Silver Breaks All Time Highs

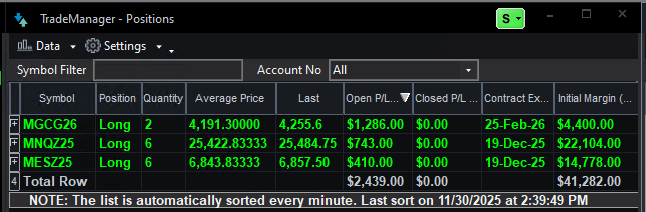

Since I lasted posted about being bullish on silver on 10/12/25, it has grown from $47 to $57 Thats a $50,000 move per 1 contract with $22k margin (not to mention risk around $3k). A return to risk ratio of 16.67 to 1 Last Post: Silver futures huge buying opportunity

2

0

1-30 of 169

skool.com/futures

A simple path to automated futures trading. Try 45+ algos for 30 days.

Powered by