Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Options

STOP trading market direction. Start using options strategies to turn volatility into steady income. We sell premium, and think in probabilities.

Memberships

Option4All

59 members • Free

Imperium Academy™

47.4k members • Free

Risk Management

11 members • Free

Skoolers

189.8k members • Free

University Of Traders

77 members • Free

PainlessTrader

378 members • $12/year

AI Stock Investing

667 members • Free

HYROS Ads Hall Of Justice

4.7k members • Free

Simple Option Trading

378 members • Free

1 contribution to Option4All

Converting a SPY Put Ratio Into a Risk-Free Butterfly 🦋 (Again)

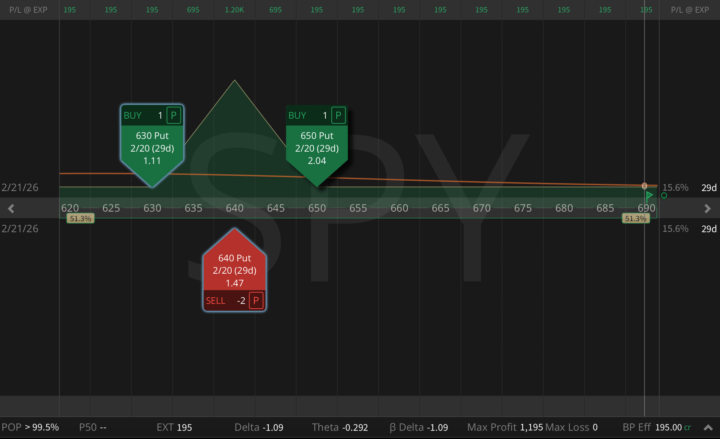

Hey, on Tuesday I published a new trade idea: a SPY 650/640 put ratio spread (1x2), 31 DTE, opened for a $306 credit right as volatility spiked. The objective was simple: get paid for the panic. Today I've pulled a super-strategic move: just bought the 630 put for $1.11, and that single adjustment transformed the entire position into a risk-free butterfly 🦋 (!) with: - Zero downside risk - Zero upside risk - Max profit: $1,200 - Min profit: $195 - Probability of Profit (PoP): 100% This is what most traders miss in high-volatility regimes: you're not predicting direction; you're engineering a distribution. When fear is overpriced, you can sometimes lock structures where the market pays you first, then sells you the wing cheap enough to remove the tail. I do this setup on SPY all the time, but the framework works on any liquid ticker with tight markets: QQQ, IWM, and even selected single names.

1

0

1-1 of 1