Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Futures Trading Group

79 members • Free

6 contributions to Futures Trading Group

Nexum Update

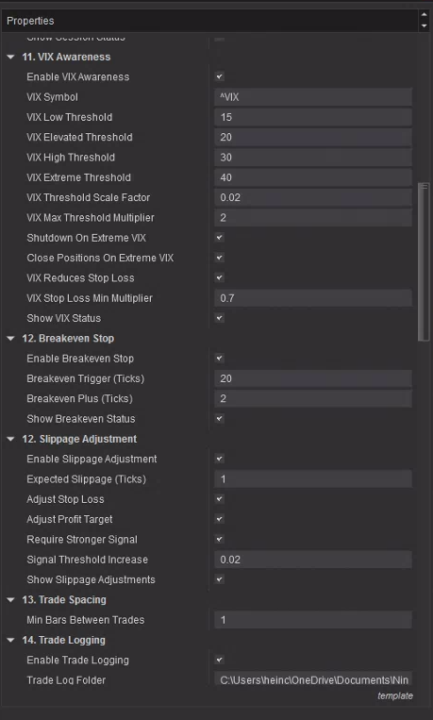

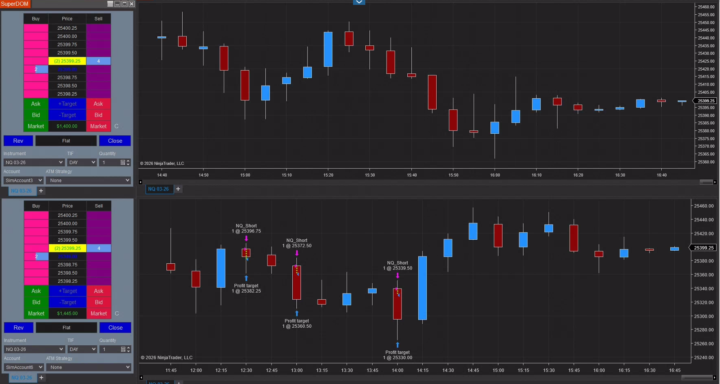

We encourage you to download the Nexum update, as it consists of bug fixes and additional logic that provides configurable slippage and breakeven settings that you might find helpful as you continue to sim trade. It also contains changes in the hidden logic that increases profit factor and win rate. The trading window has been adjusted and includes a small window in the post-lunch session. There is no need for you to make those adjustments in your settings; they are already programmed into the updated file. The new trade windows are 10:30-11:30 and 2:00-2:45. The one configurable change we encourage you to make is in the the maximum number of daily trades. Enter 4 in that setting. We've attached 3 screenshots for those who want to ensure all their settings are correct. Our goal is to continue to increase successful trades while reducing their number. Increased success rate + reduced number of trades = ever-increasing return on investment. Take the new update home. Let us know what you think Download Nexum Update

How was your trading day?

Nexum only managed two trades in the restricted window today, but they were both winners. Hit our half target of $520 ($52 in micro). And that's live, so slippage is accounted for in that number. Our SIM charts show that Volturon and Nexum both hit their full targets, trading beyond 11:30. We'd love to know how everyone did. Feedback is valuable and keeps the group interesting. In any event, if you have questions or need assistance, just reach out!

Best Data Feed??

Considering today’s data issues, appears to have been mainly Tradovate, is there a data provider that is more stable than others? It’s terrible to have a bad data feed ruin a quality strategy 🙄

Premarket 1-27-26 (FOMC Meeting, 27-28)

The E-mini Nasdaq-100 futures (NQ) for the March 2026 contract are trading higher this morning as of around 8:40 AM EST on January 27, 2026. The current price stands at 25,999.25, reflecting a gain of 150.75 points or +0.58% from the previous close of 25,848.50. Today's open was at 26,010.50, with a session high of 26,043.00 and a low of 25,967.75. Volume is building at 67,512 contracts, showing increasing participation as the regular session approaches. CME data aligns closely, with the last price at 25,996.50 (+0.57%) and volume at 67,351, though minor variations may occur from real-time feeds. From a technical perspective, NQ maintains a robust bullish outlook. The overall summary is a Strong Buy, supported by moving averages (9 Buy signals vs. 3 Sell) and technical indicators (8 Buy, 0 Sell). Key indicators include an RSI(14) at 63.856 (buy), MACD(12,26) at 67.21 (buy), and ADX(14) at 51.984 (buy, indicating strong trend momentum). The Stochastic(9,6) is overbought at 99.737, and Williams %R at -0.263 also signals overbought conditions, potentially hinting at short-term consolidation, but the Ultimate Oscillator at 56.326 and ROC at 0.423 reinforce buys. Pivot points for intraday include a classic pivot at 26,009.50, with resistance at 26,027.75 (R1), 26,051.00 (R2), and 26,069.25 (R3), and support at 25,986.25 (S1), 25,968.00 (S2), and 25,944.75 (S3). While specific time-frame breakdowns aren't detailed, the signals favor bulls across short- and long-term horizons, with early resistance near 25,893-25,900 now being tested and potentially paving the way for new highs toward 25,970 if sustained. Market sentiment is positive for tech-heavy indices, with Nasdaq futures up around 0.6-0.7% amid anticipation of big-tech earnings from Microsoft, Apple, and Tesla starting tomorrow, alongside the Federal Reserve's rate decision (expected to hold at 3.5-3.75%). Broader U.S. futures show S&P 500 up 0.2-0.3% and Dow down 0.3-0.5%, the latter dragged by health insurers like UnitedHealth after a disappointing Medicare Advantage payment proposal from the Trump administration. Trade tensions, including tariff threats and a new India-EU deal, have had limited impact so far, with global stocks at records and South Korea's KOSPI hitting highs despite early jitters. Positive macro data like strong durable goods orders supports resilience, though a potential government shutdown looms.

1-6 of 6

Active 3d ago

Joined Oct 28, 2025