Write something

Pinned

Hey everyone, thanks for joining!

When I started this community, my goal wasn’t to build another trading group full of charts and noise — I wanted a place where people could actually learn together, share real experiences, and be honest about the ups and downs of trading. Feel free to introduce yourself below 👇Tell us how long you’ve been trading, what markets you focus on, or even what made you interested in trading in the first place. Let’s make this community a place where people grow, learn, and help each other — no ego, no hype, just real progress.Glad you’re here. 🙏

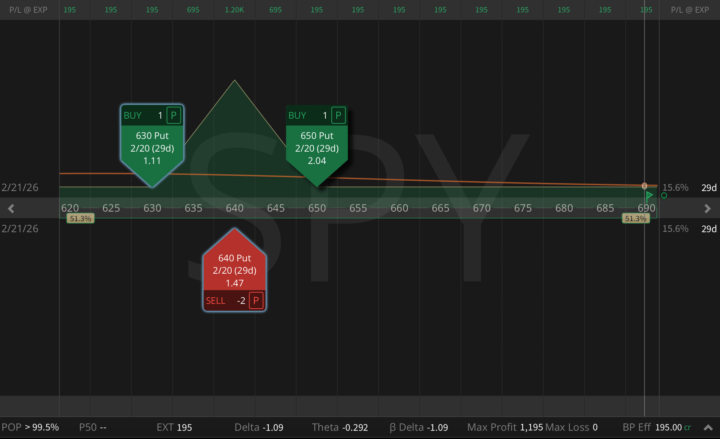

Converting a SPY Put Ratio Into a Risk-Free Butterfly 🦋 (Again)

Hey, on Tuesday I published a new trade idea: a SPY 650/640 put ratio spread (1x2), 31 DTE, opened for a $306 credit right as volatility spiked. The objective was simple: get paid for the panic. Today I've pulled a super-strategic move: just bought the 630 put for $1.11, and that single adjustment transformed the entire position into a risk-free butterfly 🦋 (!) with: - Zero downside risk - Zero upside risk - Max profit: $1,200 - Min profit: $195 - Probability of Profit (PoP): 100% This is what most traders miss in high-volatility regimes: you're not predicting direction; you're engineering a distribution. When fear is overpriced, you can sometimes lock structures where the market pays you first, then sells you the wing cheap enough to remove the tail. I do this setup on SPY all the time, but the framework works on any liquid ticker with tight markets: QQQ, IWM, and even selected single names.

1

0

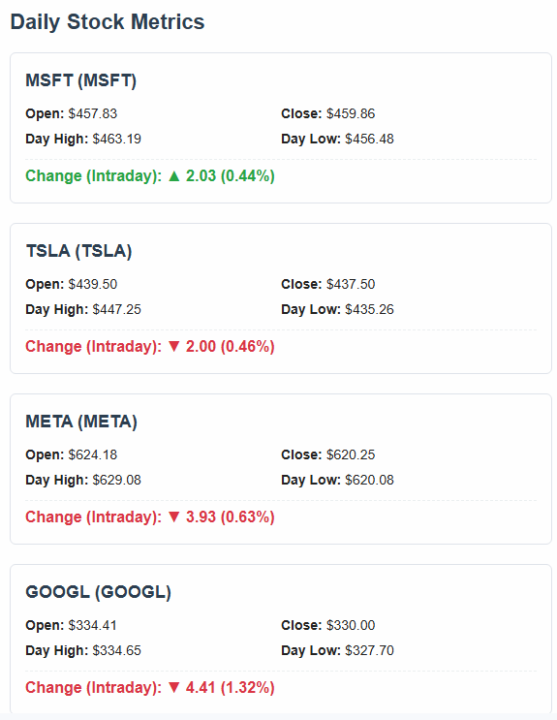

Jan 19 - stocks update

Microsoft is literally the only thing working today. Funny how everyone chases the NVDA hype until the market turns.

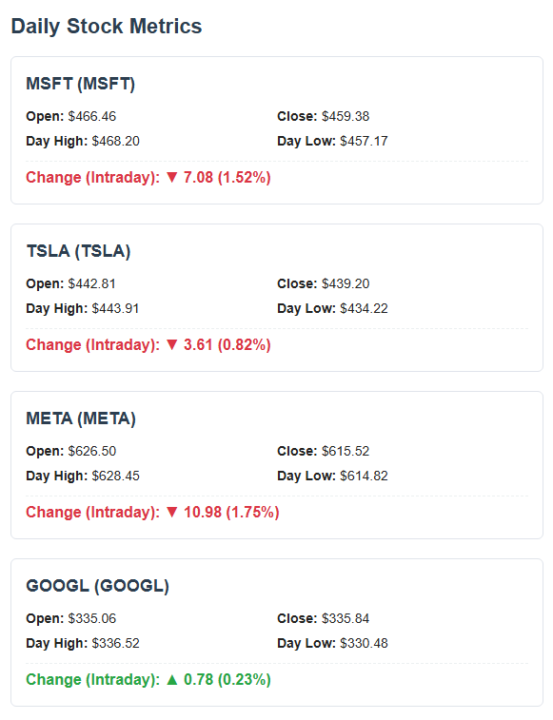

Jan 15 - stocks update

Sold off my MSFT and GOOGL today. Not worth holding them through this dip when META and NVDA are clearly holding up way better. Just following the money at this point

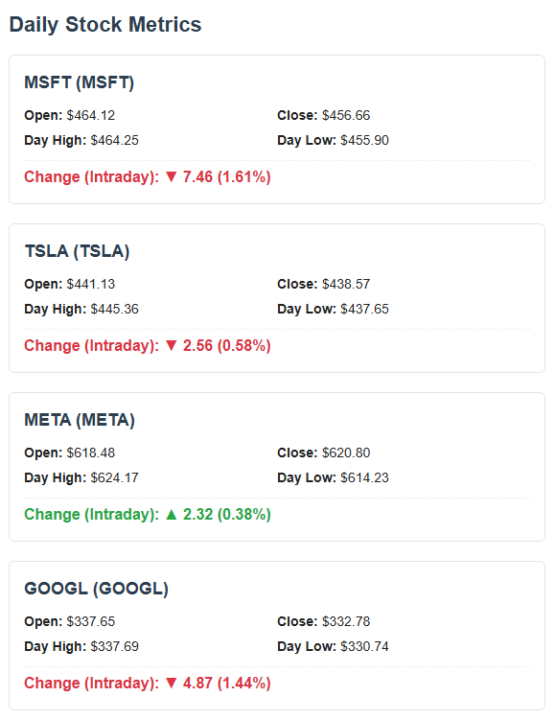

Jan 16 - stocks update

it’s a bad for tech today. msft, meta, and amzn are all dumping pretty hard... Feels like everyone is rotating out. Only reason aapl and googl are holding up is that gemini hype from earlier this week. I'm staying cautious until the dust settles...

1-21 of 21

powered by

skool.com/option4all-2121

For new & growing traders. 🎓 Learn low-risk, high-return option systems & trade confidently with real mentorship. 🚀

Suggested communities

Powered by