Activity

Mon

Wed

Fri

Sun

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

What is this?

Less

More

Memberships

Make Money In Local Markets

678 members • Free

18 contributions to Make Money In Local Markets

My First Office Loan

My first office loan was a refinance of a property in Oceanside, CA. The property was located near the Tri-City Medical Center and the owners were a group of four doctors. They purchased the property, in 2002, with bank financing and the 10-year term was coming due. I faced two challenges: 1- There were 8 tenants, all with leases which expired in less than 3 years but had options to extend. 2- The docs wanted to pull out all of the initial equity in the property so they could buy out one doc and "play with the bank's money"-- MEMO to sponsors-- bankers know this trick. The opportunities: 1- The docs all made tons of money and would guarantee the loan. 2- The properties were cash flowing to a 1.5 DSCR, driven primarily by the fact that rates were 200 basis points lower than the existing loan. 3- The three remaining partners in the property were also tenants of the property (through different entities) 4- All three docs hated their existing lender because it said "no" to their loan request-- docs hate being told no. I shopped around and found a community bank in Los Angeles County which was hungry for loan business and LOVED owner-user loans. While this was technically not an owner-user loan, this bank loved physicians and was willing to underwrite the loan as owner-user if >50% of the GLA extended their leases to 2022 so that the WALT exceeded 7 years. This is where is got interesting. Each of the partners was a tenant as well so the three remaining partners were willing to extend the lease; the 4th partner (being bought out) wanted to extend the lease without the rent bumps. The remaining partners were apoplectic, likening his actions to an airplane hijacker. This is where my math skills came in-- I quantified the loss to lease and advised them to lower that amount from the buyout. We ultimately solved the problem by extending the lease to 5 years, without rent bumps, with NO tenant options to renew. That got my WALT to just over 7 years so they could get the loan. They didn't reduce the buyout number but kicked the other doc out in 2017 and replaced him with a much higher paying tenant.

3

0

My First Commercial Loan Transaction-- Imperial Beach, CA

My first commercial loan transaction was in 2006. It was a 10-unit apartment building in Imperial Beach, CA at the corner of "Main & Main" (and right across the street from a Navy SEAL teams hangout, Ye Olde Plank Inn (see video). It was ten, 1BR, 1BA apartment renting for an average of $800/month. Most of the tenants were surfers and most every unit had a bong in it. After expenses, the NOI was about $50K annually and the contract price was $1,000,000 The buyer was an active duty NSW operator (SEAL). He had the notion that he could kick out the surfers, paint the place, make minor repairs, and replace them with single, Navy E-4 enlisted members. Their Monthly Housing Allowance was $1350--he figured that he could lease these units for $1150/month and "juice" the NOI to $75,000, stabilize the property with the newer (safer) tenants, and sell it for $1,500,000 in a few years. The challenge was that he only had $300K in equity and traditional bank financing would only yield $500K in proceeds. He was referred to me. Back then, I had a stable of "trust deed investors"; sharp real estate guys living in Del Mar or La Jolla. While conventional rates were around 7%, they would fund loans up to 70% at 10% interest-only for 5-year terms. My underwriting package was: 1- current rent roll 2- projected rent roll and pro-forma Income Statement 3- A copy of the Navy BAH chart 4- resume of the sponsor (which basically said "Warfighter") One of my investors said "Sure, I will do it for 12% at 70% LTC" and we prepared to close after he reviewed the title (he didn't need an appraisal). On the Saturday before closing, the investor called me to say that he was backing out of the deal because the sponsor had no experience. I called his buddy, another trust deed investor I knew, who immediately called his friend and said "You gotta give Brian a counter". The investor called me back and said 60%, take it or leave it. I was steamed and worried because I had to call the buyer and tell him we were coming up $100K short. He was an NSW operator so it didn't phase him. He just said "Fix it".

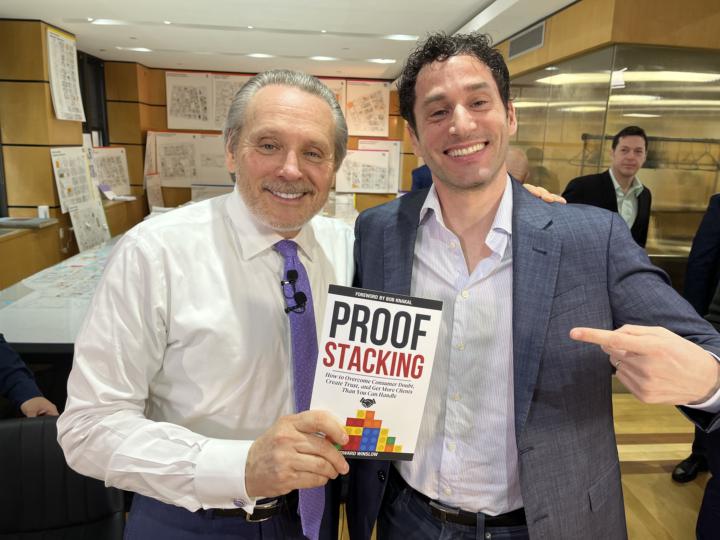

The Strip Mall Guy Story - Starting from Zero to a Multi-Million Portfolio

Get the 1 Page Case Study Course Here Last night I was at the filming of the Bob Knakal Show in NYC. Bob's first guest was the strip mall guy. What an amazing story. So inspiring. He started out working at a small shop doing retail store leasing. Zero experience. He knew nothing about real estate. He focused on a small local market. The leasing deals he was doing were small. Hair salons, spas, bakeries, the type of local businesses in every town in the country. Then one day he was working on a small retail store deal and the owner mentioned that they wanted to sell the strip center. He had no idea what to do. We went back to the office and told his boss that the owner of the Strip Center wanted to sell it. "This is going to be your first sales listing" he said. They met the owner and got the exclusive listing for 6.5 million. Once the deal sold, he put together a one pager about the sale and sent it to his database of strip mall owners. Deals came in. Interesting that he said 95% of the strip centers in the United States are owned by individuals and Families. Only 5% are institutionally owned. After 4 years he he saved about $100,000 and used that to purchase a strip center for 1.4 million. He raised another $300,000 from friends and family and got a million dollar loan. The tenants were paying all below Market. He went to all the tenants to renegotiate the leases at higher rates and they all said they were going to leave. Amazingly they all stayed and he ended up selling the Strip Center for 1.8 million. In the beginning all his deals were local in the Bay Area of California. He was offered a strip center in Tracy California which was about an hour away. It checked all the boxes of what he look looks for in a deal except one thing. It was an hour away. But he took a chance. Bought the property. Added value. And it worked. He discovered something interesting about strip centers. They're everywhere. Now he owns something like 40 maybe more all over the United States. He cultivated a niche starting in a small local market.

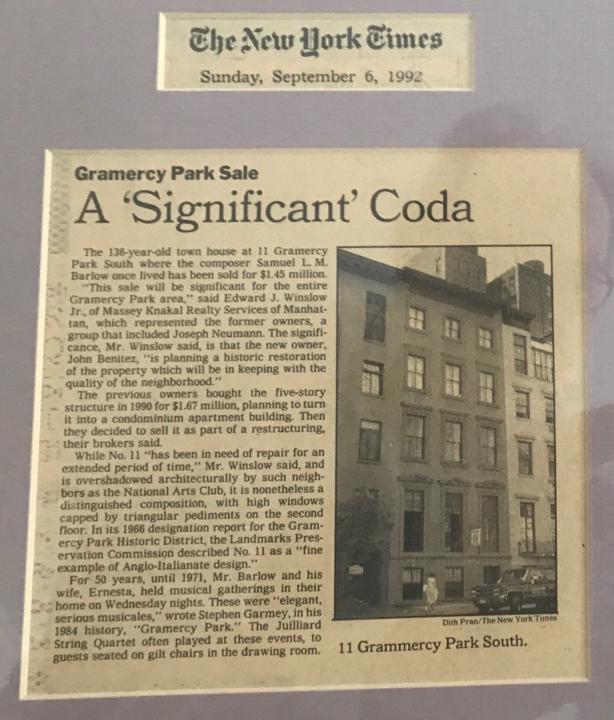

Proof Stacking Explained in 3 Steps

The Proof Stacking Model is simple. It's so simple that most people try and make it complicated thinking "It can't be that simple". My first experience started 32 years ago. As a broker just getting started, I sold a 5 story, 2 unit brownstone in Gramercy Park NYC. As I walked back to the office with commission in hand, it dawned on me ... no one knows I sold this property. My commission would only cover my living expenses for 8 months. My dilemma - "How do I get the word out fast to a lot of people so I can get more projects like this one". I had an idea! A long shot, crazy idea. What if I wrote a short story about the sale. Then sent it to the New York Times. And that's what I did. I wrote a 220 word article about the property. I wrote about the history of the property dating back to the 1890's. I wrote about Samuel Barlow, a famous composer who was the first owner. The theme was about the new buyer, an up and coming artist in the music industry restoring the property and the history of the neighborhood. Crazy, but the New York Times published it on the front page of the Sunday Real Estate Section. They never changed a word. They didn't call me to verify it. My life changed. Years later, I found the exact same writing template is loved by Google too ... because consumers like it. And, it works on social media, videos, Press Releases, Zoom Calls and One on One presentations. The reason why it works is Proof. Proof is real. Proof is trustworthy. So here I am today, almost ready to publish the Proof Stacking Book. It's a useful, how to book. Like a recipe book. Below, is the introduction. (launching soon) INTRODUCTION: PROVE IT OR LOSE IT - ProofStacking Simplified: By layering evidence—success stories, data, and visuals—you systematically build trust and dissolve skepticism. This method turns hesitant prospects into confident buyers without needing to push or persuade. - SMART Framework: Focus on one specific audience, use measurable proof to quantify results, take achievable steps to build momentum, repeat success with a consistent system, and deliver the right proof at the perfect moment. This approach creates a reliable, scalable process that works every time.

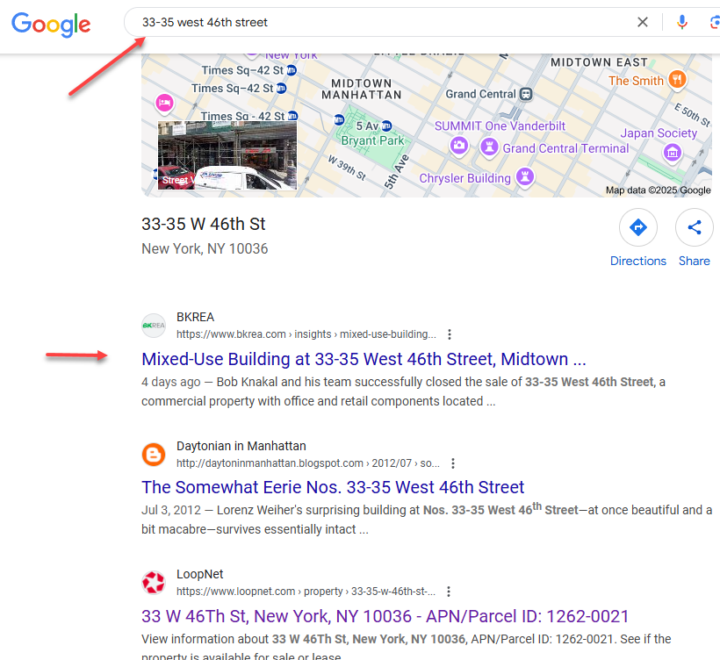

The Online for Sale or Lease Yard Sign - A Strategy For Getting Exclusive Listings

Every day, we post a success story targeting neighborhoods and property addresses for BKREA. I tried this strategy to rank on Google 10 years ago and it worked. It brought in leads from owners looking to sell or lease their property. And it brought in buyers and tenants. The concept started by thinking ... if it works to put a yard sign on a property, why wouldn't it work online too. There are 2 strategies I've used. 1. General Information about a building 2. Success Stories Both are foundations of the Proof Stacking Model. They demonstrate expertise and proof. You can use the ranking results to show building owners. This will always spark a conversation. It's an easy way to develop a conversation, trust and a relationship with an owner. Your competitors don't know how to do this. Notice in the image how the ranking is higher than Loopnet. You can also convert the page to a social media post, video, Press Release and a handout to use in presentations. It's a multi purpose sales tool. If you want to know more, pick up a copy of Proof Stacking. You can read it in a few hours. Click Here, Available On Amazon

1-10 of 18

@brian-brady-2913

Call me at 858-699-4590. I help nvestors secure financing for CRE and am a licensed real estate broker in AL, CA, and FL

Active 22d ago

Joined Oct 17, 2024

ESTJ

Tampa, FL

Powered by