Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

17 contributions to 5-Minute Futures

Cooking up something special for you guys

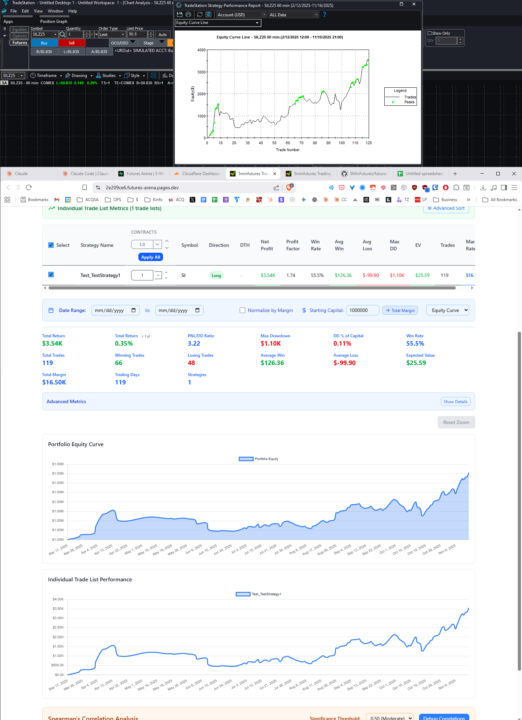

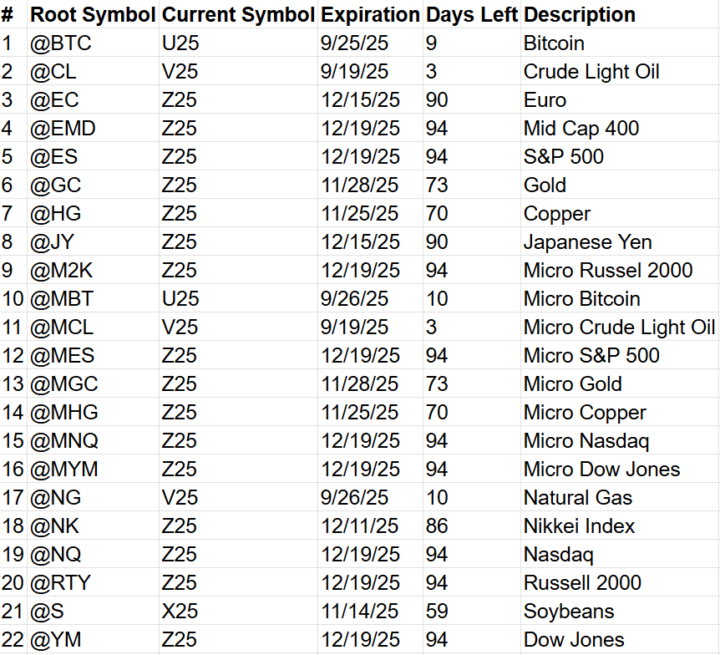

sneak peak at a new tool I'm coding, that will update Tradestation strategy performance IN REAL TIME that's right, no more manually downloading tradelists by hand or blindly guessing which algo is winning or losing this month. model custom portfolios with a few clicks of a button in browser... TBA Resources: - Screenshot 1: futures-arena.pages.dev | https://github.com/5MinFutures/futures-arena - upload_trades.txt -> .py script running on windows 10 vps with all the algos downloading to csv, and uploading to supabase... - attached screenshots 3 & 4 -> supabase table schema

1 like • 25d

@Kevin Gong -yes that is possible. Ill recommend a separate dll running on the special startegy that way it will only run when thst is on. Alos need to think about the size of the dats being sent snd the timing. We dont want to take up bandwidth on the machine while the algos are actively trading since they need the priority of bandwidth. Lets discuss the details more offline but its possible and not a bad idea from an initial glance

Roll MBT: U25 -> V25

Make sure to roll MBT today (expired yesterday) - I dislike the monthly rolls. :)

2025 September Performance: -5.81%

Starting Balance: $300k Net PNL: - -$17.43k - -5.81% Date Range: - 9/1/25 to 9/30/25 Portfolio: B (concierge tier 16 algos) Note: September is the weakness month for this portfolio from a seasonality perspective. Q4 is the strongest. PS. I share these updates to normalize transparency in the trading industry. If you'd like to join me on this mission. Share your 3rd party verified trading performance!

1 like • Oct 3

But....but...all furus win 100%!! Thanks for the transparency. Its important that traders really understand that all the "fluff" they see online is fake and everyone has losses and will have red days/months as part of the drawdowns. Anyone who tries to say otherwise is not telling the truth. A red month that follows the "plan" is still a great month b/c you followed your rules and did not let emotions take over.

@MES and @ES.D Timezone Issues

There is an issue with Alpha_L_Tiger where with the updated MESZ25, it conflicts with the @ES.D data. It is stating that "you may not mix symbols with different time zones in a window". While all the data series are tied to "exchange" this is failing but if switched to "local", it does allow them to be together. Is anyone else hitting this? I tested on a clean chart also on a other box to mimic it and was able to see what algo was failing by removing the data so it would load. You an load @MESZ25 in exhange zone and then add data2 as @ES.D to hit the failure.

1-10 of 17

@james-borowiec-3041

I enjoy coding and testing algos on the side.

Active 3d ago

Joined Jun 24, 2025

USA

Powered by