Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

The DIY Engineering Club

2.5k members • Free

Mechanical Engineering Mastery

273 members • Free

Engineers Can Talk

102 members • Free

Lots Of Projects

144 members • Free

Engineering Entrepreneurs

95 members • Free

AI Automation Society

250.1k members • Free

Software Engineering

608 members • Free

Data Alchemy

37.9k members • Free

Hire Horizon | Job Search

2.1k members • Free

37 contributions to Energy Economics & Finance

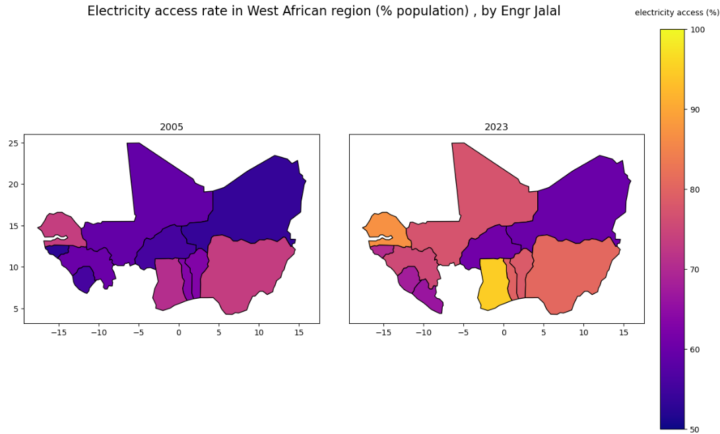

Electricity Access in West Africa: 2005 → 2023

This weekend I visualized how electricity access has changed across West Africa over the last 18 years — and the progress is striking, though uneven. Ghana – Near-universal access. A regional benchmark. Côte d’Ivoire – Strong, consistent growth into the top tier. Nigeria – Big improvement, but population size keeps the gap wide. Senegal – Solid gains driven by energy reforms. Mali & Burkina Faso – Progress, but still constrained by infrastructure. Niger – Improvement visible, yet access remains very low. Sierra Leone & Liberia – Large relative gains from low starting points. West Africa is advancing — but where you live still determines whether you have power. I’m excited to continue exploring how data can drive better decisions in energy, development, and policy. Which country’s progress surprised you the most? Data source: World Bank

Energy is a business as any other

Thank you for allowing me here, in your group. It is a pleasure to be here. I might be a bit away from the scientists. However, energy is a business as any other, and therefore, we can´t hide behind the "better future" phrases. The main interest of the market players is either to earn or save money. And that´s exactly where my mission starts.

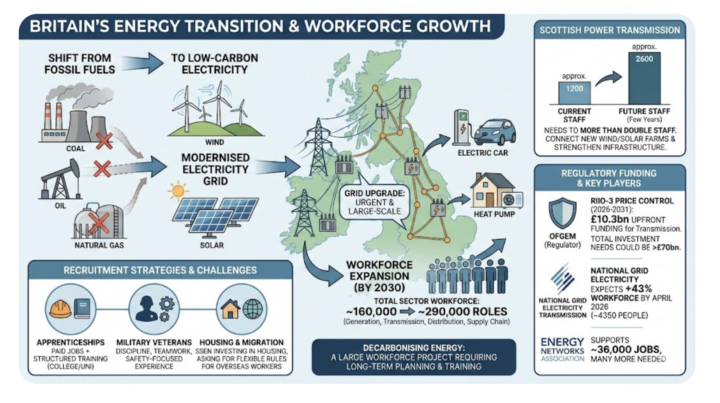

Careers: Massive Hiring in the UK Energy Sector

In the United Kingdom, the electricity grid is under urgent modernization. As a result a massive hiring boom is happening, with the sector workforce expected to grow significantly over the next years. Backed by billions in funding approved , major electricity grid operators like Scottish Power and National Grid are rapidly expanding but face a shortage of experienced staff! There has never been a more critical or lucrative time to join the energy sector. This massive hiring growth is a global phenomenon, driven by the urgent, worldwide transition to decarbonisation. As demand skyrockets and the industry faces a talent shortage, the barrier to entry has hit historic lows. The right time is now to pivot into a field that offers not just high pay, but long-term stability and the chance to work anywhere on the planet. To guarantee a role in any country within six months, focus on the industry’s most valuable intersection: energy and analytics. By learning Data Science, Machine Learning, and Optimisation specifically for energy, you enter a niche where skilled professionals are so scarce that securing a job often takes just one to five interviews! You can find everything you need to master these high-demand skills in the Classroom, which offers over 100 specialized courses designed to fast-track your career. Attached is a screenshot that illustrates the situation in the power grid sector in the United Kingdom. A detailed report on this topic has been added in Classroom section 6.3 (career support). Sources: 1. Financial Times: https://www.ft.com/content/281a5a46-b1a6-4ba3-868f-4745a0d2e1b0? 2. Investors' Chronicle: https://www.investorschronicle.co.uk/content/d0ecf236-45f5-4ca2-a897-c6533fc8d3ba? 3. Wall Street Journal: https://www.wsj.com/business/energy-oil/britain-pushed-ahead-with-green-power-its-grid-cant-handle-it-b674c413? 4. The Economist: https://www.economist.com/business/2025/01/05/a-new-electricity-supercycle-is-under-way

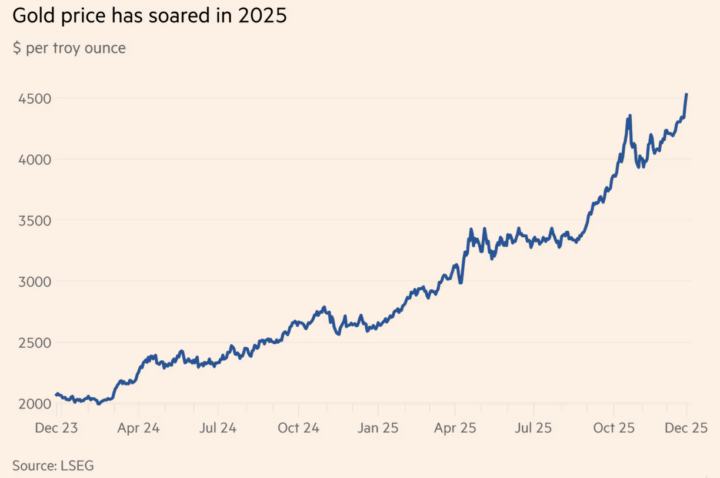

Why the Price of Gold increased in 2025

In 2025 the prices of gold and silver rose fast and reached new records. Because of this, many banks and trading firms hired more staff, and expanded their trading so they can earn more money from gold/silver related trading and services. These price increases occurred due to macroeconomic and geopolitical reasons. See the attached image (source : LSEG). A new analysis on this topic has been uploaded in Classroom --> 6.2. By the way, the analysis has been compiled using the sources below , along with some extra comments I have added. These sources below, such as the Financial Times, Bloomberg, Wall Street Journal, the Economist etc, all request you to subscribe to read their articles. I am subscribed to all of them, and so there is no need for you to subscribe also because I am bringing you the most interesting articles on energy-economics and energy - finance, including my own comments and all re-written in simple beginner-friendly accessible language. Also, they all come with my support which means if you have any questions regarding the content of these reports, you can message me! Sources: [1]: Financial Times: https://www.ft.com/content/ae214919-1617-48fa-8f0d-7734f5c98e72 [2]: Bloomberg: https://www.bloomberg.com/news/articles/2025-10-26/gold-trader-hiring-spree-drives-up-pay-as-bullion-market-booms? [3]: Wall Street Journal: https://www.wsj.com/finance/commodities-futures/a-new-wall-street-trade-is-powering-gold-and-hitting-currencies-62a61fdb?gaa_at=eafs&gaa_n=AWEtsqfhN3SK_q3Urvm-i_8Nsla_Bl-lOBBSs2p5R1c6uzTNsebYGJ6F2n3l&gaa_sig=epeZAbrguUmRTBAsQ6PG28zNhMYLR3-vgNVT9IHepcRc-paBb2Ak99AzgGzLTcSnpEzcy-fKftw4N_pIZOfDuA%3D%3D&gaa_ts=69515e33&

Analysis of a Research Topic: Investments in Photovoltaics

- Here we analyse, using simple beginner-friendly language, a research paper which focuses on the topic of Energy investments. No need for you to memorize anything. It is enough to read it once and get the main idea. It is considered very valuable at workplace to be informed about research topics - this is why it is strongly recommended to have a quick read. - You can find more than 250 such analyses in the Classroom --> section 6.1 and section 6.4. - Downloadable resource is attached down below (scroll down to download the full paper). No need to read the full paper because below you can find the key points written in beginner-friendly language. - Title of the research paper: Optimal investment decision for photovoltaic projects in China: a real options method - Citation: Zhu, X., & Liao, B. (2023). Optimal investment decision for photovoltaic projects in China: a real options method. Journal of Combinatorial Optimization, 46, 30. https://doi.org/10.1007/s10878-023-01096-5 Introduction to Solar Investment Challenges Renewable energy is essential for fixing climate change and reducing pollution. Solar photovoltaic projects, often called PV projects, are a popular way to generate clean electricity. However, building these solar projects is expensive and it takes a long time to make the money back. Because the cost of technology is dropping and government rules on electricity prices keep changing, investors find it hard to know exactly when to spend their money. This paper looks at how uncertainty makes it difficult for investors to choose the best time to build solar projects in China. The Problem with Traditional Financial Models Investors usually use a method called Net Present Value to decide if a project is worth money. This method works well when everything is certain, but it fails when the future is unpredictable. Solar projects have many unknowns, and once the money is spent, it cannot be recovered. To fix this, the authors use a method called Real Options. This approach treats a physical investment like a financial option, giving the investor the right, but not the obligation, to invest now or wait until later when conditions might be better.

1-10 of 37

@kahu-ngata-5552

Renewables Researcher, Univ. of Auckland alumni - wind energy consultant for 10+ years

Active 9d ago

Joined Sep 20, 2025

Auckland, New Zealand