Write something

Welcome to the Deal Hub

This discussion forum will be used to share deals between members, high profit opportunities I find & want to share with you, & deal breakdowns. Comment what market (City, State) you'd like to see some deals in👇🏼 Let's get investing!

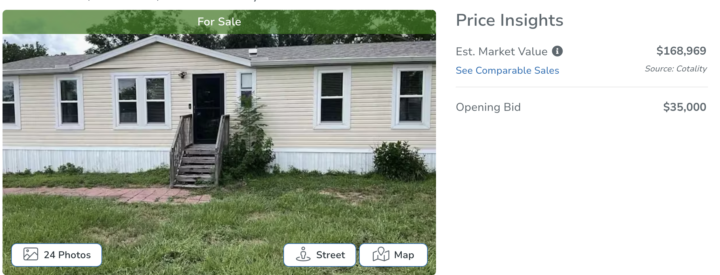

🚨 Deal Breakdown: Central Florida Mobile Home (In-Person Walkthrough)

I haven’t shared a deal breakdown in a while, so I wanted to bring one back with a property I actually went out and saw in person. 📍 Central Florida mobile home in a rental-friendly area. 🏠 The Basics • Mobile home • Solid rental demand in the area • Walked the property + spoke directly with neighbors (& discovered something I'd never expect) 💰 The Numbers Starting Bid: $35,000 Highest Seller Counter I’ve Seen: $110,000 Conservative ARV: ~$170,000 Estimated Rent: ~$1,500/month At the right purchase price, this deal 100% works. Max Bid I’d Be Comfortable With: $90,000 Here’s why 👇 Purchase Price: $90,000Renovation: $0(Minor clean-up only)Estimated Closing + Holding Costs: ~$15,000 ➡️ Total All-In Cost: ~$105,000 Conservative Resale Value (ARV): ~$170,000 📈 Estimated Flip Profit $170,000 – $105,000 = ~$65,000 That’s a $60K+ flip with:✔️ No rehab risk✔️ Faster turnaround✔️ No contractor headaches✔️ Clean exit strategy Mobile homes can be great cash-flow plays when bought right ⚠️ Why I Ultimately Passed Here’s the part most people don’t talk about — and why walking properties matters. After speaking with the neighbors, I learned about some unfortunate events tied to the property (shared in this video). Nothing that changes the numbers… but something that personally didn’t align with the type of projects I want to be involved in. And this is an important lesson: 👉 A “good deal” on paper doesn’t always mean it’s the right deal for YOU. Investing isn’t just about numbers — it’s also about:• Your risk tolerance• Your comfort level• Your long-term goals• What you want your portfolio to look like Sometimes the smartest move is passing, even when the deal technically works. 🧠 Key Takeaway This property is a great example of why: • Seeing properties in person matters • Talking to neighbors matters • Due diligence goes beyond spreadsheets

0

0

Deal Breakdown: Why I Looked & Why I Passed

Property: Ponte Vedra, FL — 3 beds / 2 baths, ~1,813 sq ft, built 2001 (found the deal listed on Auction.com Why I looked: - Good size property in a desirable ZIP (32081) with potential upside. - Appeared in an auction format — meaning if you bought right, you could capture value. - Light rehab possibility (assuming condition allows) — which usually equals faster turnaround. **Why I decided to pass — because risk was too high relative to reward: 1. Neighborhood Sales Activity: There weren’t many recent comparable sales in that exact sub-area indicating many active buyers. If buyers aren’t readily buying at those price levels, resale risk goes up. 2. HOA Neighborhood: The listing notes show an HOA (monthly dues) which adds carrying cost and complexity. HOAs can limit flexibility (renting, changes, etc). 3. Project Price + Financing Load: A higher-tier property always means more capital, more risk. Even though the ARV might be solid, the acquisition and holding costs get large. If anything goes sideways (market shifts, longer hold time, cost overruns) the margin gets eaten. 🧠 Key Lessons for You - Always check how many sales are happening in the neighborhood at your target ARV. If it’s thin, you’re assuming a lot of risk on the resale. - HOAs matter. They add cost, can restrict use (especially if you’re flipping or renting), and sometimes bring surprise rules. - Bigger properties ≠ always better. Bigger means higher entry cost + higher risk. Sometimes smaller, lower cost deals with tighter turnarounds are smarter for building momentum. - Even when a deal looks “good,” you still have to pass when the risk-reward doesn’t stack up. That’s what separates serious investors from hopeful buyers. 📌 Community Question If you were in my shoes: What’s the maximum acquisition cost (purchase + rehab + holding) you’d accept on this property to still feel comfortable with a 12-month hold and targeted exit?Drop your number and reasoning in the comments below — I’ll reply with mine so we can compare notes.

2

0

🚨Deal Breakdown: Springfield, MA

Just analyzed a new auction deal this week that’s a perfect example of how solid spreads still exist if you know where to look 👀 📍 Property Details 🏠 3 Bedrooms / 1 Bathroom 📏 1,300 sq ft 🛠 Light-to-moderate rehab — mostly cosmetic upgrades 📍 Located in Springfield, MA — a steady rental + flip market with strong buyer demand 📊 The Numbers 💰 Projected Max Bid (Purchase Price): $120,000 🧰 Rehab Budget: $45,000 📄 Closing + Holding Costs: ~$36,000 💸 Total Project Cost: ≈ $201,000 📈 After Repair Value (ARV): $237,000–$287,000 (based on comps nearby) 💵 Projected Profit: $36K–$86K 📊 ROI: 18%–43% depending on sale price 💬 Why This Deal Stands Out ✅ Even at a $120K max bid, the numbers still work — strong spread and ROI ✅ Cosmetic rehab = faster turnaround and lower risk ✅ Located in a consistent, affordable market (Springfield’s great for entry-level flips) ✅ Great example of how to use comps and ROI % to back into your maximum bid number 🧠 How You Can Find Similar Deals 1️⃣ Use Auction.com or your local county site to browse upcoming sales. 2️⃣ Pull 2–3 recent comps within 0.5–1 mile that match bed/bath count and square footage. 3️⃣ Run the math using your target ROI (I like 25–30%) to see your max allowable bid. 4️⃣ Always add your holding + closing costs — that’s where beginners under budget. 🚀 Want Hands-On Help Analyzing or Bidding on Deals Like This? schedule a call for my 1 on 1 program, where we walk through live deal breakdowns like this together and help you build your own auction investing system from scratch. Drop a comment if you’d bid on this one — what’s the highest number you’d feel comfortable going to while still keeping a solid margin? 👇

1

0

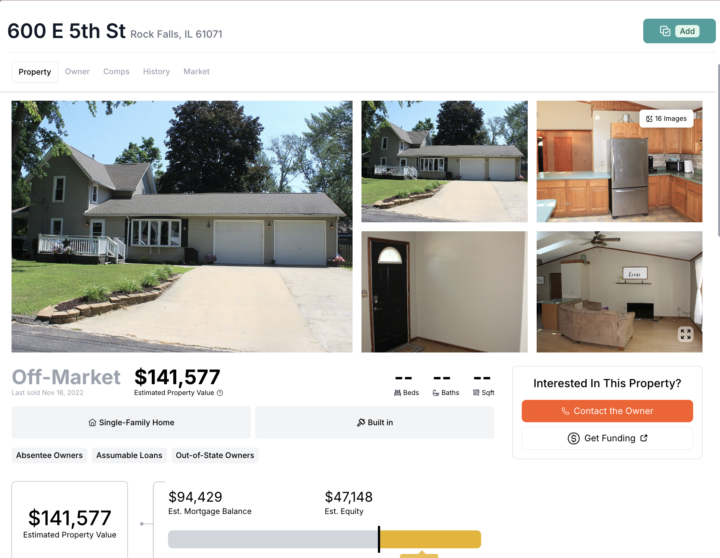

🚨 Deal Breakdown in Rock Falls, IL

Just came across an auction deal that checks all the boxes — low entry price, light rehab, and plenty of profit potential. 👀 📍 Property Details 🏠 3 Bedrooms / 1 Bathroom📏 1,800 sq ft 💡 Light cosmetic work needed — great bones overall 📍 Located in a stable market that’s not oversaturated 📊 The Numbers 💰 Projected Auction Purchase Price: $25,000 (starting bid) 🛠 Rehab Budget: $5,000–$10,000 (cosmetic refresh) 📄 Closing + Holding Costs: ~$13,000 (≈10% of ARV) 💸 Total Project Cost: ≈ $43,000–$48,000 📈 After Repair Value (ARV): $110,000–$130,000 💵 Projected Profit & ROI If sold near the midpoint ARV of $120,000, Profit: ~$72,000📊 ROI: ~150%+ 💬 Why I Like This Deal ✅ Minimal rehab = quick turnaround time ✅ Low starting bid leaves tons of room for margin ✅ Strong spread between all-in cost and ARV ✅ Located in a less competitive market = higher odds of winning the bid If you were bidding on this one, what’s the highest auction price you’d feel comfortable going to while still keeping a solid profit margin? Drop your number below 👇 Links: https://www.auction.com/details/600-e-5th-st-rock-falls-il-1882203 https://propwire.com/realestate/600-E-5th-St-Rock-Falls-IL-61071/218346057/property-details

2

0

1-13 of 13

powered by

skool.com/real-estate-investing-101-7860

Welcome to Auction Property Academy — a community of real estate investors mastering the art of finding, analyzing, and landing off-market deals.

Suggested communities

Powered by