Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

DeFi University

159 members • $97/m

AI Automation Central

143 members • $47/m

AI Automation Society

207.5k members • Free

Neural Architects

3.3k members • Free

3 contributions to DeFi University

Reducing SUI exposure on NAVI without losing leverage

Hey everyone, I’ve got a NAVI position with SUI as collateral (yep… about one-third got liquidated last Friday 😅). Earlier this week I spoke with David — he mentioned he moved his whole lend/borrow setup on Aave fully into cash. He also gave an example where he borrowed ETH on the borrow side and looped it back into supply to reduce his long ETH deltas. That got me thinking about my own position. I also want to reduce my deltas (SUI exposure) without losing leverage. The tricky part is that NAVI doesn’t have a swap feature on either the collateral or borrow side like Aave does. So if you want to derisk, you have to withdraw → swap → redeposit in smaller steps to keep your health factor stable. Then I thought: instead of looping or borrowing more, what if I just sell part of my SUI collateral for USDC and deposit that USDC as new collateral? That should also reduce my deltas, but with less risk. Below I’ve outlined the main approaches I considered 👇 ⚙️ Base setup SUI = $2.50 Collateral = 1,000 SUI ($2,500) Borrow = $1,000 USDC Starting health factor ≈ 1.5 Starting net worth = $1,500 Now let’s see what happens if SUI goes to $1.50 (bearish) or $3.50 (bullish). ---------------------- 🅰️ Option A – Collateral swap (sell SUI → deposit USDC) You sell 400 SUI ($1,000) and deposit that USDC as collateral. So now you hold 600 SUI ($1,500) + $1,000 USDC = $2,500 total collateral. Borrow stays $1,000 USDC. 📉 If SUI → $1.50 – Collateral ≈ $1,900 – Net worth ≈ $900 (so − $600 vs start) – HF ≈ 1.6 (safer) 📈 If SUI → $3.50 – Collateral ≈ $3,100 – Net worth ≈ $2,100 (+ $600 gain) – HF ≈ 1.8 (still very safe) ✅ Pros – Raises HF and lowers risk – No extra debt or interest – You can later rebuy more SUI if it drops ⚠️ Cons – You give up part of the upside if SUI pumps – Manual rebuy required ---------------------- 🅱️ Option B – Borrow hedge (borrow SUI → sell for USDC) You keep your 1,000 SUI collateral but borrow 400 SUI ($1,000) and sell it for USDC.

0 likes • Oct 23

@Kevin Banet Hi Kevin, you're a little bit hedged with 17% SUI on the borrow site, because if SUI drops, your SUI borrow will drop as well, but that probably isn't enough in case of a big drop. You cannot put in your exact situation in the Claude simulator, as you cannot add multiple different assets on the lend and/or borrow side. Do you have 100% SUI on the lend side? Best thing you can do to lower your LTV is to repay some of that USDC on the borrow side with dry powder. If you don't have extra USDC, then you could do what I did: You could withdraw some of that SUI on the lend side (make sure your health factor stays safe), then swap that for USDC and resupply that USDC on the lend side. This way your lend value will not drop as much when SUI drops. It won't reduce your LTV, but it will make it more stable. So your LTV won't drop as fast if SUI drops. You have to do this in chunks, making sure you health factor won't go close to 1. Even if it's only for a few minutes, make sure it doesn't go lower than 1.3 or something. You could do this untill your lend is 100% USDC, and then you kept your leverage, but your not exposed to the price of SUI on the lend side. If you think SUI is going to drop, you are even short then, becuase of the 17% SUI on the borrow side.

Welcome to DeFi U!

Hello everyone and welcome. As we begin building out DeFi University together, please know that any ideas you may have for a new tool, a new live call, a new course, anything that you'd like to build or incorporate in to add more value for us, the community members, that is 100% a yes here. This community is AI first, which simply means that we learn together how to use AI tools to build what will generate more value for us, the community members. We hope to foster an environment of learning and growth in many different areas of life within our DeFi University community, and now with these new AI tools any suggestion that any member has which will add value can quickly be built out and incorporated in. It's a very exciting and transformative time that we live in. To foster a sense of community spirit, please introduce yourself in the general chat as you join, and share a bit about yourself so that we can all get to know one another better. Live calls in the community take place every day Monday through Friday and they are open to all members. See you on the next live call and in the DeFi U chats! -David

9 likes • Jul 14

Hi everyone! 👋My name is Wesley, I'm a web entrepreneur from the Netherlands currently living in Belgium. I've been building websites and running digital marketing campaigns for over 15 years, but over the past years I've shifted my focus more and more toward DeFi. I’m actively investing, experimenting with strategies like LPs, lending/borrowing, and trading. I’m especially interested in capital efficiency, automation, and building systems that can generate passive income. Excited to learn, grow, and share insights with you all here in DeFi Skool!

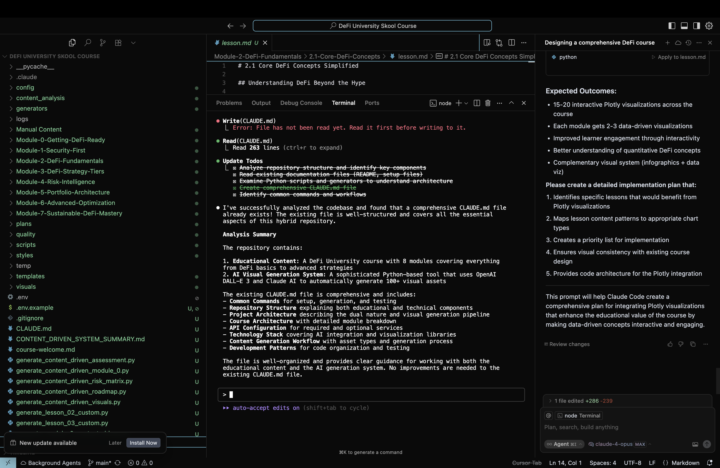

Building a DeFi Course with Cursor and Claude Code

In the spirit of building in public, I'd like to share a little bit about the tools that I have been using to build DeFi U, and which honestly could be used to build just about anything you can think of. I'll take a screenshot of Cursor and feed it to Claude then highlight how I use these tools together. That is a good starting point. I used Grok 4 Heavy to analyze the screenshot and generate this overview of my AI assisted workflow, then I fed that overview to Claude 4 Sonnet to improve the formatting of the content so that us humans can more easily read through it. Markdown format is kinda straining for the eye. DeFi University Course Development Workspace 🏗️ Workspace Layout Overview 📁 Project Sidebar (Left Panel) The left sidebar displays the hierarchical folder structure of the DeFi University Skool Course project: Course Modules: • Module-0-Getting-DeFi-Ready • Module-1 through Module-7-Sustainable-DeFi-Mastery Supporting Directories: • plans/ - Project planning documents • scripts/ - Automation scripts • templates/ - Content templates Key Files: • CLAUDE.md - AI integration documentation • generate_content_driven_module_0.py - Python content generators This systematic organization enables efficient navigation and AI-assisted content generation for each module. 📑 Editor Tabs (Top of Main Area) Multiple active tabs facilitate seamless content switching: Currently Active: • lesson.md - Located in Module-2-DeFi-Fundamentals > 2.1-Core-DeFi-Concepts Background Tabs: • DeFi University Skool Course - Project overview • Additional lesson files This setup allows rapid switching between editing lesson content and project management, with Claude integration assisting in markdown content generation and refinement. ✏️ Main Editor Content (Central Pane) The central editor displays the active lesson content: Current File: lesson.md Section: # 2.1 Core DeFi Concepts Simplified Available Panels:

1-3 of 3

@wesley-nooijens-7538

Web entrepreneur & DeFi enthusiast exploring LPs, automation & yield strategies. Based in BE & NL

Active 22d ago

Joined Jul 11, 2025

Oisterwijk, The Netherlands

Powered by