Write something

This is What I Look for When Analyzing an Auction Property (& Finding a Hidden Gem)

I just dropped a new video walking through exactly what I pay attention to when I’m analyzing an auction listing before I even consider bidding. When you’re scrolling listings, it’s easy to get caught up in the price — but there’s a lot more that goes into deciding whether a deal is worth your time and money. The goal here isn’t just to find something cheap, it’s to find something with potential and manageable risk. In the video, I cover: - How to read the listing details and what the opening bid really means - Why the property status (foreclosure vs. REO vs. private listing) matters - How to spot opportunities that others overlook - What red flags I avoid before I even start estimating repair costs - How to use the info available on the listing to pre-qualify a deal Auction properties can be a powerful play when you know what to look for — but you do need a process. Simply clicking into every “cheap” listing isn’t a strategy. If you want help implementing this method in your own market or deal-sourcing strategy, I’d love to help you map it out. 👉 Book a free strategy session and we’ll look at your goals, your budget, and build a step-by-step plan you can start using right away. Let’s turn random listings into actual investment deals. 🚀

0

0

🏁 What Actually Happens If You WIN an Auction Property?

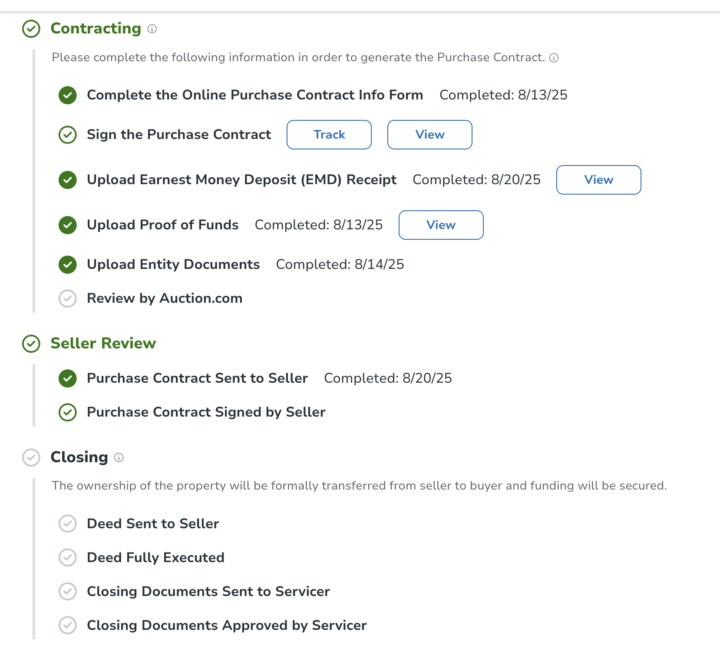

One of the biggest fears I hear from new investors is this: “Okay… but what happens if I actually win?” So let’s break it down step-by-step so you know exactly what to expect from 3rd party auctioneers. Step 1: You Win the Bid 🎉 Once the auction ends and you’re the highest bidder, you’ll receive a confirmation from the platform. At this point: - You'll get an email from everything they need from you (IE: purchase contract, Escrow deposit, LLC documentation) - You want to start sending details to your lender - The clock starts ticking. This is why preparation matters before you bid. Step 2: Deposit Is Due (Usually Within 24-48 Hours) You'll have to go to your bank to wire this to ensure it's being sent to the correct place. Example: If you win at $100,000 and the deposit is 10%, you’ll need to wire $10,000 quickly. This is not the full purchase amount — just your earnest money to secure the deal. Which will later be discounted from the closing costs. If you fail to send it?You risk losing your bidding privileges. Step 3: Final Payment Timeline Typically, you’ll have around 30-45 days (sometimes less) to close. During this time: - You finalize financing (hard money, private lender, or cash) - Title work is completed - Any outstanding issues are reviewed This is why I always tell students:👉 Have your lender lined up BEFORE you bid. If you wait until after you win, you’re already behind. Step 4: Closing Once funds are wired and documents are signed, the property officially transfers to you. Now you: - Receive ownership - Secure the property - Change utilities - Begin your renovation! Have some capital saved up and are ready to buy your 1st or 2nd investment property? - Schedule a call here for a quick strategy sesh with me & to see if maybe auction investing is a good fit for you!

3rd-Party Auctions vs. County Auctions (Know the Difference Before You Bid)

Happy Monday, everyone!Today we’re breaking down two very different types of auction platforms — and why understanding the difference can save you thousands of dollars (and major headaches). Not all auctions are created equal. 🖥️ 3rd-Party Auction Sites (Ex: Auction.com) These are platforms that host bank-owned or lender-controlled properties. ✅ Why Beginners Like These: - Often allow financing (DSCR, Fix & Flip, Non-QM, etc.) - Some properties allow inspections and appraisals - Liens are typically cleared at closing (but still verify) - More time between winning the bid and closing - Familiar buying process (title company, escrow, etc.) ⚠️ Things to Watch For: - Buyer’s premiums and auction fees - Reserve prices (not always disclosed) - Competition can drive prices up ➡️ These are generally lower risk and more beginner-friendly when paired with proper analysis. 🏛️ State & County Auctions (Tax Deeds / Foreclosures) These auctions are run directly by the county or state — and the rules are VERY different. 🚨 Why These Are Riskier: - Properties can come with liens, code violations, or unpaid utilities - You usually cannot inspect the interior - No financing — ALL CASH - Payment is often due within 24–48 hours of winning - Title issues are common (quiet title actions may be needed) 💡 Why Some Investors Still Love Them: - Less competition - Deep discounts - Strong margins if you know what you’re doing ➡️ These auctions reward advanced investors with strong systems and cash reserves. 🧠 Quick Rule of Thumb If you’re newer: ➡️ Start with 3rd-party auction platforms where risk is more controlled. If you’re experienced, well-capitalized, and understand title: ➡️ County auctions can be powerful — but mistakes are expensive. 💬 Which type of auction are you most interested in right now? 🚀 Ready to Go Deeper? If you’re serious about buying your first (or next) auction property and want step-by-step guidance, live deal breakdowns, and support inside a proven system…

Poll

3 members have voted

NEW VIDEO: Expensive Markets Have Auction Deals Under $100k?

A lot of people assume that if they live in a high-priced area, auction investing just isn’t possible. That’s not always true. Auction properties (especially tax deed and foreclosure sales) can open up opportunities most traditional buyers never look into. In this video, I break down: - How to search for low opening bids in any market - What “opening bid” actually means - Why some properties start far below market value - How to approach these deals strategically If you’ve been feeling priced out of your market, this will help you start thinking differently. And if you’d like help figuring out whether this strategy makes sense for you — your budget, your goals, your risk tolerance — book a free strategy call with me. We’ll map out a clear plan and see if you’re in the right place to start investing. Let’s invest smarter. 🏡💰

1

0

📍LIVE Recap: Where to find high-profit properties

Last week we hosted a LIVE training on How to Find High-Profit Real Estate Deals — and it was 🔥 In this training, I broke down: • The exact platforms I use to find off-market and auction properties • How to spot deals selling for up to 70–80% below market value • What separates a “cheap” property from a truly profitable one • How to quickly filter out bad deals so you don’t waste time If you’ve been struggling with where to actually find good deals (not just analyze them), this is a must-watch. Finding the deal is step one. Without deal flow, nothing else matters. The full replay is now posted below 👇🏽 Click Here to Watch the Full LIVE Replay Watch it, take notes, and then come back here and drop your biggest takeaway or any questions you have. Let’s keep building momentum 💪🏽🔥

1-16 of 16

powered by

skool.com/real-estate-investing-101-7860

Welcome to Auction Property Academy — a community of real estate investors mastering the art of finding, analyzing, and landing off-market deals.

Suggested communities

Powered by