𝐓𝐡𝐞 𝐔𝐥𝐭𝐢𝐦𝐚𝐭𝐞 𝐆𝐮𝐢𝐝𝐞 𝐭𝐨 𝐁𝐫𝐞𝐚𝐤𝐢𝐧𝐠 𝐢𝐧𝐭𝐨 𝐏𝐫𝐢𝐯𝐚𝐭𝐞 𝐄𝐪𝐮𝐢𝐭𝐲 (𝐏𝐄): 𝐅𝐫𝐨𝐦 𝐚𝐧 𝐄𝐱-𝐊𝐊𝐑 𝐑𝐞𝐜𝐫𝐮𝐢𝐭𝐞𝐫

Landing a role at elite funds like KKR or Apollo demands meticulous strategy, exceptional execution, and relentless focus. 𝐇𝐞𝐫𝐞’𝐬 𝐲𝐨𝐮𝐫 𝐩𝐫𝐨𝐯𝐞𝐧 𝐫𝐨𝐚𝐝𝐦𝐚𝐩: 1️⃣ 𝐔𝐧𝐝𝐞𝐫𝐠𝐫𝐚𝐝𝐮𝐚𝐭𝐞 𝐅𝐨𝐮𝐧𝐝𝐚𝐭𝐢𝐨𝐧 • Academics & Internships: Excel in finance or supplement your degree with finance courses. Target investment banking internships by year 2—this path is crucial. • Spring Weeks: Secure a spring week at top banks (Goldman, Morgan Stanley). These are fast tracks to summer internships. • Technical Skills Early: Master financial modelling (DCF, LBO) early. Practice extensively outside class. • Networking: Tap alumni at top banks/funds. Request coffee chats under the pretext of career advice. • Leadership: Run student investment funds or entrepreneurship projects to prove genuine investor instincts. 2️⃣ 𝐌&𝐀 𝐀𝐧𝐚𝐥𝐲𝐬𝐭 𝐒𝐭𝐢𝐧𝐭 (𝐈𝐁/𝐌𝐁𝐁) Target top banks/groups known for PE exits (Goldman TMT, Deutsche LevFin, Bain PEG). Focus on: • Complex Deals: Gain direct exposure to buy-side/sell-side transactions with PE involvement. • Deal Log: Maintain detailed records (deal type, sector, your specific role). • PE Mindset: Constantly analyse deals from an investor perspective (“Would I invest and why?”). 3️⃣ 𝐓𝐫𝐚𝐧𝐬𝐢𝐭𝐢𝐨𝐧 𝐭𝐨 𝐏𝐄 • Headhunter Strategy: Engage elite recruiters (Kea Consultants, CPI) 6–9 months into your analyst stint. Clearly articulate your PE motivation and skill mastery. • Strategic Networking: Build relationships with PE associates/partners. Attend industry events and schedule insightful coffees/chats. 4️⃣ 𝐏𝐄 𝐈𝐧𝐭𝐞𝐫𝐯𝐢𝐞𝐰 𝐌𝐚𝐬𝐭𝐞𝐫𝐲 • Technical Excellence: Master LBO models and paper LBOs. Go beyond mechanics—demonstrate investor-level insight into macro trends and deal specifics. • Investment Ideas: Prepare a clear, data-backed investment thesis using the Gravity framework (thesis, value creation, quantifiable upside). • Executive Presence: Project confidence and humility. Use deliberate pacing, strategic pauses, steady eye contact, and concise speech to convey gravitas.

0

0

Another private equity interview offer ✅

We have a 100% CV success rate in the 1-1 programmes and this is continuing 💪

2

0

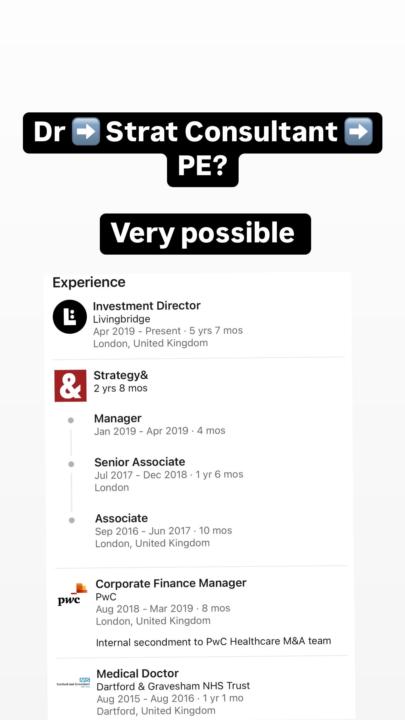

Interested in private equity? Read this ⬇️

https://timesofindia.indiatimes.com/blogs/harvard-to-wall-street-navigating-elite-finance-careers/how-to-ace-private-equity-interviews/

5

0

Search Fund Interview Advice

Hello, I am a third-year student studying finance and real estate. I want to eventually land up in a high finance role like IB or PE and as a first step towards reaching that goal, I have started finding and applying to search funds. Have just been invited to an interview at an LLM Private Equity/Search fund. Before the interview, they asked me to complete an industry appraisal and make a list of a few companies that would be a good fit for acquisition and some that would be a bad fit given the company's search criteria. I was wondering if in the interview they would only ask me follow up questions about my research and ask me to justify my responses or can there be a technical component also? And any tips on how to prepare for it!

1-5 of 5

skool.com/elitecareersstrategy

Global experts helping you enter the world's most elite finance careers.

Highest salary @ 21 $180,000 | HF, PE, VC, MBB

Powered by