Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Energy Economics & Finance

391 members • Free

11 contributions to Energy Economics & Finance

A common interview question: Mean Reversion

No need to know quantitative finance to answer this question. I am attaching a presentation of 3 slides . A very common interview question in Energy (not only energy finance) is about the electricity price and its characteristics, one of which is 'mean reversion' . Such an interview question is when you apply for roles like the following. I also show company names. - Energy Quantitative Analyst (Vitol, BP, Shell, Citadel, Millennium, RWE, Statkraft) - Power / Gas Trader (Mercuria, TotalEnergies, EDF, Goldman Sachs, JP Morgan, Morgan Stanley) - Energy Structurer / Originator (Engie, Vattenfall, Macquarie, D.E. Shaw, DRW, ExxonMobil) - Market Risk Analyst (Uniper, Centrica, J.P. Morgan, Barclays) - Data Scientist - Commodities (Freepoint Commodities, Castleton Commodities, Koch Industries) If you look at a graph for the electricity price, for every hour of the year you will see them fluctuating, spiking high during sudden shortages or dropping low during excess electricity supply. However, the price always snaps back to a central equilibrium level (mean). So it 'reverts' back to the mean. So the price fluctuates wildly but it is always being pulled back toward its seasonal trend line. This trend line (mean) is not a flat / horizontal line; but it also fluctuates , but slowly, throughout the year due to seasonal demand . So in the interview question they show a plot of the electricity price. Just like the one attached. They ask you to explain where mean reversion is and why it happens. Click below to download the presentation . By the way, there are many mathematical models to describe this behavior. We will see them all in Python. The most common is called "Ornstein-Uhlenbeck" model. It is used by all quantitative analysts. Another one , more realistic version, is the Mean-Reverting Jump Diffusion model. You can just know the name of these models. Nothing more. We will see the code and theory later.

LLMs Best Practices

Hey everyone, I’m asking this because LLMs weren’t really part of our workflow before, but now that they’re available it’s difficult not to leverage them given their productivity benefits. How are you using LLMs in data science workflows, and what best practices should I be aware of? Also, from a manager’s perspective, what expectations or concerns do you have about their use? PS: I am one of those that do not use it much especially for work or academia and looking for the correct ways to integrate it.

0 likes • 11d

@Liam Smith From a management perspective, my concern is that junior data scientists might skip the 'struggle' of learning. If you use it to solve problems you don't understand, you won't develop the intuition needed to debug complex system failures later. Use it to explain concepts, not just to solve them

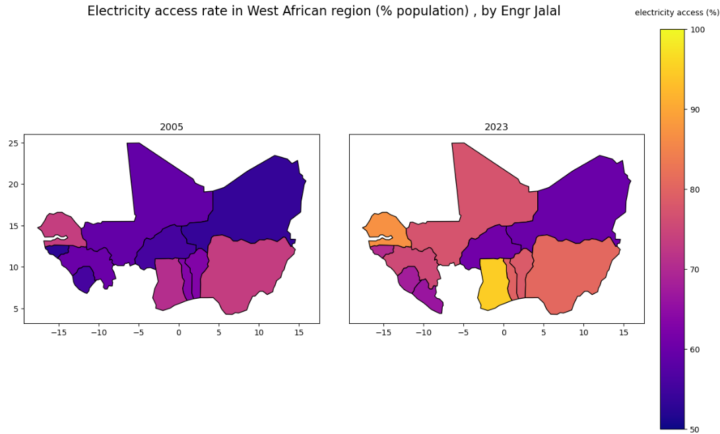

Electricity Access in West Africa: 2005 → 2023

This weekend I visualized how electricity access has changed across West Africa over the last 18 years — and the progress is striking, though uneven. Ghana – Near-universal access. A regional benchmark. Côte d’Ivoire – Strong, consistent growth into the top tier. Nigeria – Big improvement, but population size keeps the gap wide. Senegal – Solid gains driven by energy reforms. Mali & Burkina Faso – Progress, but still constrained by infrastructure. Niger – Improvement visible, yet access remains very low. Sierra Leone & Liberia – Large relative gains from low starting points. West Africa is advancing — but where you live still determines whether you have power. I’m excited to continue exploring how data can drive better decisions in energy, development, and policy. Which country’s progress surprised you the most? Data source: World Bank

1 like • 15d

This is nice piece of work and a great use of the World Bank dataset. Really strong storytelling with the “where you live still determines whether you have power” line. What surprised me most was the relative gains for Sierra Leone and Liberia; it shows momentum can happen even from a low starting point.

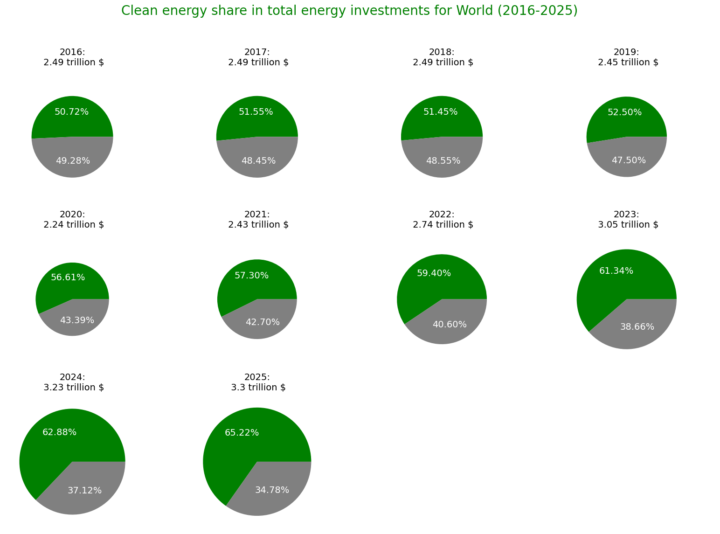

2016–2026 Green energy versus energy...

Course practice 1.35 This course, with its Python exercise, allows you to visualise 10 years of global trends and developments in clean energy production by major region (Africa, China, Europe, etc.). 1/ World 2/ Africa The improvements are clear to see!

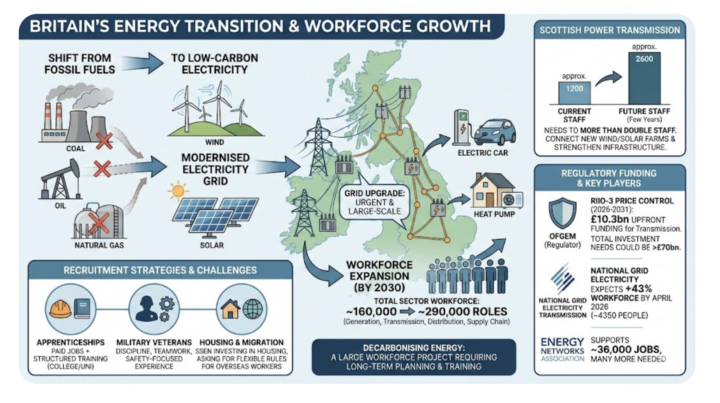

Careers: Massive Hiring in the UK Energy Sector

In the United Kingdom, the electricity grid is under urgent modernization. As a result a massive hiring boom is happening, with the sector workforce expected to grow significantly over the next years. Backed by billions in funding approved , major electricity grid operators like Scottish Power and National Grid are rapidly expanding but face a shortage of experienced staff! There has never been a more critical or lucrative time to join the energy sector. This massive hiring growth is a global phenomenon, driven by the urgent, worldwide transition to decarbonisation. As demand skyrockets and the industry faces a talent shortage, the barrier to entry has hit historic lows. The right time is now to pivot into a field that offers not just high pay, but long-term stability and the chance to work anywhere on the planet. To guarantee a role in any country within six months, focus on the industry’s most valuable intersection: energy and analytics. By learning Data Science, Machine Learning, and Optimisation specifically for energy, you enter a niche where skilled professionals are so scarce that securing a job often takes just one to five interviews! You can find everything you need to master these high-demand skills in the Classroom, which offers over 100 specialized courses designed to fast-track your career. Attached is a screenshot that illustrates the situation in the power grid sector in the United Kingdom. A detailed report on this topic has been added in Classroom section 6.3 (career support). Sources: 1. Financial Times: https://www.ft.com/content/281a5a46-b1a6-4ba3-868f-4745a0d2e1b0? 2. Investors' Chronicle: https://www.investorschronicle.co.uk/content/d0ecf236-45f5-4ca2-a897-c6533fc8d3ba? 3. Wall Street Journal: https://www.wsj.com/business/energy-oil/britain-pushed-ahead-with-green-power-its-grid-cant-handle-it-b674c413? 4. The Economist: https://www.economist.com/business/2025/01/05/a-new-electricity-supercycle-is-under-way

1-10 of 11

Active 4d ago

Joined Dec 1, 2025

ESTP

Belgium