamburger (one of the most common foods in tourist areas) Step by step, I continue applying the ideas from this course and adapting them to different countries (for example, comparing the cost of electricity in France).

1-10 of 16

Active 2h ago

Joined Sep 19, 2025

France