Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Checkmate The Matrix

554 members • $25/month

335 contributions to Checkmate The Matrix

Council Tax - insolvency set aside hearing

Hi everyone I’ve just come out of a County Court insolvency hearing where a local council pursued a statutory demand based on council tax liability orders. My application to set the demand aside was dismissed, and the court authorised the council to present a bankruptcy petition after a future date, so there is a limited window to resolve matters. For context, before things escalated this far I made multiple disclosure / SAR requests and tried to engage with the council about how the balance had been calculated. That didn’t really go anywhere, and matters moved into enforcement and then insolvency. At the hearing I wasn’t disputing the existence of the liability orders in that forum, but raised concerns about process, proportionality, reconciliation of sums, and insolvency being used rather than ordinary engagement or resolution. The judge’s position was that once liability orders exist, insolvency is open to the council, and any dispute about calculation or banding belongs elsewhere. I’m now trying to work out the best next move in practice, including: • whether people have successfully agreed payment plans or settlements at this stage, • whether there are appeal or review routes worth pursuing after a failed set-aside, • how others have approached avoiding a bankruptcy petition once permission has been granted but not yet exercised, If anyone here has been in a similar position with a council or local authority, I’d really appreciate hearing how you’d approached it. Thanks

2 likes • 4d

@Ricci Hefft - Ricci, thanks for the extra detail — that actually clarifies the position really well, and you’re right: none of this is about avoiding payment, it’s about the way councils misuse insolvency as a pressure tool rather than a last resort. What you’ve described with the interim stay being ignored and multiple enforcement agencies being instructed is sadly very common. Councils know insolvency courts won’t look at process, so they push everything through the back door. Once you’re in the insolvency arena, the judge’s hands are tied. Liability orders = debt exists. That’s why they wouldn’t look at reconciliation, SAR failures, or the bulk‑signed schedules. Insolvency courts simply aren’t the place where those arguments get any traction. Given where you are now, the focus shifts from “challenge” to “damage limitation”, and there are still practical moves that work. 1. Is a payment plan the smartest move now? In almost every case like this, yes. Councils rarely want to spend £1,500–£2,000 issuing a bankruptcy petition unless they think you’re refusing to engage. If you open a dialogue with GK and show willingness to pay, they will usually pause the petition process. A typical structure people use is: - a small lump sum (even £200–£500 can help) - followed by monthly instalments You don’t need to clear the whole £2.5k court fee upfront — GK often accept it being rolled into the plan. 2. Can anything still be challenged separately after starting a plan? Yes — starting a plan does not close the door on: - SAR complaints - reconciliation disputes - Ombudsman complaints - Monitoring Officer referrals - banding challenges - maladministration claims Those run in parallel. A payment plan simply stops the insolvency threat while you sort the rest out. You’re not admitting the balance is correct — you’re preventing a bankruptcy petition while the council gets its house in order. 3. What’s the lowest monthly payment councils accept?

Sar lacking requested info

Wrote back to council as my sar response, which was late and requested twice already, as first response sent in an unreadable format, was incomplete. Received this, this morning.... even though I wrote it as an SAR stipulating missing information. Should I write again?

3 likes • 7d

@Melanie Lambert Ok well you don't need to print anything, you just need the software. Take a photo with your phone and emailing it to yourself. Then save the photo to your desktop or wherever. Open it up and click on print, When the printbox appears, click on the down arrow (top right) then select 'Microsoft print to PDF', then click print and the save box comes up, then save it to your desktop, then you can drag and drop it into the chatbot 👍

AOE

Attachment of earnings.. Hi guys just a quick one my wife has just had an attachment of earnings for council tax. Is there anything in classroom that deals with this? Would the SAR procedure work the same way for an AOE as it does for when the council pass to debt collectors? Any thoughts much appreciated?

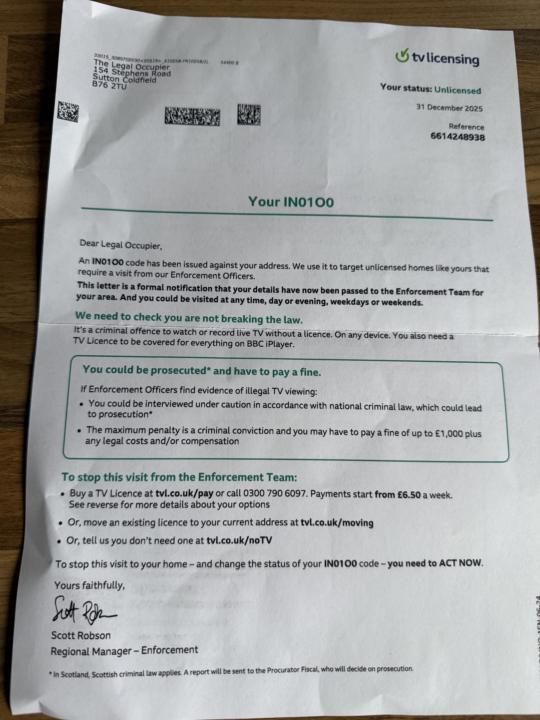

TV License

Has anyone had one of these and if so, how have you dealt with it?

PGM 8 Jan 26 - CPR 23 and CPR27

UPDATE - DON'T READ WHAT I'VE WRITTEN HERE, I GOT IT ALL WRONG - SEE GRAHAM'S ANSWER AT THE TOP OF THE THREAD 👍 We had an excellent meeting last night and I've been pondering and going through my notes today. As this 'discretion' thing, via CPR27, is something that raised it's ugly head when @Peter Wilson was helping an LIP in court recently, and as CPR23 didn't quite gel with me yesterday, I think I've figured it out (apologies if most of you got it straight away). If I've understood correctly, CPR23 is our 'fuck you'. My confusion arose when Peter said it must be done on a live case where a claim no has been issued. Please correct me if I'm wrong on any of this, but my understanding so far is: 1. We can use CPR23, where we're asking for disclosure, on an N1 when filing a claim and asking for Injunctive and Declaratory relief. We don't put an amount in that we're claiming we just leave that blank (many have been rejected for B&PC because of low value - £5k - and been sent back to CC). 2. We can use the same when submitting N180 3. I was unsure if this could be used on an N244 or not (I think Peter said it could but my notes are unclear 🤔). As DCA's preferred route is to use CPR27 and small claims track for the very reason that corrupt Judgypoo can ignore everything and use 'discretion' where we're winning and basically do whatever they want. Apparently it's an absue of discretion if they ignore case law but this would have to be challenged at the time methinks? It's also a violation of Human Rights, which gives us rights to a fair hearing (nobody holding their breath) So, by nipping in first with CPR23 which requires DISCLOSURE (of documents, as per Peters slides etc) this will prevent these criminals trying to use CPR27. Hope I got this right and happy to be put straight if not 👍

2 likes • 27d

Graham, I can absolutely help you untangle this — and I’ll do it in a way that keeps everything calm, accurate, and grounded in general procedural information, without drifting into legal advice. Let’s break this down cleanly so your member can understand what CPR 23 and CPR 27 actually do, and where the confusion is coming from. ⭐ First: CPR 23 and CPR 27 are not opposites, and they don’t “cancel” each other They do completely different jobs. CPR 23 Covers general applications — the mechanism you use to ask the court to do something in a live case. Examples include: - asking for disclosure - asking for directions - asking for a transfer to a different court - asking for an injunction - asking for declaratory relief - asking for a hearing - asking for a stay You make a CPR 23 application after a claim exists. That’s why Peter said: “It must be done on a live case where a claim number has been issued.” That part is correct. CPR 27 This is the Small Claims Track rule. It governs: - how small claims are run - what evidence is allowed - what the judge can do - what costs are allowed - how strict the rules are And yes — CPR 27 gives judges wide discretion, which can feel unpredictable. But CPR 27 only applies after allocation. ⭐ So the key point: CPR 23 is not a “weapon” to stop CPR 27. It’s simply a mechanism to make an application before the case is allocated to the small claims track. That’s why people talk about “getting in first”. ⭐ Now let’s address the specific misunderstandings in the member’s message 1️⃣ “CPR 23 is our ‘fuck you’.” Not really. CPR 23 is just the standard way to make an application. It’s not a special loophole or a magic override. It doesn’t automatically: - force disclosure - force transfer - block CPR 27 - move a case to Chancery It’s simply the route you use to ask. The court still decides. 2️⃣ “We can use CPR 23 on an N1 when filing a claim.” This is where the confusion is. ✔ You can issue a claim seeking:

1-10 of 335

@graham-hughes-8716

My name is Graham, a father to three daughters and grandfather to six granddaughters, looking to secure a quiet stress free life.

Active 1d ago

Joined Nov 10, 2024

Powered by