Write something

Converting a SPY Put Ratio Into a Risk-Free Butterfly 🦋 (Again)

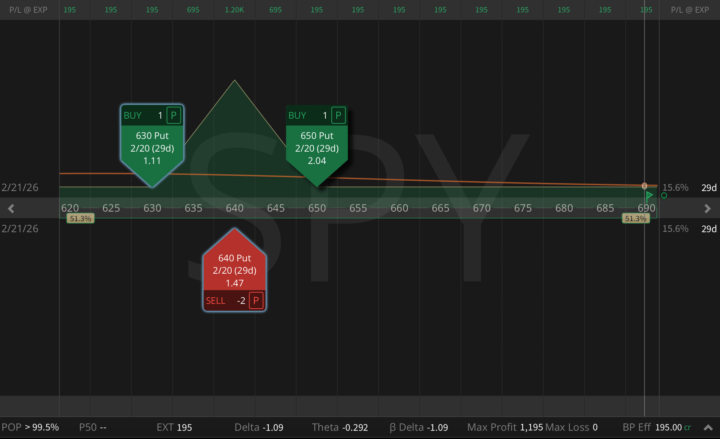

Hey, on Tuesday I published a new trade idea: a SPY 650/640 put ratio spread (1x2), 31 DTE, opened for a $306 credit right as volatility spiked. The objective was simple: get paid for the panic. Today I've pulled a super-strategic move: just bought the 630 put for $1.11, and that single adjustment transformed the entire position into a risk-free butterfly 🦋 (!) with: - Zero downside risk - Zero upside risk - Max profit: $1,200 - Min profit: $195 - Probability of Profit (PoP): 100% This is what most traders miss in high-volatility regimes: you're not predicting direction; you're engineering a distribution. When fear is overpriced, you can sometimes lock structures where the market pays you first, then sells you the wing cheap enough to remove the tail. I do this setup on SPY all the time, but the framework works on any liquid ticker with tight markets: QQQ, IWM, and even selected single names.

2

0

Hi guys if we launch our Youtube, what kind of free content you'd like to see?

We'd like to know what we kind of tutorials about options trading we can give yall. Also would like to announce that courses will be postponed until Q1 next year. We really apologise as the holidays work rush got to us!

1-2 of 2

powered by

skool.com/option4all-2121

For new & growing traders. 🎓 Learn low-risk, high-return option systems & trade confidently with real mentorship. 🚀

Suggested communities

Powered by