Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

8 contributions to StorageAce

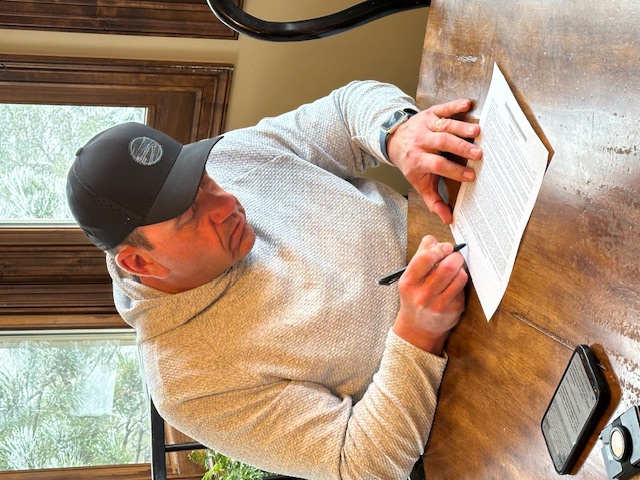

Deal #8 is in the books...

Just wrapped up an incredible week in Florida at a self-storage mastermind—packed with learning, leveling up, and some well-earned fun. And to top it all off…I signed and wired the funds for deal #8. 🙌 This community is built around winning on purpose. Living life on our terms. And it all starts with a decision—to show up, to do the work, and to keep going when it’s not convenient. This latest deal? It didn’t happen because I’m some self-storage guru. It happened because I committed to a simple process, stuck with it, and showed up daily. It was off-market. I lost it. Then I won it back—because I didn’t quit. That’s the power of consistency. If you’re in the grind right now… keep going. Because when you do the work—day in, day out—good things stack up.The results come. The momentum builds.And before you know it, you’re living a life you once only imagined. Let’s keep winning. 💪

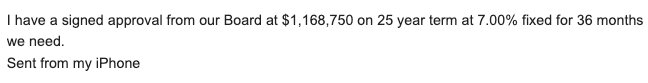

$1,168,750 Loan approved by the bank! BOOM

If you have been following my journey to purchasing facility #8, you know it's been smooth and easy until it wasn't. However, belief, process, and having a plan typically lead to good outcomes. Here is the email I just got from my lender. This is a small local bank, which I find is much more flexible and easy to work with - but might move a little slower (I am on with that). If I want to accept this, its 15% down (helps cash flow), 7% for 3 years (might push for 5), and 25 year AM (love it). Do you have a plan? Do you have well-thought-out processes and next steps to build your self-storage empire? If you are stuck, don't know how to start, or what a good deal looks like, we should see if I can help. Here is a link to my calendar for you to schedule a quick 1:1 to brainstorm and see if I can help. https://scheduler.zoom.us/dave-d-zxgzv2/triage

🚀 Looking for Off-Market Storage Deals? 🚀

A great friend of mine in the self-storage world, Scott Speer, is not only a powerhouse investor but also sources and wholesales incredible deals from time to time. If you're serious about finding quality self-storage opportunities, you’ll want to be on his buyers list! 💡 This isn’t some spammy list filled with junk deals. Scott is the real deal—he’s a straight shooter, and if you bring the right deal, he might even partner with you as a money investor. Plus, for those just getting started, his wholesale opportunities can be a game-changer. 📩 Get on the list now:👉 BUYERS LIST P.S. There’s nothing in this for me—just paying it forward and helping you get one step closer to time freedom and financial independence through investing in metal garages! 🔥💰

New Live Case Study Update: The Battle of the Banks & Owner Challenges

Hey Acers – the latest Live Case Study recording has been uploaded! If you're following along as I navigate the purchase of my 8th storage facility, you won’t want to miss this one. This week, I break down the Battle of the Banks—the back-and-forth struggle to lock in the right financing and the hurdles that come with it. I also dive into the challenges with the owners, the sticking points in negotiations, and the unexpected roadblocks that have surfaced. And as we get closer to closing, I can already see the wave of work ahead—getting this facility dialed into my process, optimizing operations, and setting it up for success. If you’re new here, this case study gives you a real-time look at what it actually takes to buy and take over a storage facility—the wins, the struggles, and the strategy behind it all. Check out the latest update here! 🚀

Looking for the Right Markets to Buy Your First Deal? This report will help.

Hello Acers, As you build towards your first self-storage investment, you’re stepping into a market with some exciting opportunities. I’ve been diving into the latest Storable Self-Storage Outlook Guide, and I want to share some nuggets that could help you focus your efforts on the right deal in the right market. TLDR; Here are some insights: ~ Relocation Trends Are Your Compass: Right now, 37% of Americans are planning or considering a move in the next 6–12 months, and 40% of movers are heading to the South (think Texas, Florida, North Carolina, Georgia). These states offer lower costs of living and job market growth, making them hotspots for relocation—and for storage demand. ~ Understand Your Audience: The 25–44 age group is the most likely to move and use storage. This demographic is typically drawn to areas with strong economic opportunities and affordable housing. If you're evaluating potential markets, consider targeting regions with growing populations in this age range. ~ Short-Term Storage Demand Is Booming: Around 73% of self-storage users need units for 6 months or less, largely driven by relocations. As a first-time investor, consider properties in markets with high population mobility, and ensure your facility offers flexible rental terms to meet this demand. ~ Price Sensitivity and Value: Price remains the #1 factor for customers selecting a storage facility, with location and security following close behind. This means that investing in a well-located property near residential areas or highways and maintaining competitive pricing can significantly boost your chances of success. ~ The South = Growth Potential: With the South dominating relocation preferences, this region offers an excellent starting point for finding your first deal. Look for opportunities in suburban markets near growing cities, where demand for storage is expected to spike. These trends are a perfect storm for new investors, helping you zero in on high-demand areas and set your strategy for success. Take a few minutes to check out the full report (attached) to dig deeper into these insights and see where the opportunities are growing.

1-8 of 8

@tom-meunier-1428

Started my self-storage journey about three years ago. Currently an equity investor in five self-storage facilities located in MS and OR.

Active 5h ago

Joined Nov 16, 2024

Powered by