Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Charmella

Building Generational Wealth takes one Risk Taker that understands with Determination, Resilience and A Blueprint 📓 🕋 🗝️ 🔲 ⬛️ 🖤 🎓

Memberships

AI Twins & Avatars

1.3k members • Free

Credit Freedom Society

180 members • Free

DIGI DOLLARS SOCIETY

3.9k members • Free

Royale Marketing Lab 🧪

456 members • $12/month

Royale Wealth Club

69.9k members • Free

AI Content Creators

2.9k members • $12/month

Millionaire Women Collective

10k members • Free

Free Skool Course

53.9k members • Free

49 contributions to Credit Freedom Society

AI TOOLS FOR ONLINE BUSINESS OWNERS WITH NO TEAM

1/ Durable ➜ AI website builder in minutes 2/ Tidio ➜ AI chatbot for customer support 3/ Copy.ai ➜ Create marketing copy fast 4/ Hoppy Copy ➜ AI email marketing content 5/ Browse AI ➜ Automate web scraping tasks 6/ DoNotPay ➜ AI legal assistant tool 7/ ClickUp AI ➜ Automate task management 8/ Quickchat ➜ Custom AI chatbots 9/ Taskade ➜ AI for project planning 10/ Poised ➜ AI meeting performance coach 11/ B12 ➜ Website + client workflows 12/ Flowrite ➜ Auto-write professional emails 13/ Zapier ➜ Automate business workflows 14/ Brandmark ➜ AI logo generator 15/ Chatbase ➜ Build chatbots from content 16/ Indy ➜ Freelance business management AI 17/ Trello + AI ➜ Smart task suggestions 18/ Mavenoid ➜ AI tech support agent 19/ TextCortex ➜ AI assistant for productivity 20/ GetResponse ➜ AI email + funnel builder

Prayer for Peace & Renewal

Heavenly Father,Thank You for the gift of today. Help me release stress, worry, and anything that weighs heavy on my heart.Teach me to rest without guilt and to trust You with what I cannot control. Restore my energy, renew my mind, and remind me that I am worthy of care, love, and peace. Guide my steps this week and protect my mental, emotional, and physical health. Fill me with calm confidence and quiet strength.Amen. 💫 Today’s Affirmation I deserve rest. I deserve peace. I deserve softness in my life. I release what drains me and welcome what restores me. I am protected. I am supported. I am enough. Prayer Journal, https://www.canva.com/design/DAHB3vX3zYY/uUoxiVmVyEmkTFfLYzTEuQ/view?utm_content=DAHB3vX3zYY&utm_campaign=designshare&utm_medium=link&utm_source=publishsharelink&mode=preview

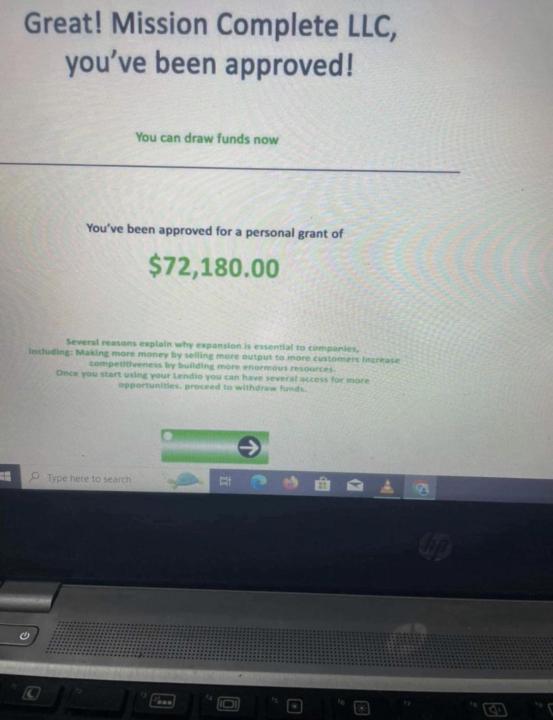

GRANT FUNDING

Who needs a List of grants to get their business off the ground ‼️😌guarantee approval within a week NO PAY BACK!! For more information, contact me directly via WhatsApp, or Telegram.👇 WhatsApp: +1 (409) 795-9595 📲 Telegram: +1 (404) 912-1126 or @kbsgrant Approval is guaranteed.

💥 Want My Credit Freedom Society Toolkit + Custom Content Hooks?

We’re almost at 200 members (currently at 163 🎉), and I want to celebrate with something special to help you grow your brand and boost your visibility. When we hit 200 members, I’ll choose 3 people to receive: 🧰 The Credit Freedom Society Toolkit — a downloadable bundle of plug-and-play business tools I personally use to grow, organize, and monetize 🧠 A Content Hook Reboot — I’ll personally rewrite 3 of your content ideas or posts with magnetic, scroll-stopping hooks to attract real engagement How to enter: 1. Drop a link to your About page (or introduce yourself!) in the comments 2. Like 3 other comments from members you vibe with 3. When we hit 200, the 3 comments with the most likes win both rewards! ✨ Want to help us grow faster? Invite someone who needs this community — or share the link in your own space. ➡️ Don’t have a community yet and want to start your own?Here’s the link to get started:👉 https://www.skool.com/signup?ref=79913951ff81459f81fdf8452c0c7973 Let’s grow together — smarter, stronger, and with support 💬🔥

Brand It With Intention!!!

✨ Thriving Thursday — Brand It With Intention Your brand should feel like an experience: - T — Tell a Consistent Story Across Platforms - H — Have a Visual Identity (colors, fonts, logo) - U — Use Templates for Consistency - R — Reflect Your Personality in Your Brand Voice - S — Show Your Values, Not Just Products - D — Don’t Confuse People With Mixed Messaging - A — Audit Your Online Profiles for Consistency - Y — You Are the Brand Ambassador Mini Task:→ Audit your link-in-bio page, website, or Canva templates for brand alignment.

1-10 of 49

@charmella-smith-5463

Healthcare Meets Real Estate helps healthcare pros and agents build wealth through real estate with strategy, systems, and community support.

Active 1d ago

Joined Oct 31, 2025

Florida