Pinned

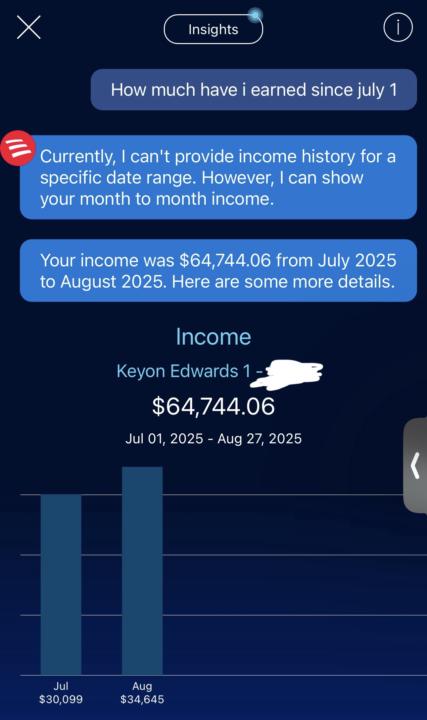

70k profit second half of the year! JOIN PRO GROUP

Numbers don’t lie these strategies work! Join PRO group

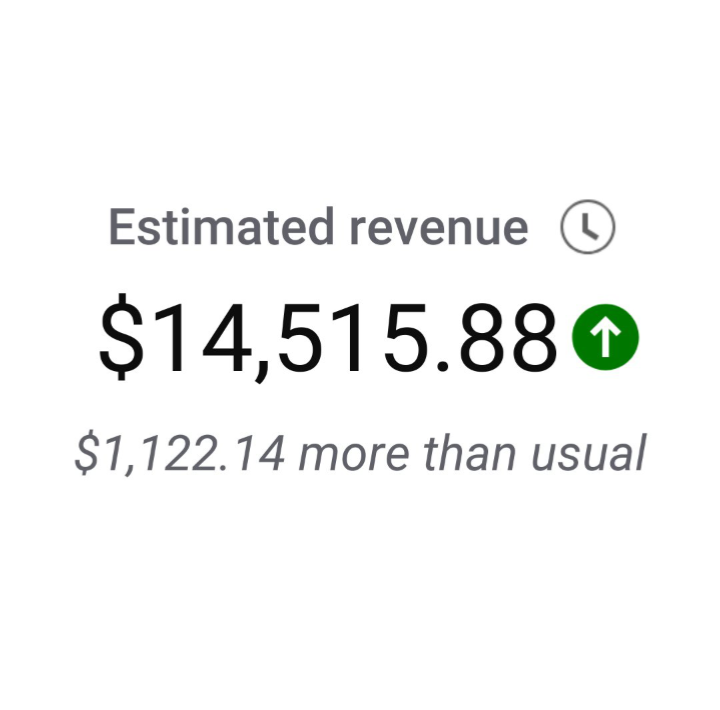

$14,515 from YouTube Automation 💰🔥

$14,515 in estimated revenue and still climbing 🚀. This is what happens when strategy, consistency, and smart YouTube automation align. No face, no guesswork—just a proven system that scales. Results like this are built step by step, not overnight. If you’re ready to learn how it’s done, don’t miss this. 👉 Check under the comments 👉 Join our Telegram channel OR DM 📥 me directly on WhatsApp

$10K in One Week with YouTube Automation 💸🚀

$10,000 made in just one week and $27K already this month 🔥. This is what happens when the right niche, automation system, and consistency come together. No face, no hype just scalable YouTube income. If you’re ready to build channels that pay, this is your sign. 👉 Check under the comments 👉 Join our Telegram channel OR DM 📥 me directly on WhatsApp

New licensed life agent

Hi group. I'm new to not only this business but also newly licensed life insurance agent. I'm here because I have soooo much to learn about everything. So please don't get sick of me asking questions ⁉️

1-30 of 176

skool.com/keylock-your-life-5051

Top Secret INSURANCE game

(ONE ON ONE MENTORSHIP)

INSURANCE = PASSIVE INCOME

Powered by