Concierge Portfolio Review: 2025 November

Based on $300k starting capital: - Total Return: +2.13% - MaxDD: 8.76% - Win Rate: 37.2% - Total Trades: 121 - Average Win: $2.06K - Average Loss: $-1.13K - Expected Value: $-52.70

2

0

VPS Update: 11/1/2025

Release Date: 11/1/25 Version: 4.2.0 Updates: - Installed Tradestation Update 89 (Version: 10.00.11.1434) - Rolled contracts - Fixed an issue where micro Kratos wasn't taking trades Notes: - OPTIONAL: To backup your workspace files: Update TS10 on your old VSP -> save your workspace files on your local pc -> have ChartVPS roll out the update -> copy/paste your workspace files into the new VPS - Toolkit may no longer work since TS changed how their desktop app detects windows. - If this is too much trouble, DM me to join the waitlist for Concierge service - Concierge: Fully managed VPS, position matching, research & development, portfolio balancing. To get the update chat ChartVPS during market close: - 5MinFutures Update (I'm ok with data loss)

Concierge Portfolio Review: 2025 October

Based on $300k starting capital: - Total Return: -2.42% - MaxDD: 6.34% - Win Rate: 41.2% - Total Trades: 165 - Winning Trades: 68 - Losing Trades: 97 - Average Win: $1.40K - Average Loss: $-1.06K - Expected Value: $-43.94

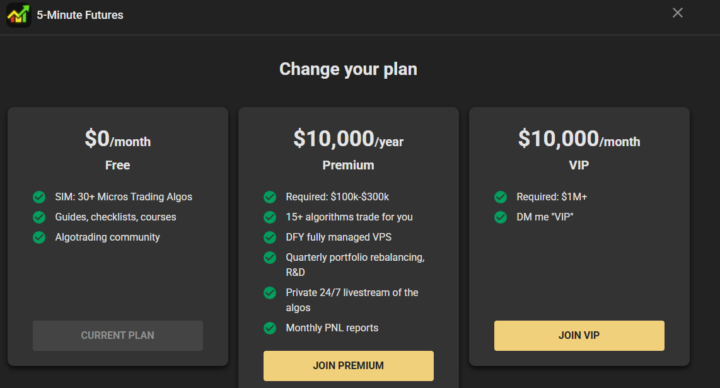

Premium & VIP subscription options!

Each progressive tier includes all the benefits of the tiers above it. Free: - This community :) - Learn how to build trading algorithms - 30 day free trial of 45+ SIM trading algos Premium: - Required: $100k USD - DFY fully managed VPS - LIVE Trading: 3 micros per trading algo - Quarterly portfolio rebalancing - Private 24/7 livestream - Research & development of new algos - Lower broker commissions - No datafeed fees - No VPS fees VIP: - Required: $1M+ USD - To join the waitlist DM me "VIP"

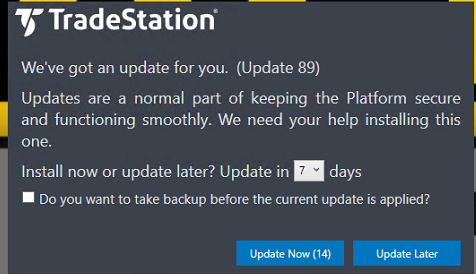

9/28/25: Avoid installing TS Update 89

PSA: Avoid installing TS update for Q4 VPS. It will break toolkit. If TS asks you to update 89 1. Set to 7 days 2. Update later

1-18 of 18

skool.com/futures

A simple path to automated futures trading. Try 45+ algos for 30 days.

Powered by