Write something

Amazon After Earnings: When Ratio Risk Beats Naked Risk

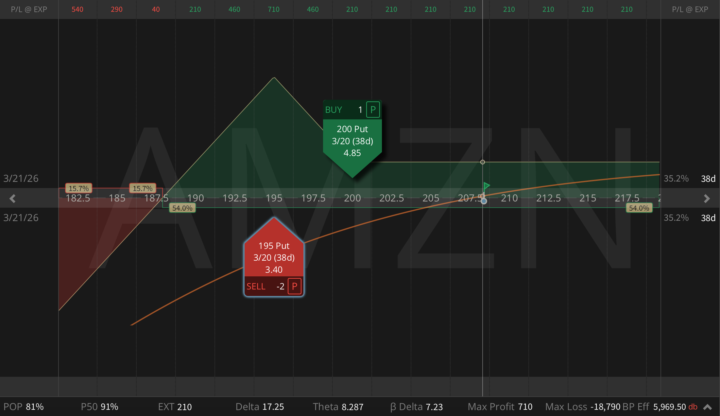

Last week we skipped trading AMZN earnings. Options were pricing 7.5%, reality was -14%, so short gamma was not the place to be. In my personal view it was only a repricing of capex and FCF timing, nothing more. AWS re-accelerated, ads keep growing >20%, NA retail margins are improving, but the market suddenly realized buybacks and FCF are pushed out by heavy AI capex. Post-earnings, the setup changed. The shock is out, downside skew is still rich, and fundamental downside convexity is much lower than before the print. That's why ratio risk now beats naked risk, so today I'm expressing this via a March put ratio:

1

0

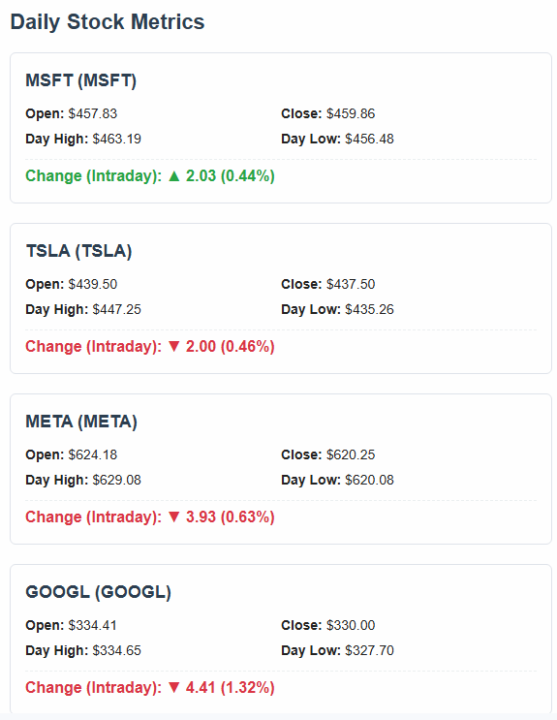

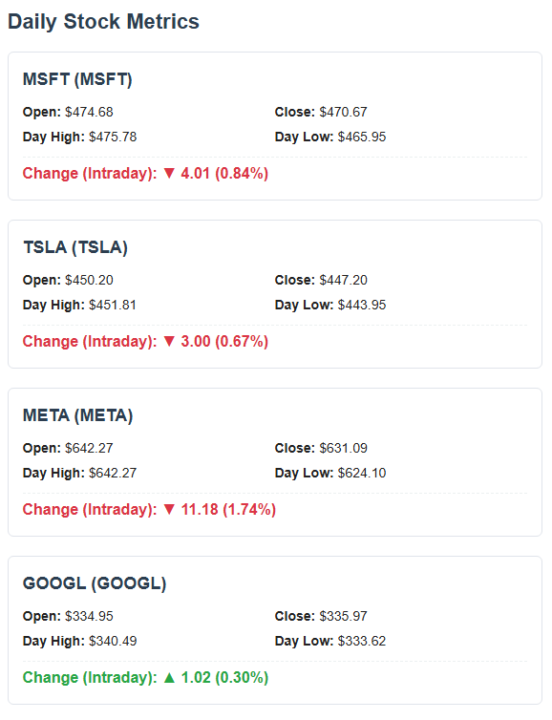

Jan 19 - stocks update

Microsoft is literally the only thing working today. Funny how everyone chases the NVDA hype until the market turns.

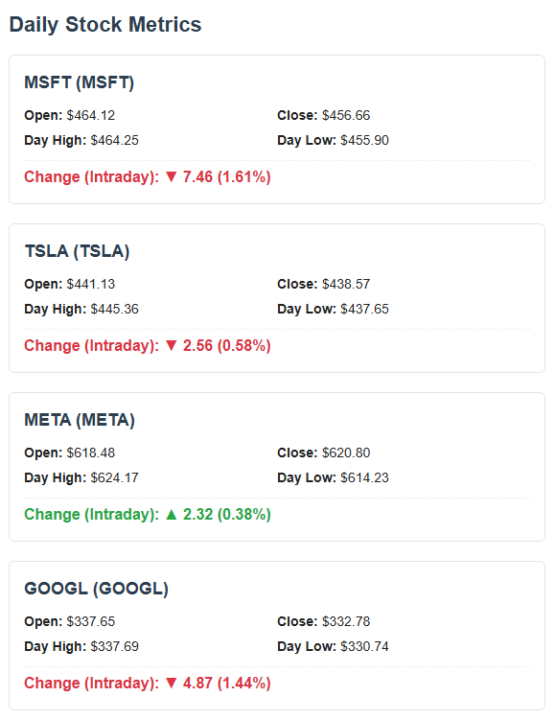

Jan 15 - stocks update

Sold off my MSFT and GOOGL today. Not worth holding them through this dip when META and NVDA are clearly holding up way better. Just following the money at this point

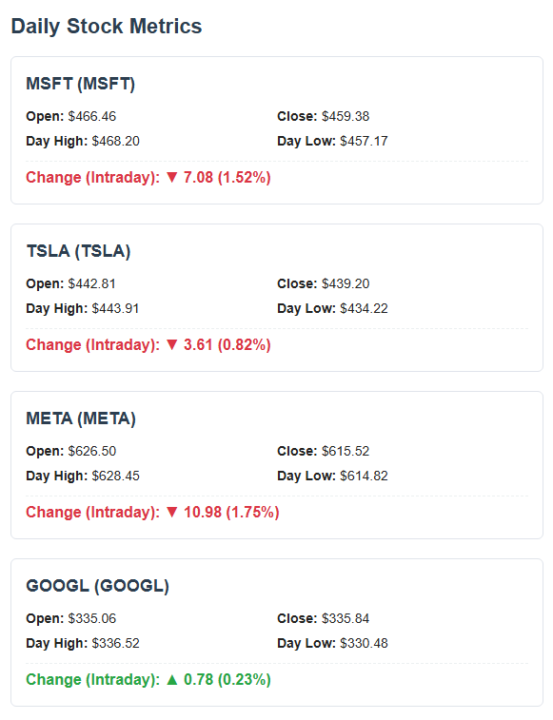

Jan 16 - stocks update

it’s a bad for tech today. msft, meta, and amzn are all dumping pretty hard... Feels like everyone is rotating out. Only reason aapl and googl are holding up is that gemini hype from earlier this week. I'm staying cautious until the dust settles...

Jan 13 - Stocks update

It's wild that apple is the only thing green today. Guess the gemini partnership is actually starting to reflect into the price. Def looks like the play right now.

1-13 of 13

powered by

skool.com/option4all-2121

For new & growing traders. 🎓 Learn low-risk, high-return option systems & trade confidently with real mentorship. 🚀

Suggested communities

Powered by