Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

AOC Blueprint

153 members • Free

DeFi University

194 members • Free

7 contributions to DeFi University

Aerodrome's front end maybe compromised. Stay safe

https://x.com/AerodromeFi/status/1992073060615377291?t=4iERrN1Gn-X2AFUCgK653g&s=19 Aerodrome's front end maybe compromised. Stay safe

3

0

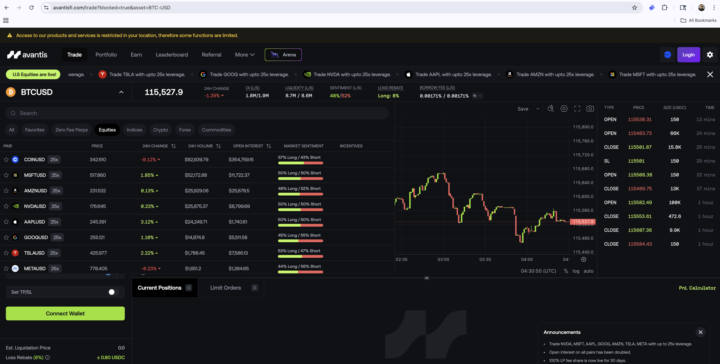

Tech Stocks Meet DeFi - AVANTIS Protocol

Just spotted something that's got me excited about the future of DeFi - AVANTIS Protocol just launched and you can now trade Microsoft, Tesla, Apple and other major stocks directly on crypto rails! Here's what's happening: - Traditional equities are now tradeable on-chain through AVANTIS - Low liquidity right now (early protocol = early opportunity) - This is exactly the kind of innovation DeFi needs to reach mass adoption We're witnessing the convergence of TradFi and DeFi in real-time. No more switching between your crypto portfolio and stock broker. Everything under one roof, with the transparency and composability of blockchain. QUESTION: Would you prefer trading Apple, Tesla, and Microsoft on DeFi protocols or traditional finance platforms?

Black Monday 1987: The Day Markets Lost Their Mind 🚨 (video)

The Crash That Changed Everything October 19, 1987 - a date that still sends shivers down Wall Street's spine. In a single trading session, the Dow Jones plummeted an astounding 22.6%, wiping out over $500 billion in market value. To put this in perspective, this was the largest one-day percentage decline in U.S. stock market history What makes Black Monday particularly relevant for today's DeFi community is how automated trading systems became the villain of the story. The crash revealed the dangerous role of financial and technological innovation in amplifying market volatility. Sound familiar? Portfolio insurance strategies - the 1987 equivalent of today's algorithmic trading - were designed to automatically sell S&P 500 futures when stock prices declined. Instead of protecting investors, these systems created a devastating domino effect. As stock prices fell, more automated selling kicked in, which drove prices down further, triggering even more selling. Lessons That Echo in DeFi Today The crash taught us that highly improbable events can happen, and they happen all the time. This is especially relevant in DeFi, where smart contracts and automated protocols can amplify both gains and losses. Key takeaways for DeFi Operators: - Circuit breakers matter: The crash led to trading halts that are still used today - Interconnected systems amplify risk: When everything is automated and connected, small problems become big ones fast - "Buy the dip" worked: Those who rebalanced and bought during the crash likely did very well The Silver Lining Unlike today's prolonged bear markets, the 1987 crash was remarkably short-lived. The Dow had recovered 288 points of its 508-point loss within just a few trading days, and by September 1989, the market had recouped virtually all losses. The bottom line? Even the most sophisticated risk management tools can backfire spectacularly. As we build the future of finance in DeFi, Black Monday reminds us that with great automation comes great responsibility. 📈⚡

Goals vs System

I thought that today's Defi Alpha call was very revealing for me. When I entered Defi, I was always asked, "What's your goal?", and I always approached it from that angle. In hindsight, I think this was counter-productive because I was always hoping and waiting., and ultimately would be disappointed. A systems first approach would definitely have created a more disciplined environment in which I could realistically set some goals.

🔄 Market Rotations: Alt Season is Nigh!

Hey everyone! Just to share some crucial insights about the rotations happening right now in crypto. The Rotation Playbook is Unfolding 📊 We're witnessing a textbook rotation pattern: 1. First Rotation: Bitcoin → Ethereum ✅ (Already in motion) 2. Second Rotation: Ethereum → Solana & Large Cap Alts ✅ (Happening NOW) Key Charts to Watch 👀 Total3 (Total Market Cap ex-BTC & ETH) - Just hit a fresh all-time high today! - Haven't held these levels yet, but this is a bullish signal for altcoins - Keep an eye on this through the rest of the month Solana Breaking Out 🚀 - Beautiful breakout to $253.50 (high of the day) - More importantly: SOL/ETH and SOL/BTC charts showing clear outperformance - This is the rotation in action - money flowing from ETH and BTC into SOL ETH/BTC Still Bullish 📈 - Current pattern: Beautiful weekly bull flag - Target: 0.055 (where the 200-week MA sits) - Expected timeframe: Next several months through year-end Bitcoin Dominance Confirmation ✔️ Bitcoin dominance is pushing lower, confirming these rotations are real. This is your classic alt season setup! The Alt Season Reality Check 🎯 Yes, although we may be in alt season NOW, here's what we haven't seen yet: - No blow-off tops - No +20-50% daily moves for weeks on end - No extreme exuberance in the market Translation: We're still early in this alt season cycle. The real fireworks haven't started yet. Action Items - Monitor Total3 for continuation to print some fresh ATH's - Watch SOL/ETH and SOL/BTC for rotation confirmation - Keep an eye on that ETH/BTC bull flag for breakout - Position accordingly - the rotation is happening but we're not at peak euphoria yet What are you all seeing in your portfolios? Anyone else noticing these rotations in other large caps? Let's discuss below! 👇 Remember: This is market analysis, not financial advice. Always DYOR and manage your risk!

1-7 of 7