Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

18 contributions to 5-Minute Futures

11/24/25: +3.8%

Open PNL: $2,410 Closed PNL: $9,075 Biggest winners today were long algos on S&P500 & Russel 200 index futures (ES & RTY) *Based on Portfolio B $300k account

Cooking up something special for you guys

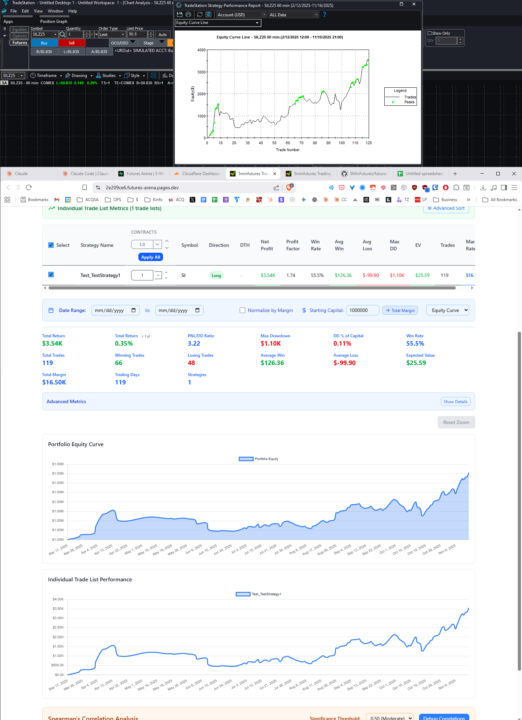

sneak peak at a new tool I'm coding, that will update Tradestation strategy performance IN REAL TIME that's right, no more manually downloading tradelists by hand or blindly guessing which algo is winning or losing this month. model custom portfolios with a few clicks of a button in browser... TBA Resources: - Screenshot 1: futures-arena.pages.dev | https://github.com/5MinFutures/futures-arena - upload_trades.txt -> .py script running on windows 10 vps with all the algos downloading to csv, and uploading to supabase... - attached screenshots 3 & 4 -> supabase table schema

Concierge Portfolio Review: 2025 October

Based on $300k starting capital: - Total Return: -2.42% - MaxDD: 6.34% - Win Rate: 41.2% - Total Trades: 165 - Winning Trades: 68 - Losing Trades: 97 - Average Win: $1.40K - Average Loss: $-1.06K - Expected Value: $-43.94

How to download algo backtests from Tradestation

This dashboard visualizes equity curves, performance metrics, and portfolio statistics for multiple algorithms. It's currently over 2,700 lines of code and capable of loading trade lists from TradeStation, calculating combined portfolio performance, and analyzing metrics like drawdown, win rate, and profits across different time periods. How to download algorithm back test data from TradeStation: - Refreshing charts in TradeStation to ensure data accuracy - Loading individual algorithm charts and turning status off/on to update data - Downloading trade lists as CSV files - Importing updated CSVs into the dashboard Labeled all algorithm entries with unique names (like Hawk, Lion, Shark) to easily identify which algorithm generated which trades in the trade lists. Algorithm Performance Analysis The dashboard enables detailed performance analysis: - Current data shows the portfolio has been flat since August, after making about $300K in April-May - Q3 2025 (July-Sept) showed modest gains of $37K with a $25K max drawdown - Q2 2025 (April-June) was extremely profitable with $297K gains and 17% max drawdown - Year-to-date performance shows 114.8% return with a 14.8% max drawdown - The portfolio demonstrated resilience during a challenging period in Feb-Mar Future Development Plans: - Add a monthly P&L matrix feature (requested by a client) - Several other features planned before public release - Estimating 60 more hours of development work - Plans to release the dashboard for free to their community - Currently hitting context limits in Claude for code revisions

FREE copy of Hormozi's new book ($100M Money Models)

I have 199 FREE QR codes to give away for Hormozi's new Money Models book, so if you need one comment below "Me" and I'll DM it to you. Prioritizing clients first, first come first serve for all members of 5-Min Futures! Happy Money Models Launch Day & Birthday Weekend to Alex Hormozi :) P.S. Free Money Models Audiobook here PSS. Free Money Models Course here 👉(must own a skool community 1st)

1-10 of 18

@scott-hemmings-8663

Trading Platform: TradeStation.

Markets: US Futures.

Active 11h ago

Joined Nov 27, 2024

Powered by