Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

ConstruPRO

350 members • Free

Making Money in Construction

275 members • $95/month

The AI Construction Academy

121 members • Free

ConstructionX AI Hub

139 members • Free

Herman Homestead

45 members • Free

Off Grid Academy

36 members • Free

Off Grid Only Collective

72 members • Free

The Off Grid Collective

298 members • Free

CG Python Academy (Free)

1.1k members • Free

18 contributions to Energy Economics & Finance

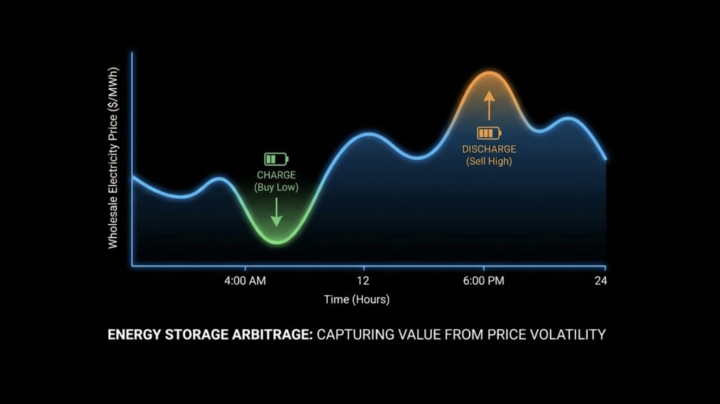

Energy Storage Arbitrage: 2 common Interview Questions

A new online course is being prepared about Energy Storage Trading using optimisation, machine learning (including reinforcement learning) , beginner-friendly ( no prerequisites ). This course will explain what energy storage trading is, what energy storage arbitrage is, etc - also all developed in Python. This is a topic that all energy companies are interested in, so there is very high probability that a relevant interview question will be asked . Even if you're not looking for jobs at the moment, you may look soon, so it is definitely useful to know this terminology. Here are two common interview questions: Interview Question1: What do we mean by Energy Storage Arbitrage? Interview Question2: What is the difference between Financial Arbitrage and Energy Storage Arbitrage? ================== Answer to Question1: It is when an Energy Storage unit buys electricity when the electricity price is low, and sells it when the electricity price is high. This operation generates economic profit by exploiting this price volatility over the course of a day, as shown in the attached slide. Answer to Question 2: The main difference is between space and time. Financial arbitrage exploits price differences between two different locations (e.g. New York and London) at the same moment (i.e. we buy a financial asset in New York and immediately we sell the same asset in London at a slightly higher price e.g. $100 versus $100.1 ). While Energy Storage arbitrage exploits price differences at different times within the same location (electricity market) e.g. the same storage unit (same location) buys electricity when its price is low, and sells it when the price is high. VIDEOS: Also, in the Classroom/6.3 I have uploaded 2 videos, each for these two questions (they provide some extra analysis). These two videos will also be part of the new course (in a few days).

New Report on Hydrogen

A new report on energy trends has been published and can be found by clicking on ‘Classroom’ and navigating to Section 6.2 (see the attached screenshot). You can use this report and the visualisations it includes, in your own projects, work, or studies, without limits. This report explains the progress for the UK’s hydrogen rollout. The report includes diagrams and flowcharts that provide context, and also a list of relevant sources that were used to complete this report. These sources are from the Financial Times, Wall Street Journal, the Economist and Investors Chronicle (all sources are available inside the report). Your subscription in this Skool community gives you access to paywalled energy-economics articles from these publications (Financial Times etc) indirectly through these reports. I have also included some explanations and additional text that explains some details. The text is written in beginner-friendly, easy-to-understand language. Reading these reports can help with interviews, meetings, presentations, networking, and public speaking. Strongly recommended.

Energy is a business as any other

Thank you for allowing me here, in your group. It is a pleasure to be here. I might be a bit away from the scientists. However, energy is a business as any other, and therefore, we can´t hide behind the "better future" phrases. The main interest of the market players is either to earn or save money. And that´s exactly where my mission starts.

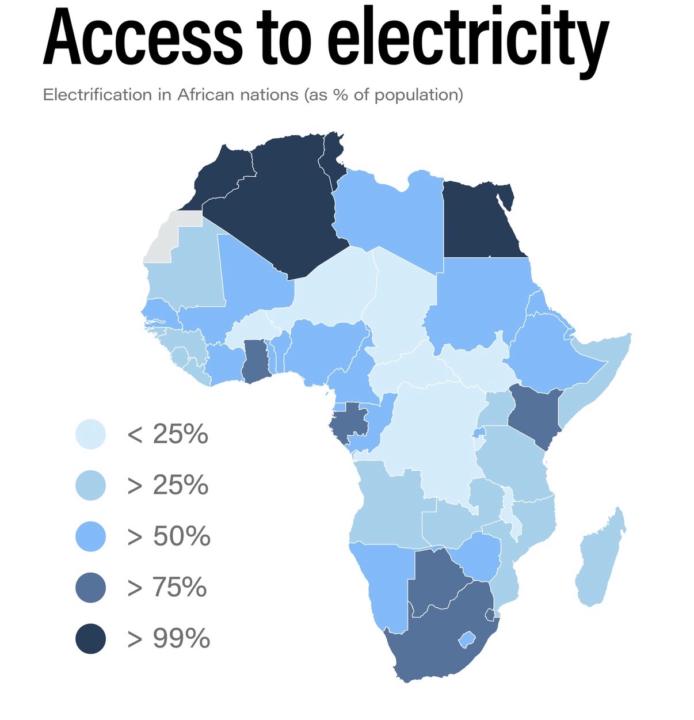

Access to Electricity in Africa

The attached plot shows the level of electricity in Africa. How best can it increase? using smart grids? micrograms?

Data Mining for Energy

Since linear and logistic regression are supervised models and are frequently used for exploratory analysis in data mining, would it be accurate to say that the distinction between data mining and machine learning is primarily methodological (discovery vs prediction) rather than algorithmic? Please feel free to share any experiences choosing to use data mining for Energy or any other industry.

1-10 of 18

Active 3d ago

Joined Oct 14, 2025

ESFP

HK