Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Duy

From zero to first $1k/month with AI automation in 30 days. Get the exact formula + templates that landed 100+ their first client.

Memberships

SW Automation

7.3k members • Free

Automate Business AI

5.3k members • Free

N8nLab

5.5k members • Free

Automation Masters

3.7k members • Free

AI Masters Community with Ed

11.1k members • Free

The RoboNuggets Network (free)

27.7k members • Free

The AI Advantage

72.1k members • Free

Ai Automation Vault

15.5k members • Free

AI Workshop Lite

14.7k members • Free

194 contributions to AI Automation Society

Receipt Scanner Built My Tax Deduction Database Automatically (7 Nodes) 🔥

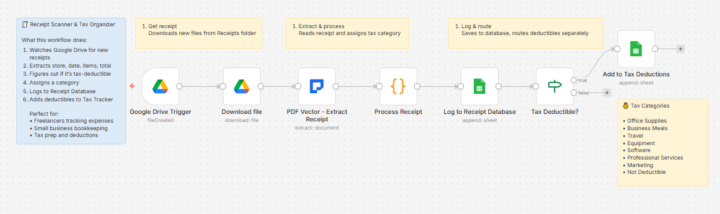

Tax season. Accountant asks for deductible receipts. I have a shoebox. She has questions. Built receipt scanner. Every receipt photographed goes into database. Tax deductible items automatically flagged and organized by quarter. THE TAX DOCUMENTATION PROBLEM: Business expense? Personal? Deductible? What category? Which quarter? Receipt fades. Memory fades. Accountant asks for documentation. You have nothing useful. THE DISCOVERY: Document extraction identifies tax deductibility. Boolean field. True or false. Deduction category assigned automatically. Dual sheet architecture. All receipts logged to one sheet. Tax deductible items copied to separate tax deductions sheet. THE WORKFLOW: Google Drive trigger watches receipts folder → Download receipt image → Document extraction pulls store, items, total, tax info, deduction status → Code processes and generates receipt ID → Sheets logs to receipt database → IF checks tax deductible → TRUE: Also logs to Tax Deductions tab. 7 nodes. Automatic tax organization. THE DEDUCTION LOGIC: JSON Schema includes deduction categories: Office Supplies, Business Meals, Travel, Equipment, Software, Professional Services, Marketing, Not Deductible. Code adds: Receipt ID (RCP-timestamp), tax year, quarter (Q1-Q4), items summary. At tax time: Filter by year. Export deductions. Hand to accountant. Done. THE TRANSFORMATION: Before: Shoebox of receipts. Panic in April. Missing documentation. Missed deductions. After: Continuous logging. Quarterly organization. Complete records. Maximum deductions. THE NUMBERS: 247 receipts processed this year $8,400 in documented deductions 4 quarters auto-organized Receipt lookup: 3 seconds vs 30 minutes Template in n8n and All templates in Github How much are you losing in undocumented deductions?

1 like • 18h

@Teena French Haha perfect timing! 😂 Grab the template in the post and adapt it to your setup. Takes about 20 minutes to get running. The dual-sheet architecture is the key part - all receipts go to one sheet, then deductibles get copied to the tax tab automatically. Let me know if you hit any snags setting it up!

36% of CFOs Use AI for AP/AR - 70% Wave Happening Now 🔥

PWC Pulse Survey October 2024: 36% of CFOs already using AI for AP/AR. Another 34% plan to implement within 12 months. That's 70% of the market moving RIGHT NOW. THE CONVERSATION SHIFT: 2022: "Should we automate invoices?" 2024: "When should we automate invoices?" 2025: "Why haven't we automated invoices yet?" Question changed from "if" to "why not already." WHAT ENTERPRISES ARE IMPLEMENTING: - Invoice processing automation: 58% of implementations - Receipt management and expense tracking: 44% - Contract analysis and compliance: 39% - Purchase order validation: 36% - Document classification and routing: 52% Notice the pattern? All document-heavy financial workflows. THE 34% IMPLEMENTATION GAP: 70% want it. Only 36% have it. Gap reason: Not lack of platforms. Lack of implementation expertise. THE POSITIONING THAT WINS: Enterprises don't need another SaaS tool. They need: - Integration with their existing ERP (NetSuite, SAP, Oracle) - Handling their specific vendor document formats - Training their team through change management - Ongoing support when edge cases appear MY POSITIONING SHIFT: Before: "I build custom automation solutions" Response: "We're already evaluating platforms" After: "I implement AI document processing for finance teams using [their current platform]" Response: "Can you integrate with our NetSuite instance?" HOSPITAL NETWORK DEAL: Regional health system. 4 locations. Processing 2,400 invoices monthly manual. Tried 2 SaaS platforms: - Platform 1: Couldn't handle medical vendor invoice formats - Platform 2: Integration with their ERP failed Both vendors gave up. I positioned as: Healthcare-specific invoice implementation specialist. THE NUMBERS: - Deal: $8,500 setup + $1,200/month - Timeline: 6 months in, still running - Automation rate: 94% of invoices auto-processed - Time saved: 280 hours monthly - Referrals generated: 2 other hospital networks CURRENT IMPLEMENTATION PIPELINE: - Enterprise deals: 2 active (hospitals + manufacturing)

Bank Statement Analyzer Found $1,200 in Forgotten Subscriptions (6 Nodes) 🔥

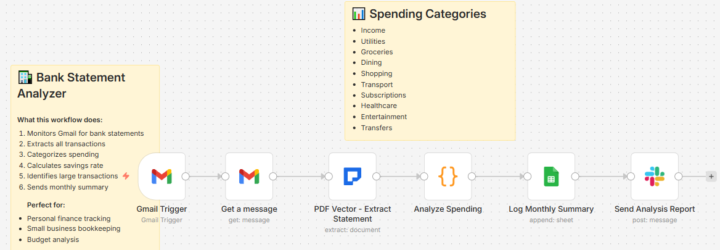

Downloaded bank statement PDF. 847 transactions. Somewhere in there: subscriptions I forgot about. Built 6-node analyzer. Found $1,200 annually in subscriptions I didn't use. Three services I'd forgotten existed. THE SUBSCRIPTION CREEP: $12/month here. $29/month there. Free trial converts. Card gets charged. You forget. Annual cost adds up. Nobody tracks it. Bank sends PDF statement. 50 pages. Who reads that? THE DISCOVERY: Document extraction pulls every transaction with category. Code analyzes spending patterns. Groups by category. Flags subscriptions. Six nodes. Complete spending analysis from PDF to Slack report. THE WORKFLOW: Gmail trigger catches statement email → Get attachment → Document extraction pulls all transactions with amounts and categories → Code analyzes spending by category → Sheets logs monthly summary → Slack sends analysis report. THE ANALYSIS LOGIC: Code calculates: - Total by category (Income, Subscriptions, Dining, Shopping, etc.) - Savings rate percentage - Large transactions over $500 - Monthly comparison trends Slack report shows spending breakdown. Where money actually goes. Not where you think it goes. THE SUBSCRIPTION DETECTION: Recurring amounts same day each month = subscription. Code flags them. Lists them separately. You decide which ones you actually use. Found three I forgot about: Old project management tool ($29/month), unused design software ($15/month), podcast hosting I discontinued ($19/month). THE TRANSFORMATION: Before: Bank statement arrives. File it. Never look at it. Surprised by balance. After: Automatic analysis. Spending patterns visible. Subscriptions surfaced. Decisions made with data. THE NUMBERS: 847 transactions analyzed 12 categories tracked $1,200 annual subscriptions found 3 forgotten services cancelled Savings rate calculated automatically Template in n8n and All templates workflows in Github

Funeral Homes Pay Me $2,000/Month - Zero Competition 🔥

"Nobody wants to touch this industry." That's exactly why there's zero competition and approved budgets waiting. Met funeral director at coffee shop. He mentioned they still fax permits in 2024. Built permit automation. Deployed to 3 funeral home locations. $1,200 monthly recurring. THE FUNERAL HOME DOCUMENT BURDEN: Every funeral requires 12-18 permits: - Death certificates (state and county) - Burial permits - Transportation authorizations - Cremation permits (if applicable) - Insurance claim forms - VA paperwork (for veterans) Manual processing per funeral: 3-4 hours Average cases monthly: 40 Monthly time waste: 120-160 hours THE 6-NODE WORKFLOW: 1. New case entered in funeral management software 2. Trigger automation based on service type 3. Auto-generate all required permit applications 4. Pre-fill from case data (deceased info, family details) 5. Route to correct state/county agencies 6. Track submission status and completion 7. Alert on missing signatures or info 8. Archive completed permits by case THE PITCH THAT CLOSED: Setup: $3,500 one-time Monthly: $400 per location Their math: - 40 cases monthly - 3 hours saved per case - 120 hours recovered - Staff cost: $35/hour - Monthly waste: $4,200 - My fee: $400 - Net savings: $3,800/month ROI: First month. WHY FUNERAL HOMES ARE GOLDMINES: - Operational budgets already approved (not discretionary spending) - Technology is 20 years behind - Staff doing manual work they hate - Compliance requirements are strict - Mistakes are unacceptable (grieving families) - Zero automation vendors competing CURRENT OPERATION: - Locations: 3 - Documents processed monthly: 1,596 - Monthly recurring: $1,200 - Setup revenue: $10,500 - Referrals waiting: 2 more locations THE BORING INDUSTRY FORMULA: 1. Find industry everyone ignores 2. Identify paper-heavy regulatory process 3. Confirm operational budgets exist 4. Build simple automation 5. Become the only vendor INDUSTRIES NOBODY WANTS: - Waste management permits

AI Categorized 2,400 Expenses Last Quarter - Zero Manual Sorting (8 Nodes) 🔥

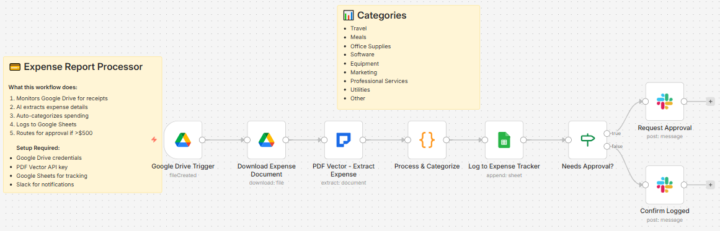

Finance team categorizing expenses manually. Every receipt. Every transaction. Someone reads merchant name. Decides category. Types it in. Built 8-node workflow. 2,400 expenses last quarter. Zero manual sorting. AI handles categorization. THE CATEGORIZATION NIGHTMARE: Is Uber travel or transportation? Is that Amazon purchase office supplies or equipment? Starbucks - meals or client entertainment? Every person categorizes differently. Audit comes. Categories inconsistent. Explanation needed for every decision. THE DISCOVERY: Document extraction returns category as enum. AI picks from predefined list. Same logic every time. But AI isn't perfect. Added merchant keyword fallback. Uber always maps to Travel. Starbucks always maps to Meals. Consistency wins. THE WORKFLOW: Google Drive trigger watches receipts folder → Download expense document → Document extraction pulls merchant, amount, date, category → Code processes and applies keyword fallback → Sheets logs to expense tracker → IF checks threshold → Over $500 triggers Slack approval → Under $500 confirms logged. 8 nodes. Categorization automated. THE SMART CATEGORIZATION: JSON Schema includes category enum: Travel, Meals, Office Supplies, Software, Equipment, Marketing, Professional Services, Utilities, Other. AI picks best match. Code validates against merchant keywords. Known merchants get consistent categories regardless of AI interpretation. THE APPROVAL ROUTING: Threshold-based logic. Anything over $500 requires manager approval. Slack notification with full details. Everything else auto-logged. No more $3,000 "office supplies" purchases slipping through. Manager sees it immediately. THE TRANSFORMATION: Before: 15 minutes per expense report reviewing categories. Arguments about what counts as what. Inconsistent across team. After: Zero time categorizing. Consistent logic. Manager only reviews high-value items. THE NUMBERS: 2,400 expenses processed last quarter 9 category types automated $500 approval threshold

1 like • 4d

@Jamila Hussein Both - LLM suggests category from enum, then merchant keywords override when there's a match. Uber → always Travel. Starbucks → always Meals. Etc. Keyword dictionary catches ~80% of volume (47 merchants). AI handles the weird one-offs. Gives me consistency on common stuff, flexibility on exceptions. What are you using?

1-10 of 194

@duy-bui-6828

Built automation systems doing 20K+/mo. Now helping automation builders get first clients FREE at https://bit.ly/skool-first-client

Active 34m ago

Joined Aug 2, 2025

Ho Chi Minh City

Powered by