Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Legacy Solar Panel Camp

16 members • Free

Ruta del Electricista

135 members • Free

Electrical Academy

56 members • Free

Electricians Wired Together

85 members • Free

The Electricity Lab

163 members • Free

AutoCAD Electrical

60 members • Free

Solar Cleaners Network Pro

284 members • Free

DIY Solar Alliance

49 members • Free

Solar Union Ascension

91 members • Free

28 contributions to Energy Economics & Finance

Energy Storage Arbitrage: 2 common Interview Questions

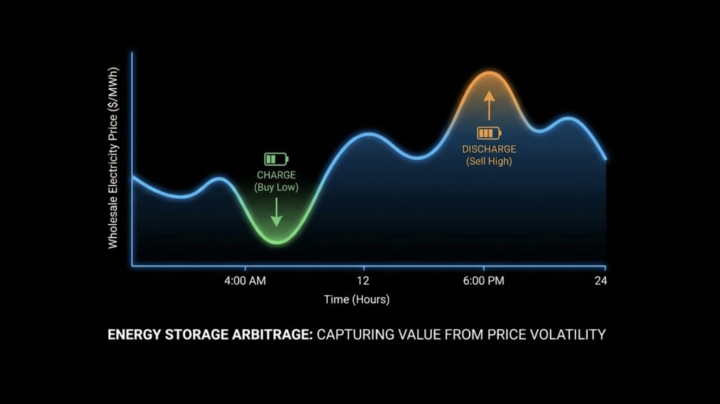

A new online course is being prepared about Energy Storage Trading using optimisation, machine learning (including reinforcement learning) , beginner-friendly ( no prerequisites ). This course will explain what energy storage trading is, what energy storage arbitrage is, etc - also all developed in Python. This is a topic that all energy companies are interested in, so there is very high probability that a relevant interview question will be asked . Even if you're not looking for jobs at the moment, you may look soon, so it is definitely useful to know this terminology. Here are two common interview questions: Interview Question1: What do we mean by Energy Storage Arbitrage? Interview Question2: What is the difference between Financial Arbitrage and Energy Storage Arbitrage? ================== Answer to Question1: It is when an Energy Storage unit buys electricity when the electricity price is low, and sells it when the electricity price is high. This operation generates economic profit by exploiting this price volatility over the course of a day, as shown in the attached slide. Answer to Question 2: The main difference is between space and time. Financial arbitrage exploits price differences between two different locations (e.g. New York and London) at the same moment (i.e. we buy a financial asset in New York and immediately we sell the same asset in London at a slightly higher price e.g. $100 versus $100.1 ). While Energy Storage arbitrage exploits price differences at different times within the same location (electricity market) e.g. the same storage unit (same location) buys electricity when its price is low, and sells it when the price is high. VIDEOS: Also, in the Classroom/6.3 I have uploaded 2 videos, each for these two questions (they provide some extra analysis). These two videos will also be part of the new course (in a few days).

Interview Questions (Since October 2025)

The goal of this community is to help you secure jobs across the wider energy sector. That includes: - Major Energy Firms (Trading houses, Utilities, Oil & Gas). - Non-Energy Firms that manage their own energy assets or investments. - Academia (PhD applications and research roles). I have compiled a list of recent questions that candidates have faced in interview stages mostly between October 2025 and January 2026 ( retrieved from student databases ). You can also see below the company they were applying to. When reading these questions we need to ask ourselves: "Could I answer this question under pressure (with maybe 1 minute of thinking)"? Also, my answers to each question are in Classroom 6.3 compiled in the form of a PDF file. This PDF file has 5 more questions included as well (and answers). 1. Energy Quant (Power/Gas) - BP: “Walk me through a forward-curve model you would use for power or gas. How do you handle seasonality, mean reversion, and spikes?” - Shell Energy Trading: “Design a risk framework for an options book on power. Which metrics would you report daily, and how would you stress test extreme events?” 2. Energy Trader - TotalEnergies: “Explain the spark spread and how it links fuel prices, heat rate, and power prices. When does a plant dispatch?” - Trafigura: “You have a short physical position for next month. How would you hedge it with futures, swaps, and optionality, and what basis risks remain?” 3. Electricity Market Analyst (ISO/Utility) - National Grid ESO: “Explain Locational Marginal Pricing (LMP): what are its components, and what data does the market-clearing optimization need?” - EPRI: “How would you build a day-ahead load forecast and quantify uncertainty? Which error metrics matter most for operations?” 4. Project Finance Analyst - Macquarie: “Define DSCR and explain how it drives debt sizing. What DSCR range would you expect for a contracted wind or solar project?”

LLMs Best Practices

Hey everyone, I’m asking this because LLMs weren’t really part of our workflow before, but now that they’re available it’s difficult not to leverage them given their productivity benefits. How are you using LLMs in data science workflows, and what best practices should I be aware of? Also, from a manager’s perspective, what expectations or concerns do you have about their use? PS: I am one of those that do not use it much especially for work or academia and looking for the correct ways to integrate it.

0 likes • 10d

@Henrik Larsson Yes. I use it for drafting client-facing deliverables like executive summaries, slide outlines, and “plain English” explanations. Best practice is to keep it away from confidential client details and to fact-check everything. As a manager, I’d care about brand risk if AI-written content contains errors

How do we define the "Energy Data Scientist" ?

The term 'Energy Data Scientist' means more than just a Data Scientist who works in an Energy Company. Given the skills that this Skool community teaches, what jobs does the Energy Data Scientist cover?

0 likes • Dec '25

@Luis G Yes and software engineering is needed in implementation consulting. With technical/specialist consulting the code is a tool to generate insights, where you build a model to answer a question like "where should we site this wind farm?" "What's the optimal battery size?". And so your deliverable is simply the insight/recommendation, not the code. The client cares about the answer, not the software. You're hired for domain expertise e.g. because you have understanding of energy markets, etc. The implementation consulting (where you wrote Accenture, Deloitte), your code is the deliverable , and so you build software that the client will use every day like a trading platform, or a forecasting dashboard . So, the code is handed over to client's IT team so they run it . So the client cares about the software working reliably. You're hired for software engineering skills . So with technical consulting they need an analyst/scientist who can code. They produce insights. And with implementation consulting , they need a software engineer .They produce code products.

2 likes • 10d

@Raheema Rahman if you dont go into energy now, e.g. 2026-2027, you will be missing a lot. Data science is saturated really. Get into energy as an advice. Dont miss this opportunity. Energy globally has massive demand: AI, renewables, smart grid, etc. They are hiring like crazy . Internationally sponsoring people without visas etc

New Online Course: Download energy data through API

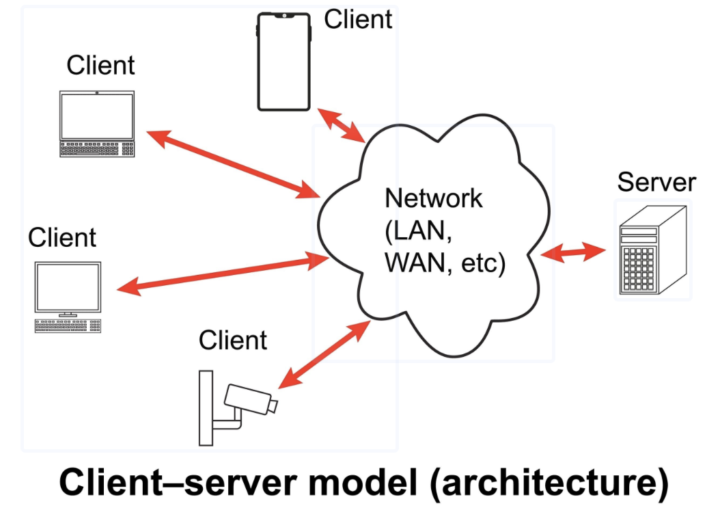

A new online course is ready, with its full Python code available to download and explained. It is in the Classroom --> 1.37. It is called "1.37. Download Electricity Market Data Via API". You will learn to build, in Python, a tool that asks the user for a date range and specific electricity generation units , and downloads the data instantly, and saves it in a multi-sheet Excel workbook. All the code is in Python and fully available for you to download. You can integrate it in your project easily. For example if you have a Machine Learning (or optimisation) model, you can integrate this code in this model. So with this code you will pull real-time data, and then pass them as inputs to your model. Or this can be used as part of an Algorithmic Trading model. By automating the retrieval of real-time signals like System Prices and grid actions, you provide the raw fuel your AI needs to train, backtest strategies, and predict market movements. This is the Client- Server software architecture. Our Python code is the "client" who asks for data. And the 'Server' is the computer (remote) where we connect and request electricity data to download. We connect to the server of the company "Elexon", which is in Great Britain. Think of the electricity grid in Great Britain as a marketplace. Elexon is the independent referee. Elexon doesn't generate electricity, and they don't sell it to your house. Their job is to make sure the "books balance" at the end of the day. If a power plant promised to generate 100MW but only generated 90MW, Elexon is the one who calculates the penalty. The "Server" we connect to is their public library of everything that happened on the grid: who generated what, when, and how much it cost. You can find more about Elexon on their website at : https://www.elexon.co.uk You can view electricity data on their portal which is called "Insights Solution" and it is at https://bmrs.elexon.co.uk .

1-10 of 28

@joshua-levvy-1786

energy focus - machine learning forecast models at M. Lynch

Active 2d ago

Joined Nov 1, 2025

ISFJ

USA