Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

ConstruPRO

350 members • Free

Data Career Network

103 members • Free

69 𝓒𝓸𝓶𝓮 𝓐𝓵𝓲𝓿𝓮 💖

71 members • Free

🇪🇪 Skool IRL: Estonia

57 members • Free

SQL Answers - Data & AI

211 members • Free

Everyday Analysts Hub

126 members • Free

Python Developers

1k members • Free

Data Innovators Exchange

649 members • Free

Data Source

821 members • Free

47 contributions to Energy Economics & Finance

A common interview question: Mean Reversion

No need to know quantitative finance to answer this question. I am attaching a presentation of 3 slides . A very common interview question in Energy (not only energy finance) is about the electricity price and its characteristics, one of which is 'mean reversion' . Such an interview question is when you apply for roles like the following. I also show company names. - Energy Quantitative Analyst (Vitol, BP, Shell, Citadel, Millennium, RWE, Statkraft) - Power / Gas Trader (Mercuria, TotalEnergies, EDF, Goldman Sachs, JP Morgan, Morgan Stanley) - Energy Structurer / Originator (Engie, Vattenfall, Macquarie, D.E. Shaw, DRW, ExxonMobil) - Market Risk Analyst (Uniper, Centrica, J.P. Morgan, Barclays) - Data Scientist - Commodities (Freepoint Commodities, Castleton Commodities, Koch Industries) If you look at a graph for the electricity price, for every hour of the year you will see them fluctuating, spiking high during sudden shortages or dropping low during excess electricity supply. However, the price always snaps back to a central equilibrium level (mean). So it 'reverts' back to the mean. So the price fluctuates wildly but it is always being pulled back toward its seasonal trend line. This trend line (mean) is not a flat / horizontal line; but it also fluctuates , but slowly, throughout the year due to seasonal demand . So in the interview question they show a plot of the electricity price. Just like the one attached. They ask you to explain where mean reversion is and why it happens. Click below to download the presentation . By the way, there are many mathematical models to describe this behavior. We will see them all in Python. The most common is called "Ornstein-Uhlenbeck" model. It is used by all quantitative analysts. Another one , more realistic version, is the Mean-Reverting Jump Diffusion model. You can just know the name of these models. Nothing more. We will see the code and theory later.

Interview Questions (Since October 2025)

The goal of this community is to help you secure jobs across the wider energy sector. That includes: - Major Energy Firms (Trading houses, Utilities, Oil & Gas). - Non-Energy Firms that manage their own energy assets or investments. - Academia (PhD applications and research roles). I have compiled a list of recent questions that candidates have faced in interview stages mostly between October 2025 and January 2026 ( retrieved from student databases ). You can also see below the company they were applying to. When reading these questions we need to ask ourselves: "Could I answer this question under pressure (with maybe 1 minute of thinking)"? Also, my answers to each question are in Classroom 6.3 compiled in the form of a PDF file. This PDF file has 5 more questions included as well (and answers). 1. Energy Quant (Power/Gas) - BP: “Walk me through a forward-curve model you would use for power or gas. How do you handle seasonality, mean reversion, and spikes?” - Shell Energy Trading: “Design a risk framework for an options book on power. Which metrics would you report daily, and how would you stress test extreme events?” 2. Energy Trader - TotalEnergies: “Explain the spark spread and how it links fuel prices, heat rate, and power prices. When does a plant dispatch?” - Trafigura: “You have a short physical position for next month. How would you hedge it with futures, swaps, and optionality, and what basis risks remain?” 3. Electricity Market Analyst (ISO/Utility) - National Grid ESO: “Explain Locational Marginal Pricing (LMP): what are its components, and what data does the market-clearing optimization need?” - EPRI: “How would you build a day-ahead load forecast and quantify uncertainty? Which error metrics matter most for operations?” 4. Project Finance Analyst - Macquarie: “Define DSCR and explain how it drives debt sizing. What DSCR range would you expect for a contracted wind or solar project?”

Research paper: Machine Learning for Solar Energy Economy

Few professionals in energy also read research publications. There are over 200 such analysis in sections 6.1 and 6.4 in the Classroom. Below is a popular paper connecting solar PV economics, machine learning and energy storage. Below there is also a brief summary. Scroll down to download it. - Title: Optimizing distributed solar energy economics: A machine learning classification approach to storage system management - Citation: Wenhui, L., Li, H., Laghari, M. A., Guliyeva, S., Amonova, N., & Yuan, H. (2025). Optimizing distributed solar energy economics: A machine learning classification approach to storage system management. Case Studies in Thermal Engineering, 75, 107106. https://doi.org/10.1016/j.csite.2025.107106 - Downloadable resource is attached below Key Points: Solar energy is a clean resource, but it faces a major challenge because the sun does not shine consistently. This makes it difficult to match the amount of electricity generated with the amount people need to use. Batteries are used to store extra energy for later, but they are expensive and can wear out if used incorrectly. Traditional methods for managing this storage often fail to look at both the technical needs and the financial costs at the same time. The researchers in this study developed a new method to solve these problems using a type of artificial intelligence called K-Nearest Neighbors or KNN. This is a classification tool that looks at past examples to decide what to do in the current situation. Instead of only focusing on the technical side of things, this new system includes economic factors. It helps the system decide the best times to charge or discharge the battery to save the most money. The study uses a concept called entransy dissipation theory alongside the computer model. This is a physics principle that measures the loss of energy quality during transfer processes. By using this theory, the system ensures that energy is not just stored, but is kept at a high quality. This approach balances the need to save energy quantity with the need to maintain its usefulness, which helps in reducing the overall costs of running the system.

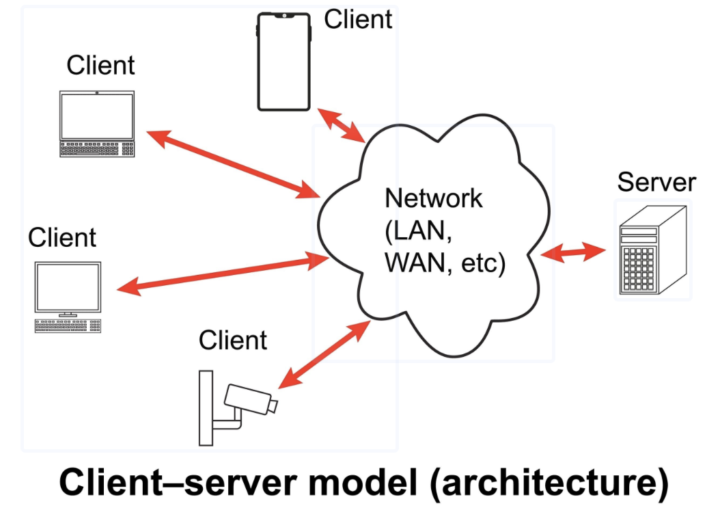

New Online Course: Download energy data through API

A new online course is ready, with its full Python code available to download and explained. It is in the Classroom --> 1.37. It is called "1.37. Download Electricity Market Data Via API". You will learn to build, in Python, a tool that asks the user for a date range and specific electricity generation units , and downloads the data instantly, and saves it in a multi-sheet Excel workbook. All the code is in Python and fully available for you to download. You can integrate it in your project easily. For example if you have a Machine Learning (or optimisation) model, you can integrate this code in this model. So with this code you will pull real-time data, and then pass them as inputs to your model. Or this can be used as part of an Algorithmic Trading model. By automating the retrieval of real-time signals like System Prices and grid actions, you provide the raw fuel your AI needs to train, backtest strategies, and predict market movements. This is the Client- Server software architecture. Our Python code is the "client" who asks for data. And the 'Server' is the computer (remote) where we connect and request electricity data to download. We connect to the server of the company "Elexon", which is in Great Britain. Think of the electricity grid in Great Britain as a marketplace. Elexon is the independent referee. Elexon doesn't generate electricity, and they don't sell it to your house. Their job is to make sure the "books balance" at the end of the day. If a power plant promised to generate 100MW but only generated 90MW, Elexon is the one who calculates the penalty. The "Server" we connect to is their public library of everything that happened on the grid: who generated what, when, and how much it cost. You can find more about Elexon on their website at : https://www.elexon.co.uk You can view electricity data on their portal which is called "Insights Solution" and it is at https://bmrs.elexon.co.uk .

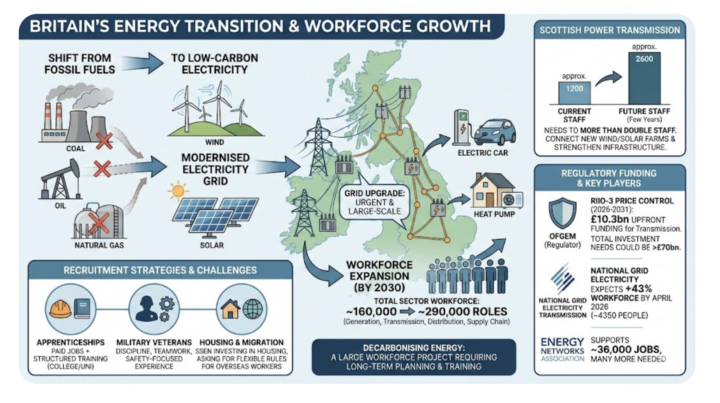

Careers: Massive Hiring in the UK Energy Sector

In the United Kingdom, the electricity grid is under urgent modernization. As a result a massive hiring boom is happening, with the sector workforce expected to grow significantly over the next years. Backed by billions in funding approved , major electricity grid operators like Scottish Power and National Grid are rapidly expanding but face a shortage of experienced staff! There has never been a more critical or lucrative time to join the energy sector. This massive hiring growth is a global phenomenon, driven by the urgent, worldwide transition to decarbonisation. As demand skyrockets and the industry faces a talent shortage, the barrier to entry has hit historic lows. The right time is now to pivot into a field that offers not just high pay, but long-term stability and the chance to work anywhere on the planet. To guarantee a role in any country within six months, focus on the industry’s most valuable intersection: energy and analytics. By learning Data Science, Machine Learning, and Optimisation specifically for energy, you enter a niche where skilled professionals are so scarce that securing a job often takes just one to five interviews! You can find everything you need to master these high-demand skills in the Classroom, which offers over 100 specialized courses designed to fast-track your career. Attached is a screenshot that illustrates the situation in the power grid sector in the United Kingdom. A detailed report on this topic has been added in Classroom section 6.3 (career support). Sources: 1. Financial Times: https://www.ft.com/content/281a5a46-b1a6-4ba3-868f-4745a0d2e1b0? 2. Investors' Chronicle: https://www.investorschronicle.co.uk/content/d0ecf236-45f5-4ca2-a897-c6533fc8d3ba? 3. Wall Street Journal: https://www.wsj.com/business/energy-oil/britain-pushed-ahead-with-green-power-its-grid-cant-handle-it-b674c413? 4. The Economist: https://www.economist.com/business/2025/01/05/a-new-electricity-supercycle-is-under-way

1-10 of 47

@paul-e-adams-phd-8694

MEng. Aiming for PhD. Software Engineering

Active 3d ago

Joined Sep 13, 2025

ESFJ

Wales