Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

ACES Connection Group

728 members • Free

AI Networking Exchange

247 members • Free

GrowGetters ONLY Collective

352 members • Free

RM

Referrals Made Easy!

1.7k members • $10/month

6 contributions to GrowGetters ONLY Collective

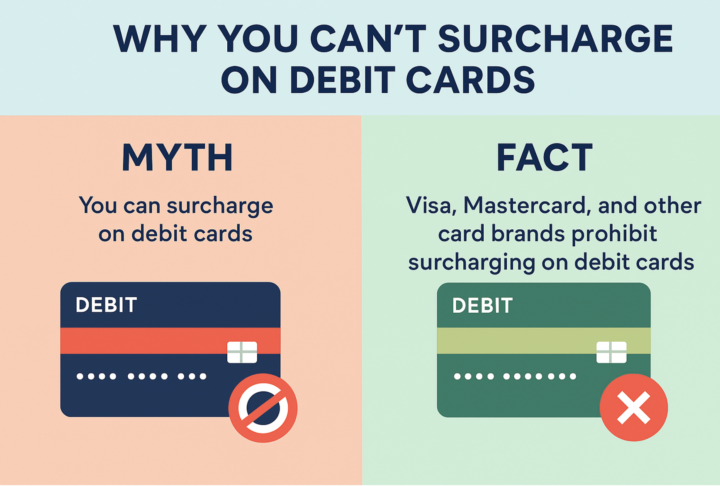

Why You Can’t Surcharge on Debit Cards

Card Network Rules Visa, Mastercard, and other card brands prohibit surcharging on debit cards, even when the debit transaction is run “as credit.” Their rules only allow surcharging on true credit card transactions. Consumer Protection Regulators and card brands want to protect consumers from paying extra fees on essential, everyday payment methods like debit cards. Debit cards pull funds directly from a customer’s bank account, so surcharges are considered unfair or predatory. Legal Restrictions Some U.S. states already regulate or restrict credit card surcharges. Federal and card network rules apply nationwide to prohibit debit surcharges specifically. Business Alternatives You can surcharge credit cards (within network and state rules). You can use Cash Discount Programs (offering a lower price for cash) that apply to all payment types, structured compliantly. You can build processing costs into pricing instead of trying to pass them only onto debit. You can only surcharge credit cards, never debit cards. Trying to do so puts you out of compliance with Visa/MC rules and could result in fines or loss of your merchant account. Mx Merchant will make your business more Efficient, more Effective and more Profitable I offer a complimentary 30-minute discussion to walk through what that looks like for you. Feeling Froggy? Jump on my calendar www.calendly.com/jsaluk #strategy#business#creativity#innovation#40000hoursofmerchantservicesexperience

1

0

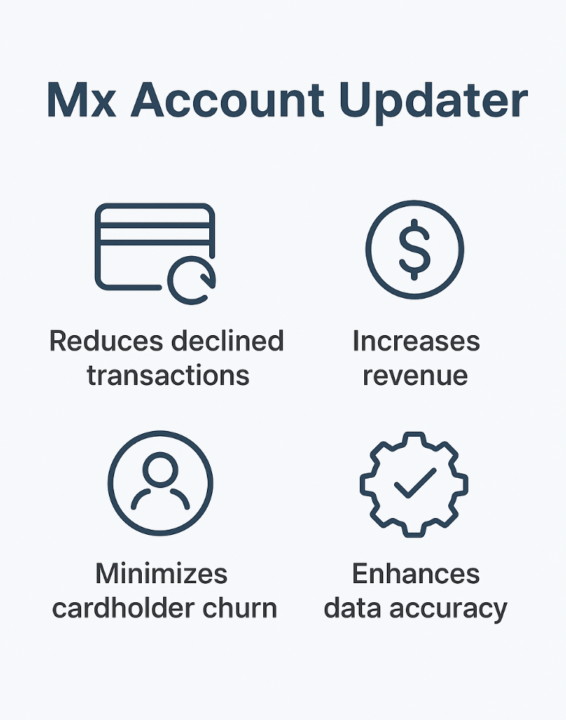

How to avoid lost sales and delayed payments

Are you still updating customers’ information manually? That is very tiring and frustrating to do! Keep the payment information of your customers updated automatically through Mx Account Updater. Steer clear from delayed payments and do not lose a sale because of outdated customer card account details. Say goodbye to the tedious manual updating task and start using the Mx Account Updater to keep everything in place with account details and payment information. This MX platform partnered with Mx Invoice recurring billing will help your staff save more time and have seamless payment transactions. Moreover, with the MX Account Updater, the risks relating to sensitive card information being known to the staff will be eradicated. How does Mx Account Updater work? The vaulted customer card account details are daily forwarded to Visa, MasterCard, Discover, and other card brands. If there are any changes in the information, the card brands will send it over. Mx Account Updater will automatically sync the new information which might include the customer’s account number, expiration date, closed account, and other necessary details. Mx Merchant will make your business more Efficient, more Effective and more Profitable I offer a complimentary 30-minute discussion to walk through what that looks like for you. Feeling Froggy? Jump on my calendar www.calendly.com/jsaluk #strategy #business #creativity #innovation #40000hoursofmerchantservicesexperience

1

0

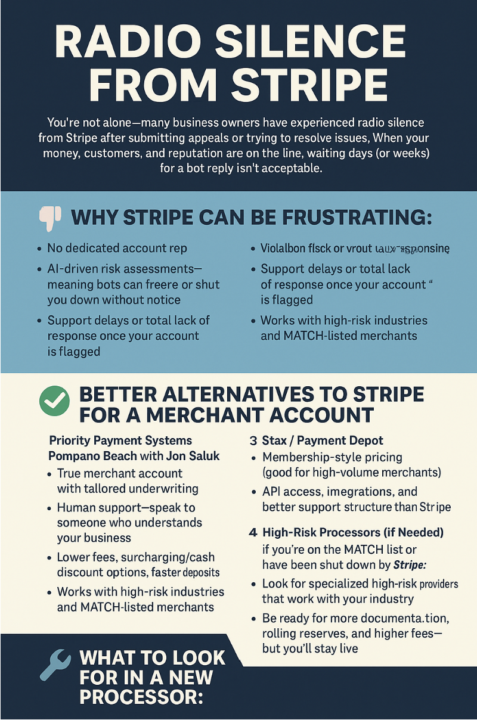

Radio Silence from Stripe

You're not alone—many business owners have experienced radio silence from Stripe after submitting appeals or trying to resolve issues. When your money, customers, and reputation are on the line, waiting days (or weeks) for a bot reply isn't acceptable. Why Stripe Can Be Frustrating: - No dedicated account rep - AI-driven risk assessments—meaning bots can freeze or shut you down without notice - Support delays or total lack of response once your account is flagged - Zero flexibility on chargebacks, reserves, or disputes Better Alternatives to Stripe for a Merchant Account Here are reliable, human-powered alternatives that give you more control and support: 1. Priority Payment Systems Pompano Beach with Jon Saluk - True merchant account with tailored underwriting - Human support—speak to someone who understands your business - Lower fees, surcharging/cash discount options, faster deposits - Works with high-risk industries and MATCH-listed merchants 2. National Processing / Dharma / Helcim - More transparent pricing models (often interchange-plus) - Built for small to medium businesses - Real customer service teams and lower reserves 3. Stax / Payment Depot - Membership-style pricing (good for high-volume merchants) - API access, integrations, and better support structure than Stripe 4. High-Risk Processors (If Needed) If you’re on the MATCH list or have been shut down by Stripe: - Look for specialized high-risk providers that work with your industry - Be ready for more documentation, rolling reserves, and higher fees—but you’ll stay live What to Look for in a New Processor: - Real-time, human support - Transparent and fair pricing - Control over your funding timeline - Chargeback tools and fraud prevention - Integration with your current tech stack (POS, CRM, invoicing) Mx Merchant will make your business more Efficient, more Effective and more Profitable I offer a complimentary 30-minute discussion to walk through what that looks like for you.

1

0

👋 Introduce Yourself — INTROS ONLY

Welcome to GrowGetters ONLY! This thread is for one purpose: INTRODUCTIONS. Let us know: - Who you are - Why you’re here - Where you are from - How you help others - What you’re hoping to learn, gain, or grow in this community - Or heck - Whatever you'd like. This is your group too... Share away! Drop your intro below and make it count — connections start right here. 🌱 Ready? Let’s grow.

2 likes • Jun 5

Providing merchant account solutions in all 50 states since 2003. Does your merchant account include Banking, Payables, Treasury Solutions & Lines of Credit? [email protected] 516.250.9536 https://www.linkedin.com/in/jonsaluk/

1-6 of 6

@jon-saluk-1526

Providing merchant account solutions any way you want your customers to pay you by credit card in all 50 states since 2003.

Active 8h ago

Joined Jun 5, 2025

pompano beach fl 33062

Powered by