𝐓𝐡𝐞 𝐔𝐥𝐭𝐢𝐦𝐚𝐭𝐞 𝐆𝐮𝐢𝐝𝐞 𝐭𝐨 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐢𝐧𝐠 𝐟𝐨𝐫 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐁𝐚𝐧𝐤𝐢𝐧𝐠— 𝐅𝐫𝐨𝐦 𝐚𝐧 𝐄𝐱-𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐑𝐞𝐜𝐫𝐮𝐢𝐭𝐞𝐫 𝐖𝐡𝐨 𝐒𝐩𝐨𝐤𝐞 𝐚𝐭 𝐇𝐚𝐫𝐯𝐚𝐫𝐝

In front-office investment banking, who you know often matters as much as what you know. 𝐇𝐞𝐫𝐞’𝐬 𝐚 𝐩𝐫𝐞𝐜𝐢𝐬𝐞 𝐛𝐥𝐮𝐞𝐩𝐫𝐢𝐧𝐭 𝐭𝐨 𝐞𝐥𝐢𝐭𝐞 𝐧𝐞𝐭𝐰𝐨𝐫𝐤𝐢𝐧𝐠 𝐬𝐮𝐜𝐜𝐞𝐬𝐬: 1️⃣ 𝐄𝐥𝐢𝐭𝐞 𝐏𝐫𝐞-𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐢𝐧𝐠 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 Don’t show up unprepared. Research each banker deeply, and know their recent deals and market views. Instead of generic questions, ask insightful specifics, e.g.: "𝘐 𝘯𝘰𝘵𝘪𝘤𝘦𝘥 𝘎𝘰𝘭𝘥𝘮𝘢𝘯 𝘢𝘥𝘷𝘪𝘴𝘦𝘥 𝘰𝘯 𝘵𝘩𝘦 $35.9𝘣𝘯 𝘒𝘦𝘭𝘭𝘢𝘯𝘰𝘷𝘢-𝘔𝘢𝘳𝘴 𝘥𝘦𝘢𝘭; 𝘩𝘰𝘸 𝘥𝘪𝘥 𝘺𝘰𝘶𝘳 𝘵𝘦𝘢𝘮 𝘮𝘢𝘯𝘢𝘨𝘦 𝘵𝘩𝘰𝘴𝘦 𝘤𝘳𝘰𝘴𝘴-𝘣𝘰𝘳𝘥𝘦𝘳 𝘤𝘩𝘢𝘭𝘭𝘦𝘯𝘨𝘦𝘴?" This signals genuine curiosity, commercial awareness, and makes you memorable. 2️⃣ 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜 𝐈𝐧𝐢𝐭𝐢𝐚𝐥 𝐎𝐮𝐭𝐫𝐞𝐚𝐜𝐡 Never start with “𝘐 𝘸𝘢𝘯𝘵 𝘢 𝘫𝘰𝘣.” Lead with genuine interest in them: "𝘏𝘪 𝘔𝘴. 𝘚𝘮𝘪𝘵𝘩, 𝘐’𝘮 𝘢 𝘫𝘶𝘯𝘪𝘰𝘳 𝘢𝘵 𝘏𝘢𝘳𝘷𝘢𝘳𝘥 𝘧𝘢𝘴𝘤𝘪𝘯𝘢𝘵𝘦𝘥 𝘣𝘺 𝘺𝘰𝘶𝘳 𝘳𝘰𝘭𝘦 𝘪𝘯 𝘵𝘩𝘦 𝘈𝘉𝘊 𝘛𝘦𝘤𝘩 𝘐𝘗𝘖—𝘸𝘰𝘶𝘭𝘥 𝘺𝘰𝘶 𝘣𝘦 𝘰𝘱𝘦𝘯 𝘵𝘰 𝘢 𝘣𝘳𝘪𝘦𝘧 𝘤𝘢𝘭𝘭? 𝘐’𝘥 𝘷𝘢𝘭𝘶𝘦 𝘺𝘰𝘶𝘳 𝘪𝘯𝘴𝘪𝘨𝘩𝘵𝘴." During the chat, focus on their experiences, listen actively, and build rapport. Avoid asking favours too soon. Bankers remember candidates who truly connect. 3️⃣ 𝐍𝐮𝐫𝐭𝐮𝐫𝐞 𝐑𝐞𝐥𝐚𝐭𝐢𝐨𝐧𝐬𝐡𝐢𝐩𝐬 𝐓𝐡𝐨𝐮𝐠𝐡𝐭𝐟𝐮𝐥𝐥𝐲 Networking isn’t transactional—it’s relational. Regularly stay in touch by: • Sending prompt thank-you notes highlighting a specific insight. • Sharing relevant articles or updates. • Congratulating their successes. Consistent, thoughtful engagement builds trust. A Morgan Stanley VP noted a student’s intelligent follow-ups transformed a cold email into a personal recommendation. 4️⃣ 𝐋𝐞𝐯𝐞𝐫𝐚𝐠𝐞 𝐑𝐞𝐥𝐚𝐭𝐢𝐨𝐧𝐬𝐡𝐢𝐩𝐬 𝐆𝐫𝐚𝐜𝐞𝐟𝐮𝐥𝐥𝐲 Earn your ask. When the time is right, tactfully seek guidance: "𝘠𝘰𝘶𝘳 𝘢𝘥𝘷𝘪𝘤𝘦 𝘩𝘢𝘴 𝘣𝘦𝘦𝘯 𝘪𝘯𝘷𝘢𝘭𝘶𝘢𝘣𝘭𝘦; 𝘢𝘯𝘺 𝘵𝘪𝘱𝘴 𝘧𝘰𝘳 𝘱𝘰𝘴𝘪𝘵𝘪𝘰𝘯𝘪𝘯𝘨 𝘮𝘺𝘴𝘦𝘭𝘧 𝘧𝘰𝘳 𝘑𝘗𝘔𝘰𝘳𝘨𝘢𝘯 𝘪𝘯𝘵𝘦𝘳𝘷𝘪𝘦𝘸𝘴? 𝘏𝘢𝘱𝘱𝘺 𝘵𝘰 𝘴𝘩𝘢𝘳𝘦 𝘮𝘺 𝘊𝘝 𝘪𝘧 𝘺𝘰𝘶 𝘩𝘢𝘷𝘦 𝘢 𝘮𝘰𝘮𝘦𝘯𝘵." This respectful approach often naturally leads to referrals without being presumptuous. Senior bankers appreciate humility and tactful ambition. 𝑺𝒕𝒓𝒂𝒕𝒆𝒈𝒊𝒄 𝑻𝒂𝒌𝒆𝒂𝒘𝒂𝒚 Elite networking is not about accumulating contacts — it is about engineering credibility, relevance, and advocacy. When you demonstrate commercial fluency, genuine curiosity, and executive presence, bankers stop viewing you as a student seeking help and start seeing you as a future colleague. That shift — from transactional outreach to relationship capital — is what converts conversations into referrals.

1

0

3-Day Investment Banking Course

Hi team, I am unable to access the recordings of 3-Day Investment Banking course, available in the skool community. It asks to sign in through Vimeo. Did that, nothing happened. Please help.

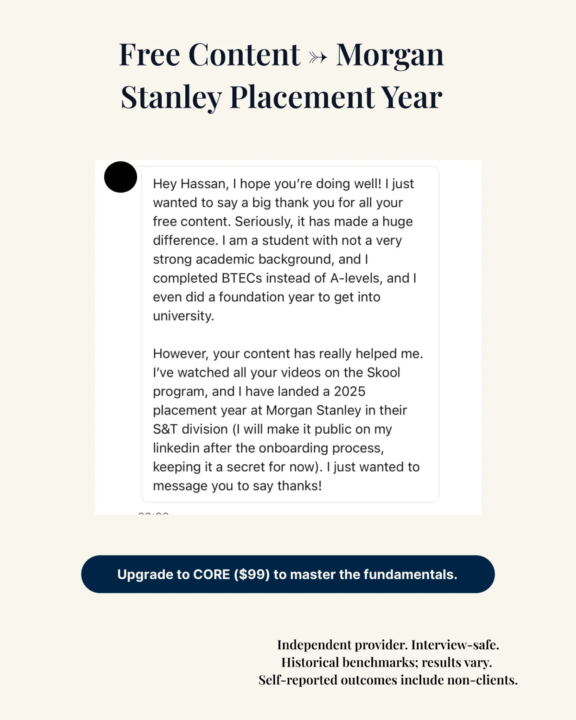

Free Content → Morgan Stanley Placement Year (S&T Division)

Proof that access isn’t the issue — structure is. PROOF: • Secured a Morgan Stanley S&T Placement Year (2025) using free ECS content alone. • Candidate had BTECs + Foundation Year, no A-levels or traditional finance background. • Learned to structure motivation and delivery using PEAL-3™ and STAR-3™ frameworks. METHOD: We train candidates to think and write like future analysts — not applicants. Every framework breaks complex recruiter logic into replicable steps: motivation, delivery, and evidence. — Elite Career Strategy™ — training-only; public facts; no guarantees; interview-safe. This candidate came from a non-traditional academic path — BTECs, foundation year, and no early exposure to finance. After applying the principles taught in ECS free content — structuring answers through PEAL-3™ and building story precision with STAR-3™ — they secured a 2025 Placement Year at Morgan Stanley in Sales & Trading. Proof: When you apply the right method, background stops mattering.

1

0

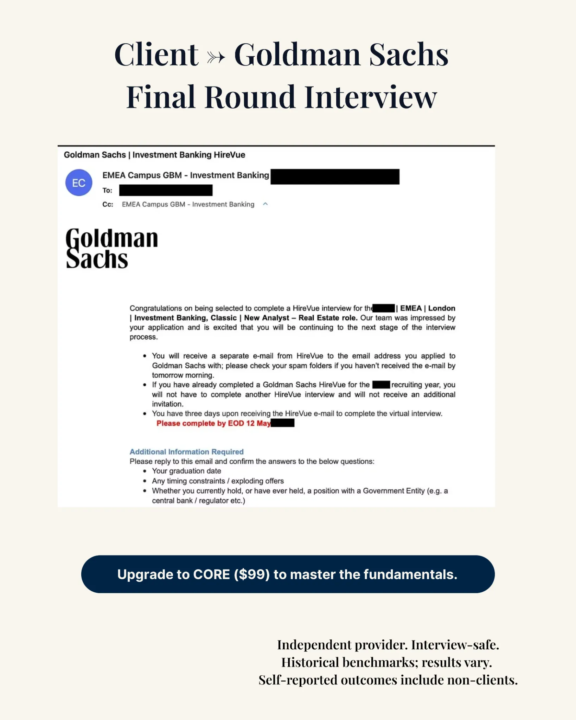

Client → Goldman Sachs Final Round Interview (Investment Banking)

Proof that precision and preparation outperform prestige. PROOF: • 95% offer rate benchmark — under-30 flagship clients targeting IB, Law & PE. • Client advanced to final round for Goldman Sachs Investment Banking (EMEA | London). • Built through VTMR™ CV bullet precision, PEAL-X™ firm-specific motivation, and STAR-3™ interview logic. METHOD: Every answer engineered for commercial fluency — not guesswork. We train clients to think, speak, and write like analysts from day one, combining measurable drills with recruiter logic. Want the same frameworks behind this? Join CORE ($99). — Elite Career Strategy™ — training-only; public facts; no guarantees; interview-safe. This candidate entered from a non-target background with limited finance experience, but mastered the fundamentals that matter — clarity, structure, and deal awareness. By using PEAL-X™ to anchor every motivation answer to Goldman Sachs’ specific mandates and STAR-3™ to deliver concise technical stories, they reached the final round for Investment Banking (Real Estate, London) — a process with sub-1% progression rates. Proof: structure, not connections, drives access to elite firms. --- Join the CORE ECS Skool Community For live breakdowns, offer case studies, and frameworks that have helped under-30 candidates reach final rounds and offers at Goldman Sachs, J.P. Morgan, and Morgan Stanley.

1

0

1-30 of 111

skool.com/elitecareersstrategy

Global experts helping you enter the world's most elite finance careers.

Highest salary @ 21 $180,000 | HF, PE, VC, MBB

Powered by