Write something

Pinned

START HERE: Welcome to Auction Property Academy

Welcome to Auction Property Academy. I'm excited to have you apart of this amazing community! That being said, I want to go over some community guidelines with you all and give you a chance to introduce yourself and get active in this community Step 1: IMPORTANT - First please introduce yourself in the Welcome tab using this copy-paste template 1. What's your name? 2. Where are you from/based? 3. What you wanna learn about from this community? Step 2: Head over to the modules and start going through the content Step 3: Answer the poll below Step 4: Comment on this post to let you know you've introduced yourself. Last thing, be respectful, add value and follow the rules. Welcome to the best Auction Property Academy in the world. Glad to have you. - Tiffany

Poll

38 members have voted

Pinned

Welcome to the Deal Hub

This discussion forum will be used to share deals between members, high profit opportunities I find & want to share with you, & deal breakdowns. Comment what market (City, State) you'd like to see some deals in👇🏼 Let's get investing!

Pinned

Have Questions?

Hey Investors! Im creating a tab for the community to be able to ask questions as i've been getting a ton of questions in my messages & think we can all benefit from Q&As. Just remember, no question is too small so drop them as a post on here👇🏼

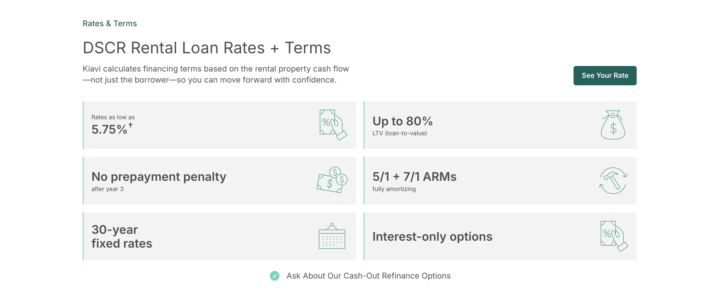

Straight From My Lenders: Rental Loan Rates in the 5%'s

Getting financing for a buy & hold anytime soon or refinancing out of a BRRRR deal? Rates just went down even further & we are in the 5's! Here's what my rep from Kiavi just sent me: - Rates as low as 5.75%* and LTV up to 80%* - Cash-out refinances after a property is owned for 90 days or is free and clear - Flexible DSCRs as low as 0.8X - No hard credit pulls Remember, they calculate your financing terms based on the property’s cash flow, not your personal income. That means no W2s, bank statements, or hard credit pulls. Want to get a quote for your next deal? Submit a request here: https://try.kiavi.com/sczxcel2n5pp I've used Kiavi to fund a couple of my deals & rates have never been this low (since pre-covid). Just remember to always shop around for the best rate if this aligns with your strategy.

This is What I Look for When Analyzing an Auction Property (& Finding a Hidden Gem)

I just dropped a new video walking through exactly what I pay attention to when I’m analyzing an auction listing before I even consider bidding. When you’re scrolling listings, it’s easy to get caught up in the price — but there’s a lot more that goes into deciding whether a deal is worth your time and money. The goal here isn’t just to find something cheap, it’s to find something with potential and manageable risk. In the video, I cover: - How to read the listing details and what the opening bid really means - Why the property status (foreclosure vs. REO vs. private listing) matters - How to spot opportunities that others overlook - What red flags I avoid before I even start estimating repair costs - How to use the info available on the listing to pre-qualify a deal Auction properties can be a powerful play when you know what to look for — but you do need a process. Simply clicking into every “cheap” listing isn’t a strategy. If you want help implementing this method in your own market or deal-sourcing strategy, I’d love to help you map it out. 👉 Book a free strategy session and we’ll look at your goals, your budget, and build a step-by-step plan you can start using right away. Let’s turn random listings into actual investment deals. 🚀

0

0

1-30 of 78

powered by

skool.com/real-estate-investing-101-7860

Welcome to Auction Property Academy — a community of real estate investors mastering the art of finding, analyzing, and landing off-market deals.

Suggested communities

Powered by