Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

5-Minute Futures

7.4k members • Free

25 contributions to 5-Minute Futures

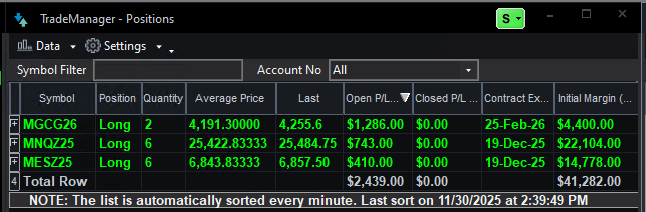

12/11/25 | Open PNL: +1.29% | Closed PNL: +1.76%

I cover what it looks like when 16+ algorithms are trading futures markets on autopilot in this quick video!

How to get VIP Tech Support👇

Need help? 1. Post a comment below 2. Use the search bar at the top P.S. For faster response times tag: @Kevin Gong

1 like • 14d

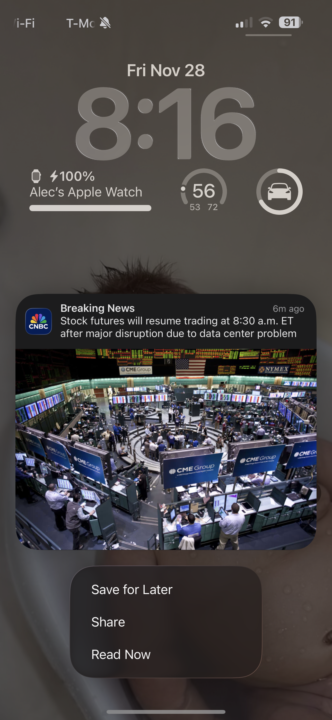

There are several reasons why markets didn't react more negatively to the CME outage: 1. Timing Was Critical The outage occurred on Black Friday following Thanksgiving, during a holiday-shortened trading session with typically lower liquidity, which likely prevented a more severe market reaction. Most institutional traders were off, and trading volumes were already expected to be light. 2. Markets Were Already Closed The technical glitch originated late on Thursday, November 27, around 8:40 PM CT — after U.S. equity markets had already closed for Thanksgiving. This meant the outage happened during relatively quiet overnight hours when fewer participants were active. 3. Restoration Before Market Open While premarket activity and trading in crucial contracts were down for over 11 hours, CME worked quickly to restore services, with most platforms coming back online around or before the regular equity market open on Friday. This minimized the impact on actual cash market trading. 4. Markets Actually Moved Higher SPY was up about 0.3%, QQQ up 0.4%, and a Dow-tracking ETF up roughly 0.3% in pre-market trading, suggesting positive sentiment was already in place regardless of the technical issue. 5. Infrastructure Issue, Not Market Fundamentals Traders understood this was a technical cooling system failure at a data center, not a fundamental market problem or financial crisis. Once confidence was restored that systems were coming back online, there was little reason for panic selling. The combination of holiday timing, quick resolution, and the nature of the problem (technical infrastructure rather than economic/financial stress) helped contain what could have been a much more disruptive event.

How Do You Handle Drawdown?

I’ve been thinking a lot about drawdowns and how everyone manages them. I’m running strictly algos now, and one of the biggest differences compared to when I traded manually is how much less tilt I experience. Following Kevin’s system has basically removed the emotional swings I used to put myself through. For those of you who’ve made a similar transition, or even those still trading manually, how do you think about an acceptable drawdown? And when you are in a drawdown, what helps you manage it, both from a risk perspective and a mental one? I am curious to hear how others define their thresholds and keep a clear head when things pull back.

1-10 of 25

Active 1d ago

Joined Oct 4, 2024

Florida

Powered by