Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

The MHP Pros Mastermind

110 members • $99/month

Mobile Home Park Mastermind

650 members • Free

23 contributions to The MHP Pros Mastermind

chat GPT

You should really consider trading your Netflix subscription for a GPT subscription.

Q3 2025 Manufactured Housing Report

REITs are posting strong numbers. Rents are up. Occupancy is tight. Investor appetite is steady, but disciplined. 📍 What’s happening: – ELS pushing 5.1% rent hikes for 2026 – Sun Communities hitting 98% occupancy and $457M in new acquisitions – UMH expanding aggressively with 321 new sites and double-digit NOI growth – Financing is available, but only for the best: 5.25–5.75% rates, ~65% LTV Even with home sales cooling, the big players are leaning into infill, operational gains, and long-term demand. The playbook is clear: buy scale, push rents, control costs. 🧠 If you’re not watching how the REITs are moving, you’re missing the

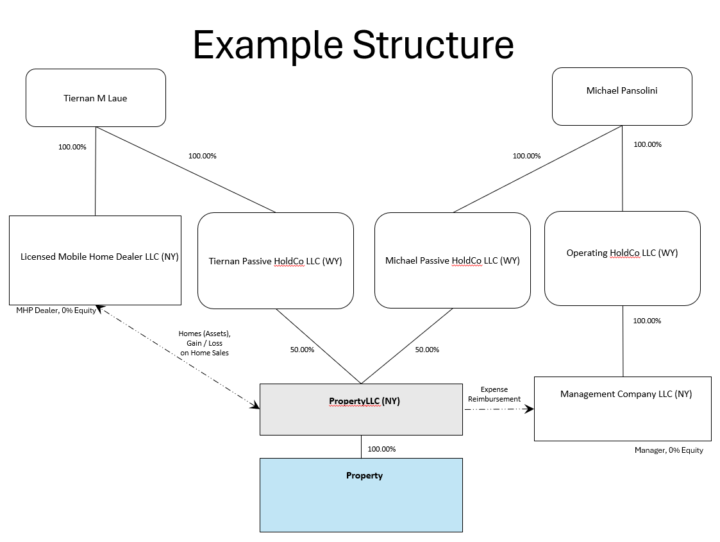

Example Structure of our Latest Investment

@Tiernan Laue and I structured our latest investment as follows, for those interested. The HoldCo for Operating companies is a separate step I took that I'm not sure is entirely necessary but I wanted an extra layer of anonymity and protection between my OpCos and my Operating Entities. Everything else is pretty standard. As you can see by the dotted lines, there is no ownership of the property LLC by the Mobile Home Dealer Entity OR the Property Management Company entity. These are fireable entities - ultimately we could hire other dealers / property managers other than ourselves to replace those roles.

1 like • 18d

Yeah, the guy I learned it from was Mark Warda. He actually sat on The Board of State of Florida fir land trust law committee and wrote several of the land. Trust books, the Illinois land trust and land trust in Florida along with personal property. Trust Joe SEGAL in Florida now took over his firm with aspire legal, and he can actually set these entities up for you. Feed could probably do the same but if you're in Florida, Joe SEGAL does it as well there's several attorneys who actually do this. I know a lot of investors who will use individuals to be trustees. I have seen where other people have made huge mistakes or told somebody who the beneficiaries were of a trust that sort of thing but in Florida that's how I have my stuff structured everything is hidden. I've dropped my own land, trust and personal property trust but I've had them done by attorneys in the past and if you're not familiar with how to do that, I highly recommend paying a pro to do it.

Finding sellers

Some of the old school ways of finding mom n pop owners still work! When I say old school I mean 10 years ago LOL.

Land Investor in SC - Chicago Based

Hey Everyone - My name is Nick. I’ve been investing in real estate on side of my tech sales job for the last 4 years but now at the point where I’m ready to go full time. My primary active income in real estate is land investing in the Carolinas. What we’ve noticed in the last two years is the majority of the land we pick up goes to a homesteader, manufacture home builder or modular home builder. I’m looking to put more of my active income to work and MHPs or RV parks have been on my radar. I currently manage a small multifamily property in Chicago and I’d rather avoid that asset class moving forward. HOAs sucks 😂 Outside of that I’m an integrator at heart so if you’re looking for anything operations related let me know. Gohighlevel is your best friend as an entrepreneur. Their new Ai employees are a life saver!

1-10 of 23

Active 32m ago

Joined Dec 1, 2025

Tampa, Florida

Powered by