Activity

Mon

Wed

Fri

Sun

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

What is this?

Less

More

Memberships

850 Deep

273 members • Free

Auction Property Academy

101 members • Free

GBA Circle - Communauté

2.6k members • Free

8 contributions to Auction Property Academy

🚨Multifamily Deals in Chicago, IL

A market that has surprised me recently is Chicago... We found multifamily properties going up for auction on Hubzu.com and some of them we're under $100k😳 The apartments in the area are renting for > $2k . Meaning we would most likely break the 1% rule - & be able to cashflow pretty heavily. Not to mention, some of these were NOT cash only, meaning you could probably get a fix and flip loan to acquire, fund the renovation, and refinance once it's all finished into a DSCR Loan (otherwise known as the BRRRR strategy) What do you guys think of these deals? https://www.hubzu.com/property/90016945606-8239-S-COMMERCIAL-AVE-Chicago-IL-60617 https://www.hubzu.com/property/90017301347-2535-W-WARREN-BLVD-Chicago-IL-60612 https://www.hubzu.com/property/91616777745-7155-S-SANGAMON-STREET-Chicago-IL-60621 *disclaimer: I am not familiar with this market/ area in Chicago in terms of safety and/or the surrounding neighborhood. You can check this by visiting the property which I highly recommend, or looking on google maps around to see what the area looks like.

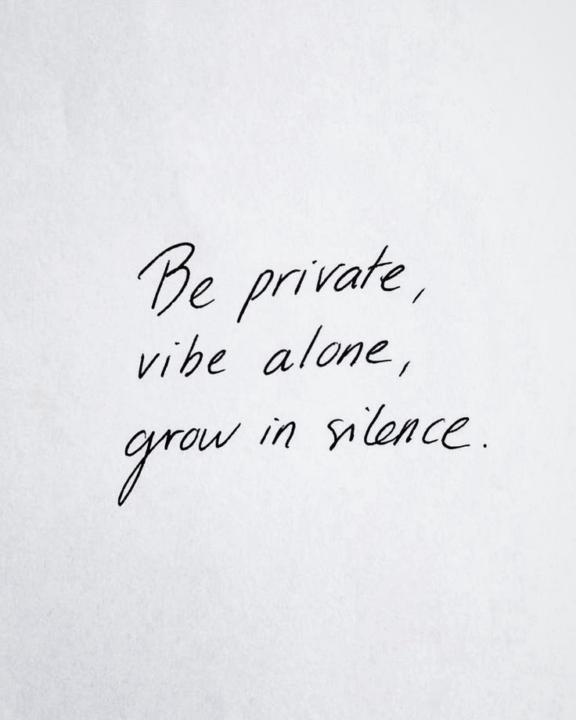

Residential Vs. Commercial Real Estate (Book Rec.)

I recently read "Crushing it in Apartments & Commercial Real Estate" by Brian Murray & It definitely expanded my view point on investing in real estate - as someone who's only investing in single family... 🚨One of the biggest differences between residential and commercial real estate is how properties are valued. - In residential, value is based on comps (what similar houses sold for). - In commercial, value is based on income and expenses using the cap rate formula. 🏠That means small changes in management can lead to huge jumps in property value. For example, in the book’s case study (page 87): - By increasing income by just $13,000 (through things like higher rents or extra fees) - And reducing expenses by $3,000 (tightening management and costs)→ The property’s value jumped from $276,917 to $460,758. ✅That’s nearly a $184,000 increase in value without adding a single unit—just smarter operations. This is why commercial investors love cap rates: they reward efficiency, not just market appreciation. ❓QUESTION FOR YOU: Do you find yourself more drawn to residential strategies (like flips and rentals) or does commercial feel more appealing knowing you can “force” appreciation like this? Want to read the book? - Find it here: https://amzn.to/4oOG9DB

How Much Money💰 Do You Need to Invest?

QUESTION I GET A LOT: "How much do I need to start investing in real estate?" We talked about this on TikTok Live yesterday, and the truth is… probably less than you think. ⭐️Here’s the breakdown by price range:⭐️ 🏠$5K – $15K: Tax Deed Sales & Flipping Empty Lots - Great starting point if you don’t have a ton of capital. - Example: In Marion County, FL, I’ve seen land sell for 8K–12K at tax deed auctions. Investors then resell for double once the title is cleared. - Watch out: These properties can come with liens, code violations, or unpaid taxes. Always do a due diligence search (O&E report). Resource: Check your county clerk auction page or sites like Bid4Assets.com. 🏠$20K – $70K: Foreclosure Auctions with Hard Money Loans - If you’ve saved a bit more, this opens up bigger properties. - Example: On Auction.com, a home in Georgia sold for 180K. With 15% down through a hard money lender, you’d only need about 27K to secure it. The lender covers rehab and closing. - With 30K in capital, you could realistically play in the 150K–600K price range. Resource: Auction.com, Hubzu.com, Xome.com. Check our “Real Estate Resources” guide in the classroom tab for more. 🏠$100K+: County Foreclosures, Direct-to-Seller, Commercial - With cash, you’re in the strongest position. - Example: A friend bought a county foreclosure for 120K cash and flipped it in 4 months for 210K. Because he paid cash, he avoided lender inspections and delays. - Cash also lets you go direct-to-seller and make strong offers—this is how many investors scale into rentals or commercial. Resource: County foreclosure lists/sites, Propwire.com ✅ Takeaway: You don’t need a quarter-million in the bank to get started. Real estate has entry points for every budget—you just need to pick the strategy that matches your capital. ❓QUESTION FOR YOU: Which range do you fall into right now? And which strategy are you leaning towards—tax deeds, foreclosures, or direct-to-seller?

Poll

5 members have voted

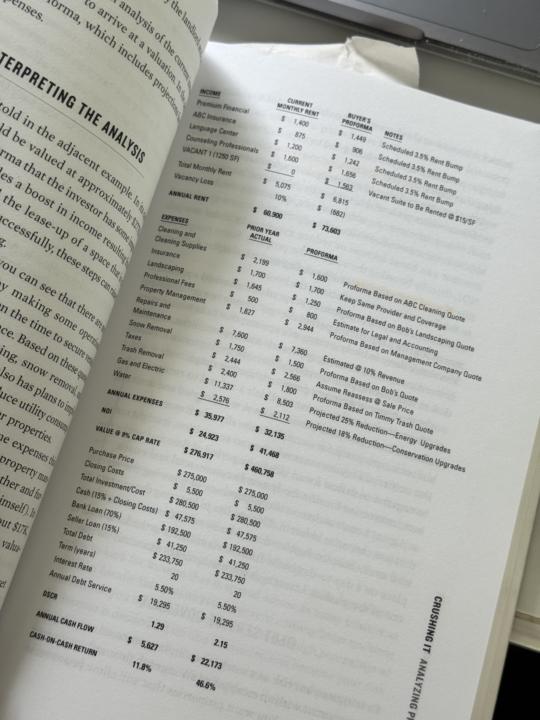

93% ROI Case Study ($1M DEAL)

Good Morning Investors! I found an exciting case study on a commercial project done in Central, FL. When this 22-unit apartment building in Leesburg first hit the market, it was in rough shape — think boarded-up windows, only 4 units occupied, and the rest sitting vacant to keep squatters out. An investor picked it up for $585,000 and went all-in on a complete transformation. Every single unit got: ✅ New kitchens & bathrooms ✅ Fresh paint & flooring ✅ Updated fixtures & brand-new AC units The exterior got a facelift too — fresh paint, new windows, and new doors. The end result? A property that went from 18 empty units to 100% occupancy in a short period of time. Now, just 87 days on the market, it’s pending at $2,250,000. This is the power of strategic investing + high-quality renovations. Deals like this are exactly why I love sharing real numbers and real transformations with you all — because it shows what’s truly possible when you know how to spot and execute on the right opportunities. https://equitypro.com/properties/lake-county-value-add-17-unit-opportunity

New Auction Site ✅

Good morning everyone! I was doing my daily rounds of looking at potential deals and came across this auction website: https://federa.com/explore You can add your bid & the days to close for a competitive offer meaning you can most likely use a hard money lender to finance the deal. 🚨Hot tip: I would search up the property address on Zillow and find the real estate agency that listed it to ask details questions like: Any outstanding liens? Hard money lending? Minimum reserve? I will keep yall updated on it🫡

0 likes • Aug 7

@Tiffany Dasilva okay sound good ! [email protected]

1-8 of 8